Green financing focuses on funding projects with positive environmental impacts, promoting sustainability through investments in renewable energy, clean technology, and eco-friendly infrastructure. Equity financing involves raising capital by selling shares of the company to investors, providing funds without incurring debt but diluting ownership. Explore further to understand the distinct benefits and applications of green financing versus equity financing in modern banking.

Why it is important

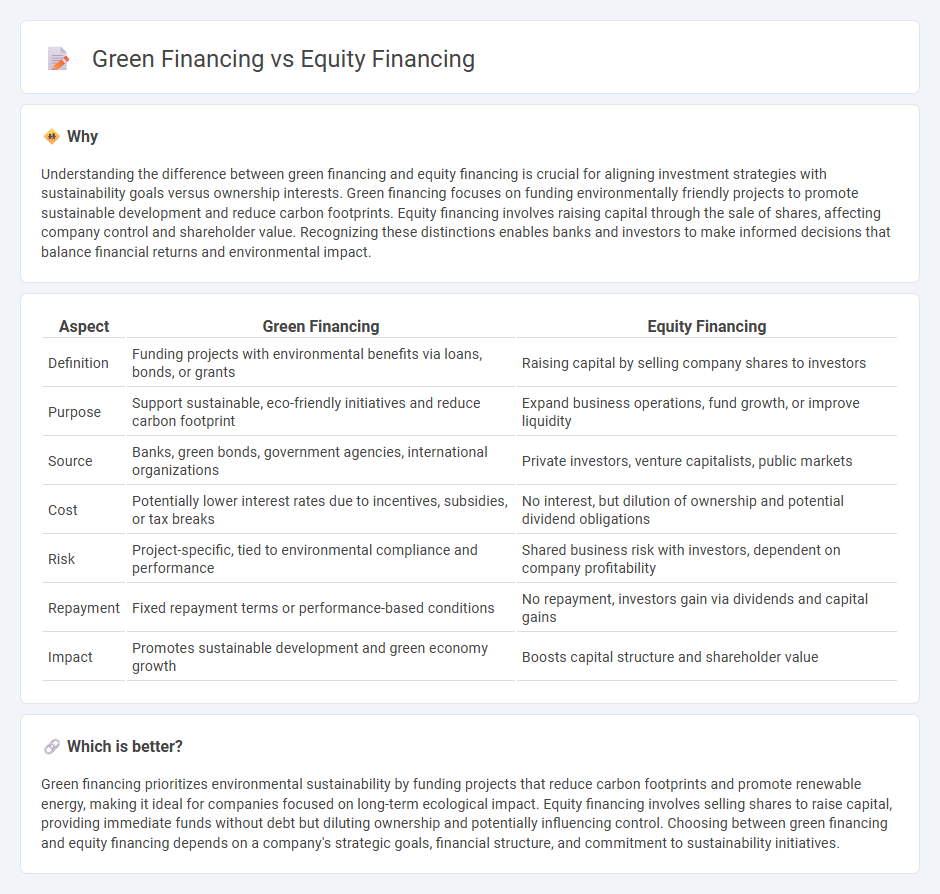

Understanding the difference between green financing and equity financing is crucial for aligning investment strategies with sustainability goals versus ownership interests. Green financing focuses on funding environmentally friendly projects to promote sustainable development and reduce carbon footprints. Equity financing involves raising capital through the sale of shares, affecting company control and shareholder value. Recognizing these distinctions enables banks and investors to make informed decisions that balance financial returns and environmental impact.

Comparison Table

| Aspect | Green Financing | Equity Financing |

|---|---|---|

| Definition | Funding projects with environmental benefits via loans, bonds, or grants | Raising capital by selling company shares to investors |

| Purpose | Support sustainable, eco-friendly initiatives and reduce carbon footprint | Expand business operations, fund growth, or improve liquidity |

| Source | Banks, green bonds, government agencies, international organizations | Private investors, venture capitalists, public markets |

| Cost | Potentially lower interest rates due to incentives, subsidies, or tax breaks | No interest, but dilution of ownership and potential dividend obligations |

| Risk | Project-specific, tied to environmental compliance and performance | Shared business risk with investors, dependent on company profitability |

| Repayment | Fixed repayment terms or performance-based conditions | No repayment, investors gain via dividends and capital gains |

| Impact | Promotes sustainable development and green economy growth | Boosts capital structure and shareholder value |

Which is better?

Green financing prioritizes environmental sustainability by funding projects that reduce carbon footprints and promote renewable energy, making it ideal for companies focused on long-term ecological impact. Equity financing involves selling shares to raise capital, providing immediate funds without debt but diluting ownership and potentially influencing control. Choosing between green financing and equity financing depends on a company's strategic goals, financial structure, and commitment to sustainability initiatives.

Connection

Green financing and equity financing are connected through their mutual role in supporting sustainable business growth and environmental projects by attracting investment capital. Equity financing provides companies with the necessary funds by selling shares, which can be specifically directed toward green initiatives such as renewable energy, energy efficiency, and sustainable infrastructure. This synergy enhances the financial resources available for environmentally responsible projects, aligning investor interests with the goals of reducing carbon footprints and promoting long-term ecological benefits.

Key Terms

Ownership (Equity Stake)

Equity financing involves raising capital through the sale of shares, granting investors partial ownership and equity stakes in the company, which entitles them to voting rights and profit sharing. Green financing primarily supports environmentally sustainable projects and may include equity financing, debt, or grants but does not inherently convey ownership stakes unless structured as equity investment. Explore the specifics of ownership implications and investment returns by delving deeper into equity versus green financing models.

Environmental Impact (Sustainability)

Equity financing involves raising capital through the sale of shares, often prioritizing financial returns over environmental considerations, whereas green financing explicitly directs funds toward projects with measurable positive environmental impacts such as renewable energy and carbon reduction. Green financing supports sustainability by incentivizing investments that contribute to lower carbon footprints and promote ecological balance, aligning closely with global climate goals. Explore how these funding mechanisms can drive sustainable development and environmental responsibility in more detail.

Capital Structure

Equity financing involves raising capital through the sale of shares, impacting a company's capital structure by increasing shareholder equity and potentially diluting ownership, whereas green financing focuses on funding environmentally sustainable projects, often through specialized instruments like green bonds that attract investors interested in sustainability without immediately altering equity stakes. The integration of green financing can enhance a firm's capital structure by diversifying funding sources and aligning financial strategies with ESG goals. Explore how these financing methods reshape capital frameworks and drive sustainable growth.

Source and External Links

How equity financing works for startups - Equity financing is raising capital by selling ownership stakes in a company to investors, who become long-term partners sharing the company's future success without repayment obligations.

Equity Financing - Definition, How it Works, Pros, Cons - Equity financing involves selling company shares to raise capital, often used by startups via angel investors, venture capital, crowdfunding, or IPOs, giving investors ownership rights and potential dividends or share value appreciation.

Equity Financing Guide: Pros & Cons, Types, How it Works - Equity financing exchanges ownership shares for capital, reducing financial burden but diluting ownership and requiring investor involvement in decisions, differing from debt financing which requires repayment with interest.

dowidth.com

dowidth.com