Credit builder cards report payments to major credit bureaus, helping users improve their credit scores through responsible use; they often come with low credit limits and manageable fees tailored for credit-building purposes. Store cards, issued by specific retailers, offer rewards and discounts at their associated stores but typically have higher interest rates and limited credit score benefits outside that retailer. Discover detailed comparisons to choose the best option for your financial goals.

Why it is important

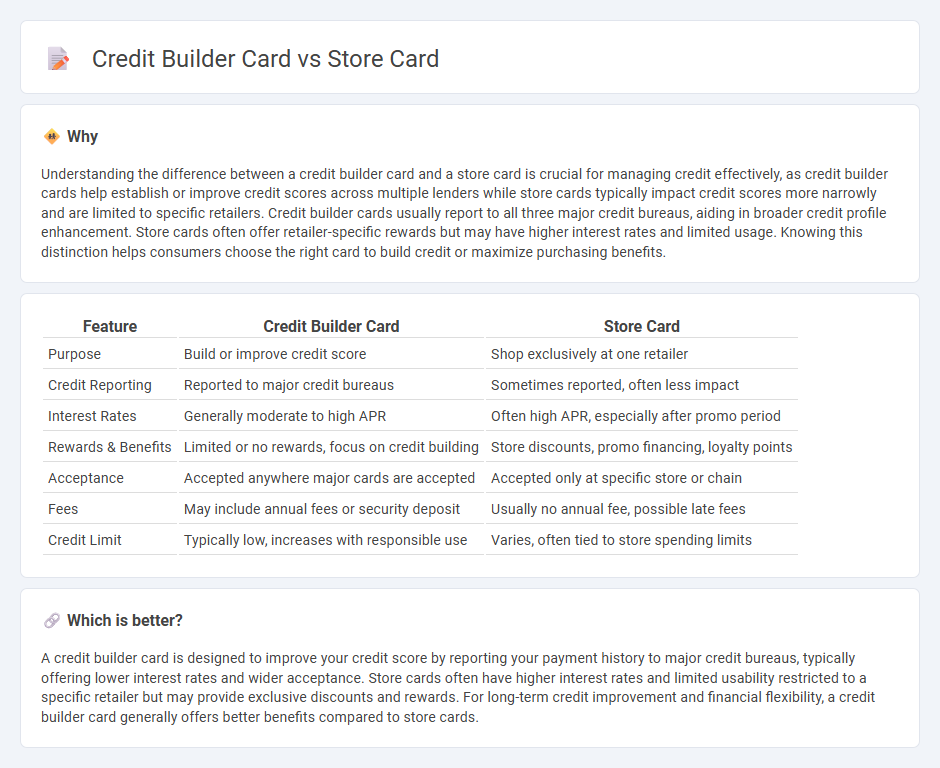

Understanding the difference between a credit builder card and a store card is crucial for managing credit effectively, as credit builder cards help establish or improve credit scores across multiple lenders while store cards typically impact credit scores more narrowly and are limited to specific retailers. Credit builder cards usually report to all three major credit bureaus, aiding in broader credit profile enhancement. Store cards often offer retailer-specific rewards but may have higher interest rates and limited usage. Knowing this distinction helps consumers choose the right card to build credit or maximize purchasing benefits.

Comparison Table

| Feature | Credit Builder Card | Store Card |

|---|---|---|

| Purpose | Build or improve credit score | Shop exclusively at one retailer |

| Credit Reporting | Reported to major credit bureaus | Sometimes reported, often less impact |

| Interest Rates | Generally moderate to high APR | Often high APR, especially after promo period |

| Rewards & Benefits | Limited or no rewards, focus on credit building | Store discounts, promo financing, loyalty points |

| Acceptance | Accepted anywhere major cards are accepted | Accepted only at specific store or chain |

| Fees | May include annual fees or security deposit | Usually no annual fee, possible late fees |

| Credit Limit | Typically low, increases with responsible use | Varies, often tied to store spending limits |

Which is better?

A credit builder card is designed to improve your credit score by reporting your payment history to major credit bureaus, typically offering lower interest rates and wider acceptance. Store cards often have higher interest rates and limited usability restricted to a specific retailer but may provide exclusive discounts and rewards. For long-term credit improvement and financial flexibility, a credit builder card generally offers better benefits compared to store cards.

Connection

Credit builder cards and store cards both serve as tools to establish or improve credit history by reporting payment activity to credit bureaus, helping consumers build a positive credit profile. Store cards, often issued by retail brands, can function similarly to credit builder cards when timely payments are reported, contributing to credit score enhancement. Using either card responsibly by making on-time payments and maintaining low balances supports creditworthiness and expands borrowing opportunities.

Key Terms

Credit Limit

Store cards typically offer lower credit limits restricted to a specific retailer, allowing limited spending and rewards focused on that store. Credit builder cards provide higher credit limits designed to help improve overall credit scores through responsible use, often accepted universally. Discover how selecting the right card based on credit limit can influence your credit growth journey.

Interest Rate

Store cards typically feature higher interest rates compared to credit builder cards, often exceeding 20% APR due to their revolving debt model linked to specific retailers. Credit builder cards, designed to help improve credit scores, usually offer lower interest rates and more flexible payment options to reduce financial strain. Explore detailed comparisons to understand which card type aligns best with your financial goals and credit needs.

Credit History

Store cards typically report limited data to credit bureaus, often resulting in a less significant impact on overall credit history compared to credit builder cards. Credit builder cards are designed specifically to improve credit scores by reporting regular payments, credit utilization, and account age, making them more effective for establishing or rebuilding credit history. Explore how each card type influences credit history and choose the best solution to boost your financial profile.

Source and External Links

Best Store Credit Cards of 2025 - NerdWallet - Store cards are credit cards branded by specific retailers offering exclusive discounts and rewards but generally have higher interest rates and lower credit limits; they can be either closed-loop (usable only at the retailer) or open-loop (usable anywhere Visa/Mastercard are accepted).

Amazon Store Card - Amazon Pay - The Amazon Store Card allows purchases on Amazon and beyond via Amazon Pay, offers 0% APR financing on qualifying purchases over $150, and has features like no fraud liability and equal monthly payment options.

Card Manager - StoreCard.com - This site provides an online portal where users can access their store card balance, transaction history, and other account features.

dowidth.com

dowidth.com