Neo brokerages offer low-cost, user-friendly platforms with real-time trading and advanced analytics, appealing to tech-savvy investors. Direct stock purchase plans (DSPPs) enable investors to buy shares directly from companies, often without brokerage fees and with options for automatic reinvestment. Explore the differences to determine which investment approach aligns best with your financial goals.

Why it is important

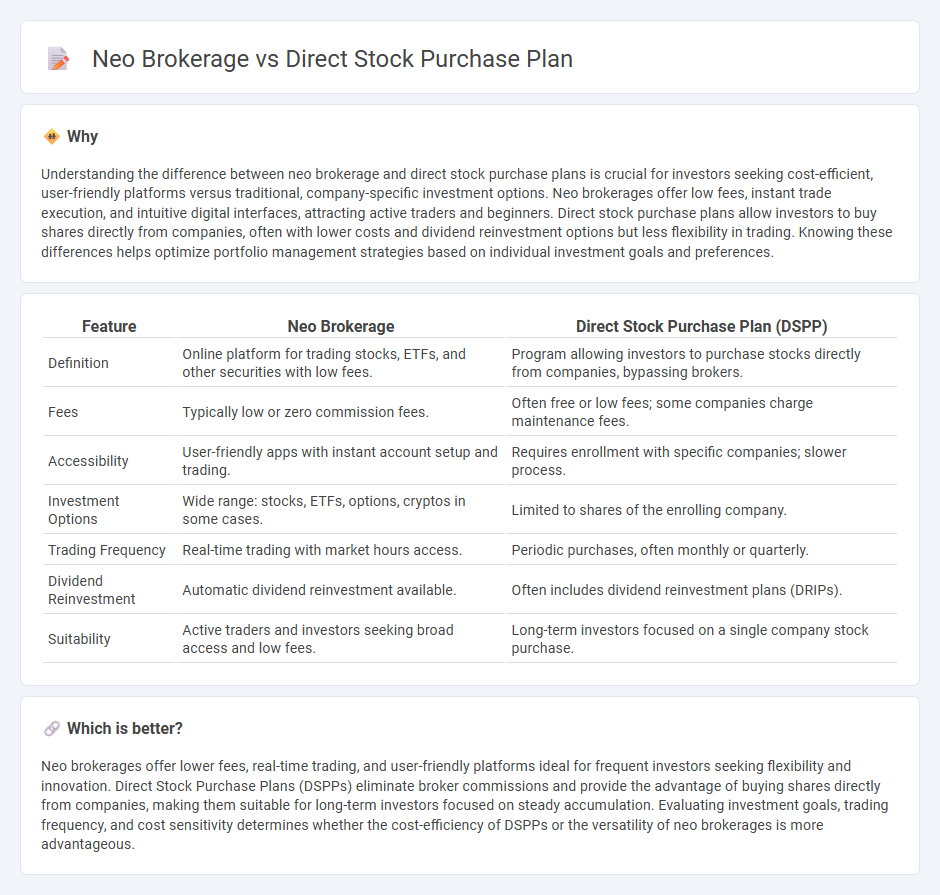

Understanding the difference between neo brokerage and direct stock purchase plans is crucial for investors seeking cost-efficient, user-friendly platforms versus traditional, company-specific investment options. Neo brokerages offer low fees, instant trade execution, and intuitive digital interfaces, attracting active traders and beginners. Direct stock purchase plans allow investors to buy shares directly from companies, often with lower costs and dividend reinvestment options but less flexibility in trading. Knowing these differences helps optimize portfolio management strategies based on individual investment goals and preferences.

Comparison Table

| Feature | Neo Brokerage | Direct Stock Purchase Plan (DSPP) |

|---|---|---|

| Definition | Online platform for trading stocks, ETFs, and other securities with low fees. | Program allowing investors to purchase stocks directly from companies, bypassing brokers. |

| Fees | Typically low or zero commission fees. | Often free or low fees; some companies charge maintenance fees. |

| Accessibility | User-friendly apps with instant account setup and trading. | Requires enrollment with specific companies; slower process. |

| Investment Options | Wide range: stocks, ETFs, options, cryptos in some cases. | Limited to shares of the enrolling company. |

| Trading Frequency | Real-time trading with market hours access. | Periodic purchases, often monthly or quarterly. |

| Dividend Reinvestment | Automatic dividend reinvestment available. | Often includes dividend reinvestment plans (DRIPs). |

| Suitability | Active traders and investors seeking broad access and low fees. | Long-term investors focused on a single company stock purchase. |

Which is better?

Neo brokerages offer lower fees, real-time trading, and user-friendly platforms ideal for frequent investors seeking flexibility and innovation. Direct Stock Purchase Plans (DSPPs) eliminate broker commissions and provide the advantage of buying shares directly from companies, making them suitable for long-term investors focused on steady accumulation. Evaluating investment goals, trading frequency, and cost sensitivity determines whether the cost-efficiency of DSPPs or the versatility of neo brokerages is more advantageous.

Connection

Neo brokerages leverage technology to offer streamlined platforms for investing, often integrating direct stock purchase plans (DSPPs) that enable investors to buy shares directly from companies without intermediaries. This connection reduces transaction costs and enhances accessibility for retail investors seeking low-fee, user-friendly stock purchasing options. By combining these services, neo brokerages facilitate efficient market participation and support long-term investment strategies through DSPPs.

Key Terms

Commission Structure

Direct stock purchase plans (DSPPs) typically offer commission-free or very low-cost stock acquisitions directly from companies, eliminating traditional brokerage fees. Neo brokerages, on the other hand, provide ultra-low to zero-commission trades via digital platforms but may generate revenue through order flow or premium services. Explore detailed comparisons of fee structures to determine which option aligns best with your investment goals.

Account Ownership

Direct Stock Purchase Plans (DSPPs) enable investors to buy shares directly from a company, granting true ownership with shares held in their name and often providing benefits like dividend reinvestment. Neo brokerages facilitate stock trading through simplified platforms but typically hold shares in a pooled or nominee account, meaning investors may not possess direct ownership of individual shares. Explore the nuances of account ownership to determine which investment approach best aligns with your financial goals.

Trading Platform

Direct Stock Purchase Plans (DSPPs) offer straightforward access to company shares without a traditional brokerage account, often lacking advanced trading platforms or real-time market data. Neo brokerages provide robust, technology-driven trading platforms featuring intuitive interfaces, instant trade executions, and a wide range of analytical tools suitable for active traders. Explore how these trading platforms impact your investment strategies and user experience.

Source and External Links

Direct Stock Purchase Plan (DSPP) - Corporate Finance Institute - A Direct Stock Purchase Plan (DSPP) lets individuals buy stocks directly from a company--bypassing a brokerage--typically with no trading commissions, but often with minimum investment requirements and possible transfer fees.

Direct Investing | Investor.gov - Direct stock plans (DSP) allow you to buy or sell company stock directly through the company, avoiding brokerage commissions but potentially incurring plan-specific fees and purchase/sale timing restrictions.

Dividend Reinvestment and Direct Stock Purchase Plan | Main Street Capital - This DSPP enables new and existing stockholders to purchase shares directly from the company without trading fees or commissions, with flexible initial and ongoing investment amounts and automatic payment options.

dowidth.com

dowidth.com