Finfluencers leverage digital platforms and social media to provide accessible financial advice, often targeting younger audiences with personalized investment insights and trending market analyses. Relationship managers offer tailored, in-depth client services through direct interactions, focusing on long-term financial planning and trust-building for high-net-worth individuals. Explore how combining both approaches can optimize your banking experience and financial growth.

Why it is important

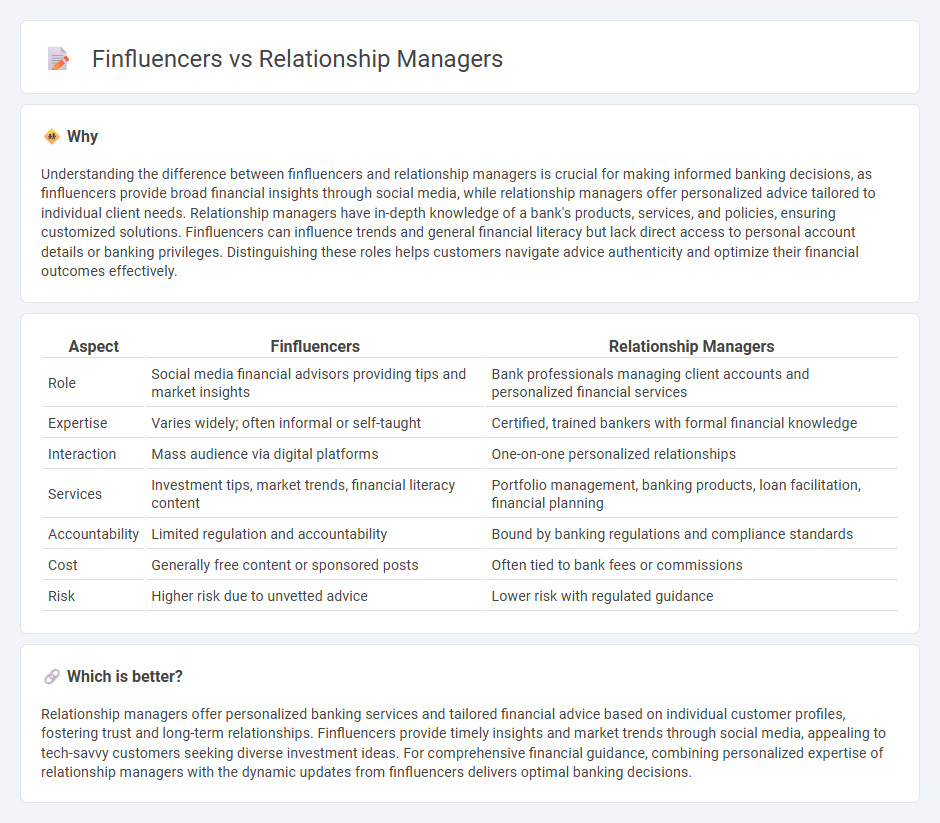

Understanding the difference between finfluencers and relationship managers is crucial for making informed banking decisions, as finfluencers provide broad financial insights through social media, while relationship managers offer personalized advice tailored to individual client needs. Relationship managers have in-depth knowledge of a bank's products, services, and policies, ensuring customized solutions. Finfluencers can influence trends and general financial literacy but lack direct access to personal account details or banking privileges. Distinguishing these roles helps customers navigate advice authenticity and optimize their financial outcomes effectively.

Comparison Table

| Aspect | Finfluencers | Relationship Managers |

|---|---|---|

| Role | Social media financial advisors providing tips and market insights | Bank professionals managing client accounts and personalized financial services |

| Expertise | Varies widely; often informal or self-taught | Certified, trained bankers with formal financial knowledge |

| Interaction | Mass audience via digital platforms | One-on-one personalized relationships |

| Services | Investment tips, market trends, financial literacy content | Portfolio management, banking products, loan facilitation, financial planning |

| Accountability | Limited regulation and accountability | Bound by banking regulations and compliance standards |

| Cost | Generally free content or sponsored posts | Often tied to bank fees or commissions |

| Risk | Higher risk due to unvetted advice | Lower risk with regulated guidance |

Which is better?

Relationship managers offer personalized banking services and tailored financial advice based on individual customer profiles, fostering trust and long-term relationships. Finfluencers provide timely insights and market trends through social media, appealing to tech-savvy customers seeking diverse investment ideas. For comprehensive financial guidance, combining personalized expertise of relationship managers with the dynamic updates from finfluencers delivers optimal banking decisions.

Connection

Finfluencers leverage social media platforms to educate and influence consumers on banking products, complementing relationship managers who provide personalized financial advice and build trust through direct client interactions. Both roles enhance customer engagement by combining digital insights with tailored solutions to improve financial decision-making. This synergy drives increased customer acquisition and retention in the competitive banking sector.

Key Terms

**Relationship Managers:**

Relationship Managers specialize in personalized client engagement, offering tailored financial advice based on in-depth understanding of individual needs and long-term goals. They leverage expertise in portfolio management, risk assessment, and regulatory compliance to foster trust and ensure sustained financial growth. Explore how Relationship Managers can provide customized solutions to enhance your financial strategy.

Client Portfolio

Relationship managers provide personalized investment strategies by analyzing client portfolios to optimize asset allocation and risk management. Finfluencers influence a broader audience through social media, offering general financial advice and trending investment insights without tailored portfolio management. Discover detailed comparisons to understand the impact on your client portfolio.

Cross-selling

Relationship managers leverage personalized client data to cross-sell financial products tailored to individual needs, enhancing customer loyalty and lifetime value. Finfluencers use their social media influence to promote trending financial products broadly, driving high-volume but often less personalized cross-selling opportunities. Explore how combining both approaches can maximize cross-selling effectiveness in financial services.

Source and External Links

A Comprehensive Guide to Relationship Management - Relationship managers build and maintain strong client relationships through communication, ensure client satisfaction by resolving issues proactively, and offer strategic advice to help clients meet their goals, especially in sectors like finance.

Relationship Manager: What Is It? and How to Become One? - A relationship manager manages client relationships to ensure satisfaction, combining customer service, sales skills, and product knowledge, usually requiring a business degree and experience in related roles.

Relationship Manager: Job Description, Qualifications, Types - Relationship managers can specialize as client relationship managers focusing on customer trust and sales support, or as business relationship managers who manage vendor and partner relationships to support company operations and strategy.

dowidth.com

dowidth.com