Neo brokerages use digital platforms to offer low-cost, user-friendly trading services primarily to retail investors, while investment banks provide comprehensive financial advisory, underwriting, and capital raising services to corporations and institutional clients. Neo brokerages focus on streamlined access to stock markets with minimal fees, whereas investment banks engage in complex transactions like mergers, acquisitions, and initial public offerings. Explore the distinct roles and advantages of neo brokerages and investment banks to understand their impact on the financial industry.

Why it is important

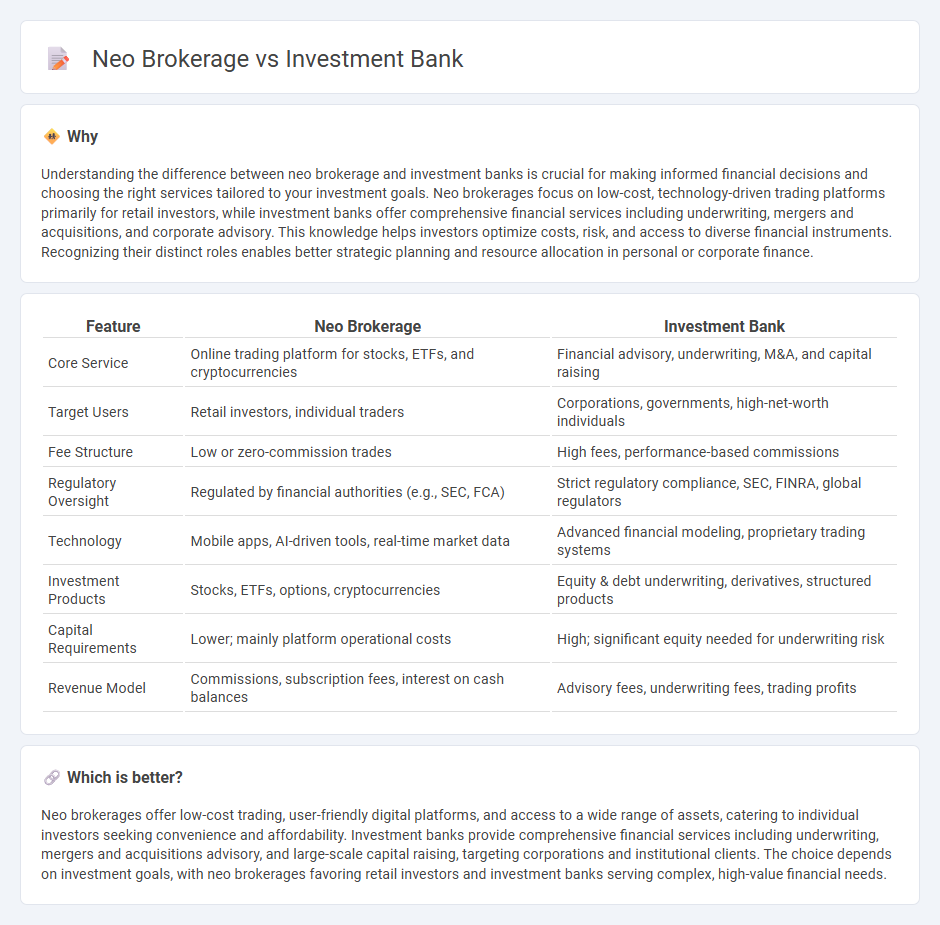

Understanding the difference between neo brokerage and investment banks is crucial for making informed financial decisions and choosing the right services tailored to your investment goals. Neo brokerages focus on low-cost, technology-driven trading platforms primarily for retail investors, while investment banks offer comprehensive financial services including underwriting, mergers and acquisitions, and corporate advisory. This knowledge helps investors optimize costs, risk, and access to diverse financial instruments. Recognizing their distinct roles enables better strategic planning and resource allocation in personal or corporate finance.

Comparison Table

| Feature | Neo Brokerage | Investment Bank |

|---|---|---|

| Core Service | Online trading platform for stocks, ETFs, and cryptocurrencies | Financial advisory, underwriting, M&A, and capital raising |

| Target Users | Retail investors, individual traders | Corporations, governments, high-net-worth individuals |

| Fee Structure | Low or zero-commission trades | High fees, performance-based commissions |

| Regulatory Oversight | Regulated by financial authorities (e.g., SEC, FCA) | Strict regulatory compliance, SEC, FINRA, global regulators |

| Technology | Mobile apps, AI-driven tools, real-time market data | Advanced financial modeling, proprietary trading systems |

| Investment Products | Stocks, ETFs, options, cryptocurrencies | Equity & debt underwriting, derivatives, structured products |

| Capital Requirements | Lower; mainly platform operational costs | High; significant equity needed for underwriting risk |

| Revenue Model | Commissions, subscription fees, interest on cash balances | Advisory fees, underwriting fees, trading profits |

Which is better?

Neo brokerages offer low-cost trading, user-friendly digital platforms, and access to a wide range of assets, catering to individual investors seeking convenience and affordability. Investment banks provide comprehensive financial services including underwriting, mergers and acquisitions advisory, and large-scale capital raising, targeting corporations and institutional clients. The choice depends on investment goals, with neo brokerages favoring retail investors and investment banks serving complex, high-value financial needs.

Connection

Neo brokerages leverage cutting-edge technology platforms to offer user-friendly, low-cost trading services, attracting a tech-savvy investor base. Investment banks collaborate with neo brokerages by providing access to capital markets, underwriting securities, and facilitating IPOs for emerging companies within the neo brokerage ecosystem. This synergy accelerates market liquidity and expands investment opportunities for both retail clients and institutional stakeholders.

Key Terms

Underwriting (Investment Bank)

Investment banks specialize in underwriting by assuming the risk of purchasing newly issued securities and reselling them to investors, which provides crucial capital for corporations and governments. Neo brokerages primarily facilitate low-cost, user-friendly trading platforms without underwriting services, focusing on retail investors with lower fees and simplified access. Explore the distinct underwriting advantages investment banks offer to better understand their critical role in financial markets.

Commission-free Trading (Neo Brokerage)

Neo brokerages revolutionize investing with commission-free trading, eliminating fees traditionally charged by investment banks, making market access affordable and transparent for retail investors. These platforms leverage advanced technology and streamlined interfaces to enable real-time trades and fractional share purchases without hidden costs. Discover how commission-free trading through neo brokerages can transform your investment strategy.

Capital Raising (Investment Bank)

Investment banks excel in capital raising by underwriting and distributing large-scale securities offerings, including IPOs, debt issuances, and private placements for corporations and governments. They provide strategic advisory services, pricing expertise, and access to extensive institutional investor networks, facilitating efficient capital access and optimizing funding costs. Discover how investment banks drive capital formation compared to neo brokerages.

Source and External Links

Investment banking - Wikipedia - Investment banking is an advisory-based financial service for institutional investors, corporations, and governments, involving activities such as issuing securities, risk management, and corporate treasury operations, with divisions including front, middle, and back office functions.

Investment Bank | Mergers & Acquisitions | InvestmentBank.com - This firm offers investment banking and capital advisory services to middle-market companies, combining bulge-bracket sophistication with boutique advisory to maximize transaction value for buy- or sell-side clients.

Investment Banking - JPMorgan - JPMorgan provides investment banking solutions including mergers and acquisitions, capital raising, and sustainability-focused financing, supporting corporations, institutions, and governments globally with strategic advisory tailored to complex transactions.

dowidth.com

dowidth.com