Central bank digital currency (CBDC) represents a state-backed, digital form of money issued by the central bank, offering enhanced security and real-time settlement compared to traditional retail deposits held by commercial banks. Retail deposits involve funds stored by consumers in private banks, subject to fractional reserve banking and interest fluctuations. Explore the key differences and implications of CBDC versus retail deposits in the modern banking landscape.

Why it is important

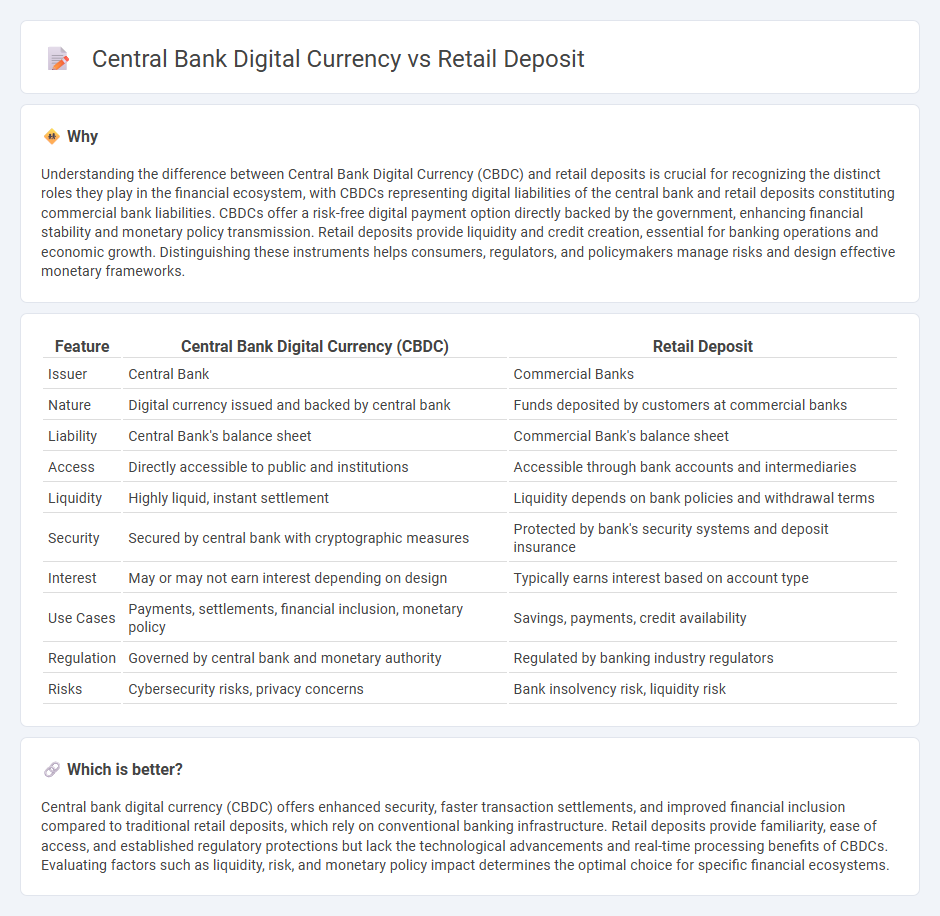

Understanding the difference between Central Bank Digital Currency (CBDC) and retail deposits is crucial for recognizing the distinct roles they play in the financial ecosystem, with CBDCs representing digital liabilities of the central bank and retail deposits constituting commercial bank liabilities. CBDCs offer a risk-free digital payment option directly backed by the government, enhancing financial stability and monetary policy transmission. Retail deposits provide liquidity and credit creation, essential for banking operations and economic growth. Distinguishing these instruments helps consumers, regulators, and policymakers manage risks and design effective monetary frameworks.

Comparison Table

| Feature | Central Bank Digital Currency (CBDC) | Retail Deposit |

|---|---|---|

| Issuer | Central Bank | Commercial Banks |

| Nature | Digital currency issued and backed by central bank | Funds deposited by customers at commercial banks |

| Liability | Central Bank's balance sheet | Commercial Bank's balance sheet |

| Access | Directly accessible to public and institutions | Accessible through bank accounts and intermediaries |

| Liquidity | Highly liquid, instant settlement | Liquidity depends on bank policies and withdrawal terms |

| Security | Secured by central bank with cryptographic measures | Protected by bank's security systems and deposit insurance |

| Interest | May or may not earn interest depending on design | Typically earns interest based on account type |

| Use Cases | Payments, settlements, financial inclusion, monetary policy | Savings, payments, credit availability |

| Regulation | Governed by central bank and monetary authority | Regulated by banking industry regulators |

| Risks | Cybersecurity risks, privacy concerns | Bank insolvency risk, liquidity risk |

Which is better?

Central bank digital currency (CBDC) offers enhanced security, faster transaction settlements, and improved financial inclusion compared to traditional retail deposits, which rely on conventional banking infrastructure. Retail deposits provide familiarity, ease of access, and established regulatory protections but lack the technological advancements and real-time processing benefits of CBDCs. Evaluating factors such as liquidity, risk, and monetary policy impact determines the optimal choice for specific financial ecosystems.

Connection

Central bank digital currency (CBDC) directly influences retail deposit dynamics by offering a digital alternative issued and backed by the central bank, potentially reducing reliance on traditional bank deposits. CBDCs enhance payment efficiency and financial inclusion, reshaping retail deposit competition between commercial banks and central banks. The integration of CBDCs into the banking system could alter liquidity management, affect deposit stability, and redefine monetary policy transmission.

Key Terms

Customer Accounts

Retail deposits are traditional bank accounts where customers store funds insured by government agencies, providing safety and liquidity. Central bank digital currency (CBDC) represents a digital form of legal tender issued directly by the central bank, enabling instant settlement and enhanced transaction transparency. Explore the detailed differences and implications of retail deposits versus CBDCs for customer accounts to understand future financial landscapes.

Monetary Policy

Retail deposits represent traditional bank-held funds accessible to the general public, influencing money supply through deposit creation and lending activities. Central bank digital currencies (CBDCs) directly issued by the central bank offer a new tool for monetary policy by enabling precise control over the money supply and interest rates through programmable features. Explore how CBDCs can transform monetary policy implementation and financial stability in modern economies.

Digital Ledger

Retail deposits represent traditional bank account funds recorded on centralized ledgers managed by commercial banks, ensuring secure and regulated access to customer funds. Central Bank Digital Currency (CBDC), particularly when integrated with Digital Ledger Technology (DLT), offers a decentralized, tamper-resistant system that enhances transparency, real-time settlement, and reduces counterparty risks. Explore the transformative impact of Digital Ledger Technology on future financial systems by learning more about CBDCs and retail deposits.

Source and External Links

73. Retail deposits definition (LCR, Basel III) - Lewik - Retail deposits are deposits placed with a bank by a natural person, including demand and term deposits, distinguished from wholesale deposits from business entities, and are defined specifically for regulatory liquidity coverage ratio purposes under Basel III.

Retail Deposit Analyzer | Benchmark Bank Deposits & Grow Market ... - Curinos offers a Retail Deposit Analyzer tool that helps banks benchmark deposit rates, optimize pricing strategies, and improve deposit portfolio performance using detailed account-level data and market insights.

Retail Deposits - Oracle Help Center - Oracle documents enhancements related to retail deposits, including features for deposit account maturity notifications, top-ups, withdrawals, and generation of periodic statements for term or certificate deposits.

dowidth.com

dowidth.com