Debt recycling leverages existing home equity to systematically pay down non-deductible debt while building tax-deductible investment loans, boosting wealth over time. Interest-only loans require payment of only the interest portion, reducing monthly outgoings but not decreasing the principal balance. Explore how these strategies compare to optimize your financial plan.

Why it is important

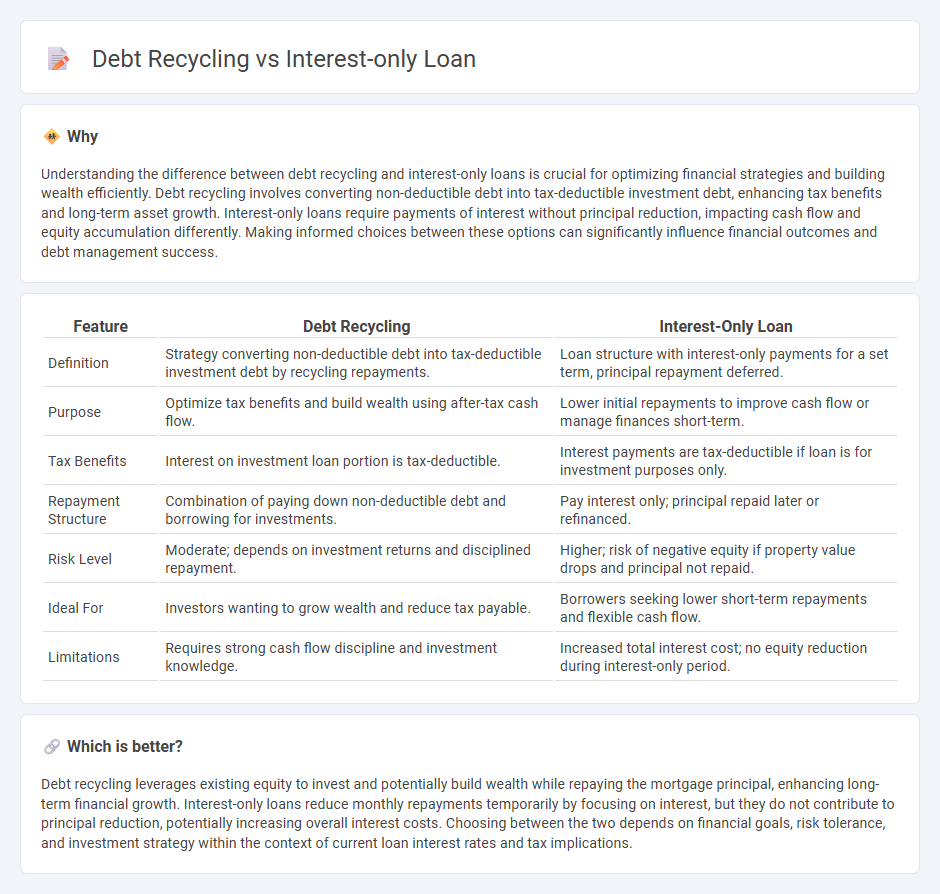

Understanding the difference between debt recycling and interest-only loans is crucial for optimizing financial strategies and building wealth efficiently. Debt recycling involves converting non-deductible debt into tax-deductible investment debt, enhancing tax benefits and long-term asset growth. Interest-only loans require payments of interest without principal reduction, impacting cash flow and equity accumulation differently. Making informed choices between these options can significantly influence financial outcomes and debt management success.

Comparison Table

| Feature | Debt Recycling | Interest-Only Loan |

|---|---|---|

| Definition | Strategy converting non-deductible debt into tax-deductible investment debt by recycling repayments. | Loan structure with interest-only payments for a set term, principal repayment deferred. |

| Purpose | Optimize tax benefits and build wealth using after-tax cash flow. | Lower initial repayments to improve cash flow or manage finances short-term. |

| Tax Benefits | Interest on investment loan portion is tax-deductible. | Interest payments are tax-deductible if loan is for investment purposes only. |

| Repayment Structure | Combination of paying down non-deductible debt and borrowing for investments. | Pay interest only; principal repaid later or refinanced. |

| Risk Level | Moderate; depends on investment returns and disciplined repayment. | Higher; risk of negative equity if property value drops and principal not repaid. |

| Ideal For | Investors wanting to grow wealth and reduce tax payable. | Borrowers seeking lower short-term repayments and flexible cash flow. |

| Limitations | Requires strong cash flow discipline and investment knowledge. | Increased total interest cost; no equity reduction during interest-only period. |

Which is better?

Debt recycling leverages existing equity to invest and potentially build wealth while repaying the mortgage principal, enhancing long-term financial growth. Interest-only loans reduce monthly repayments temporarily by focusing on interest, but they do not contribute to principal reduction, potentially increasing overall interest costs. Choosing between the two depends on financial goals, risk tolerance, and investment strategy within the context of current loan interest rates and tax implications.

Connection

Debt recycling involves using an interest-only loan to convert non-deductible debt, such as a home mortgage, into tax-deductible investment debt by borrowing against home equity to invest. Interest-only loans minimize principal repayments, maximizing available cash flow to fund investments, which aligns with the debt recycling strategy. This approach leverages the interest deductibility of investment loans to improve after-tax returns while managing overall debt efficiently.

Key Terms

Principal

Interest-only loans temporarily reduce monthly payments by limiting repayments to the principal's interest, allowing borrowers to maintain cash flow without reducing principal balance. Debt recycling involves strategically converting non-deductible debt into tax-deductible investment debt by paying down the principal on personal loans while borrowing to invest. Explore detailed strategies and benefits of managing your principal in these financial approaches to optimize your loan structure and tax efficiency.

Cash Flow

Interest-only loans reduce initial repayments, enhancing short-term cash flow by only paying interest without principal reduction. Debt recycling replaces non-deductible personal debt with tax-deductible investment loans, optimizing cash flow through potential tax benefits and asset accumulation. Explore detailed strategies to maximize your cash flow through interest-only loans and debt recycling.

Equity

Interest-only loans allow borrowers to pay only the interest on their mortgage, preserving principal and potentially maximizing available equity for future investments. Debt recycling involves converting non-deductible debt into tax-deductible investment debt by using existing home equity, thereby accelerating wealth creation through strategic borrowing. Explore detailed strategies and tax implications to optimize your equity effectively.

Source and External Links

Interest-Only Mortgage: Pros & Cons - For the first several years, you pay only interest, resulting in lower monthly payments, but once the interest-only period ends, you must pay both principal and interest, often leading to much higher payments.

How Does an Interest-Only Mortgage Work? - An interest-only mortgage allows you to make low payments covering just interest for a set period (up to 10 years), after which you must start repaying the principal, refinance, or pay off the balance in a lump sum.

Interest-Only Loan - With this loan, your monthly payments cover only interest for a set term (typically 5-10 years), leaving the principal balance unchanged unless you choose to make additional payments.

dowidth.com

dowidth.com