Neobanks operate exclusively online without traditional branch networks, offering streamlined digital financial services with lower fees and enhanced user experience. Challenger banks combine digital innovation with banking licenses, enabling them to provide a wider range of regulated financial products while directly competing with established banks. Explore more to understand the distinct features and benefits of neobanks and challenger banks.

Why it is important

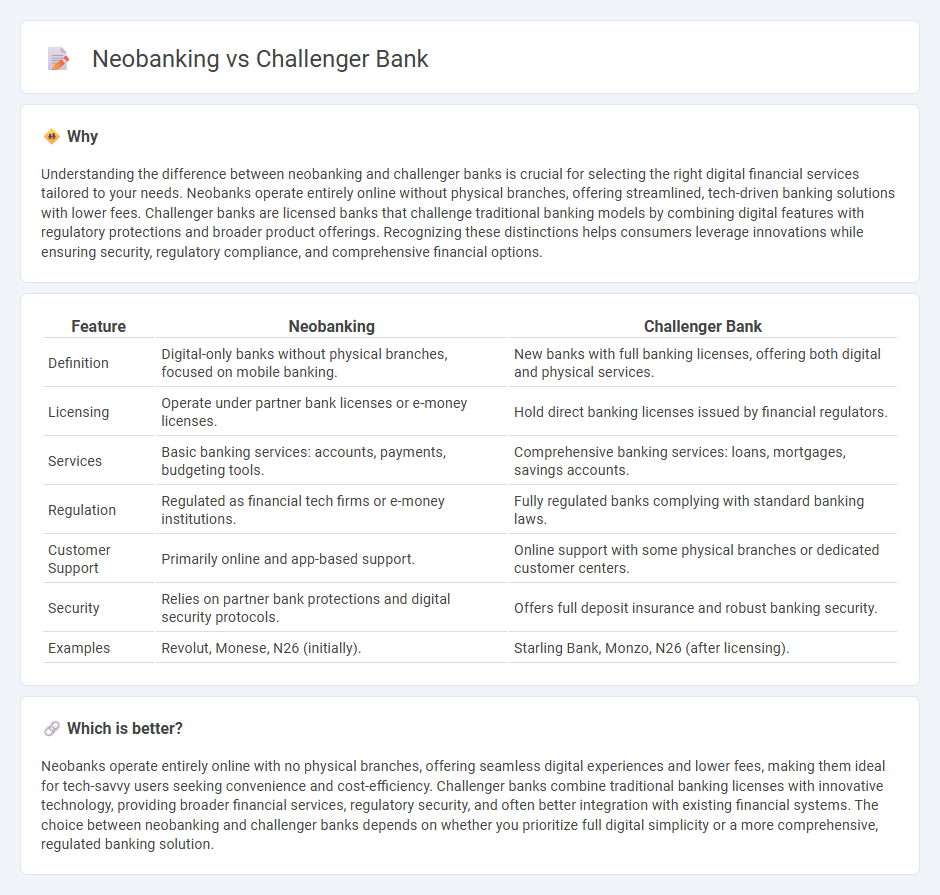

Understanding the difference between neobanking and challenger banks is crucial for selecting the right digital financial services tailored to your needs. Neobanks operate entirely online without physical branches, offering streamlined, tech-driven banking solutions with lower fees. Challenger banks are licensed banks that challenge traditional banking models by combining digital features with regulatory protections and broader product offerings. Recognizing these distinctions helps consumers leverage innovations while ensuring security, regulatory compliance, and comprehensive financial options.

Comparison Table

| Feature | Neobanking | Challenger Bank |

|---|---|---|

| Definition | Digital-only banks without physical branches, focused on mobile banking. | New banks with full banking licenses, offering both digital and physical services. |

| Licensing | Operate under partner bank licenses or e-money licenses. | Hold direct banking licenses issued by financial regulators. |

| Services | Basic banking services: accounts, payments, budgeting tools. | Comprehensive banking services: loans, mortgages, savings accounts. |

| Regulation | Regulated as financial tech firms or e-money institutions. | Fully regulated banks complying with standard banking laws. |

| Customer Support | Primarily online and app-based support. | Online support with some physical branches or dedicated customer centers. |

| Security | Relies on partner bank protections and digital security protocols. | Offers full deposit insurance and robust banking security. |

| Examples | Revolut, Monese, N26 (initially). | Starling Bank, Monzo, N26 (after licensing). |

Which is better?

Neobanks operate entirely online with no physical branches, offering seamless digital experiences and lower fees, making them ideal for tech-savvy users seeking convenience and cost-efficiency. Challenger banks combine traditional banking licenses with innovative technology, providing broader financial services, regulatory security, and often better integration with existing financial systems. The choice between neobanking and challenger banks depends on whether you prioritize full digital simplicity or a more comprehensive, regulated banking solution.

Connection

Neobanks and challenger banks both operate as digital-first financial institutions designed to disrupt traditional banking by offering seamless mobile and online services. Challenger banks often have full banking licenses, allowing them to provide a wider range of services, while neobanks may partner with existing banks to offer limited banking functionalities. Both leverage advanced fintech technologies, targeting tech-savvy consumers seeking lower fees, faster transactions, and enhanced user experience.

Key Terms

Digital-only

Challenger banks and neobanks both operate as digital-only financial institutions, offering streamlined, tech-driven banking services without traditional branches. Challenger banks often hold full banking licenses and provide a wider range of financial products, while neobanks typically focus on user-friendly mobile apps and niche market segments with limited services. Discover the key differences and benefits of digital-only banking by exploring detailed comparisons.

Regulatory License

Challenger banks operate under full banking licenses granted by regulatory authorities, allowing them to offer a comprehensive range of financial services, including deposit protection and lending capabilities. Neobanks often function without a traditional banking license, partnering with licensed banks to provide financial products while focusing on digital-first customer experiences. Explore the differences in regulatory frameworks to understand how each model impacts security and service offerings.

Financial Technology (Fintech)

Challenger banks are fully licensed digital banks that directly compete with traditional banks by offering streamlined services with innovative technology, whereas neobanks primarily focus on mobile-first financial solutions, often partnering with established banks to provide a seamless user experience. Both leverage Fintech advancements such as AI-driven analytics, blockchain security, and real-time payment systems to enhance customer engagement and operational efficiency. Explore the evolving landscape of Fintech to understand the distinct roles and future potential of challenger banks and neobanks.

Source and External Links

Challenger Banks Explained: Trends and Opportunities - Ulam Labs - Challenger banks are digital-first financial institutions that operate mainly through mobile apps and online platforms, offering user-friendly, more agile banking services that challenge traditional banks by providing lower fees and innovative tools like instant spending notifications and fee-free international transfers, emerging strongly after regulatory changes post-2008 financial crisis.

The Rise of Challenger Banks: Are the Apps Taking Over? - Challenger banks have become significant competitors globally by capturing market share with digital banking solutions, prompting traditional banks to respond by launching FinTech brands themselves and partnering with FinTech providers to retain customers.

Challenger Banks: What You Need to Know | Jenius Bank - Challenger banks prioritize a modern, customer-centric digital experience, aiming to offer convenient services such as mobile access, better rates, and fee transparency, redefining banking especially for tech-savvy and younger generations since the term arose after the 2008 financial crisis.

dowidth.com

dowidth.com