Synthetic identity fraud involves criminals creating fictitious identities by combining real and fake information to open fraudulent bank accounts and conduct illicit activities. Social engineering exploits human psychology to manipulate individuals into divulging confidential banking information, enabling unauthorized access to accounts. Explore further to understand how banks detect and prevent these sophisticated security threats.

Why it is important

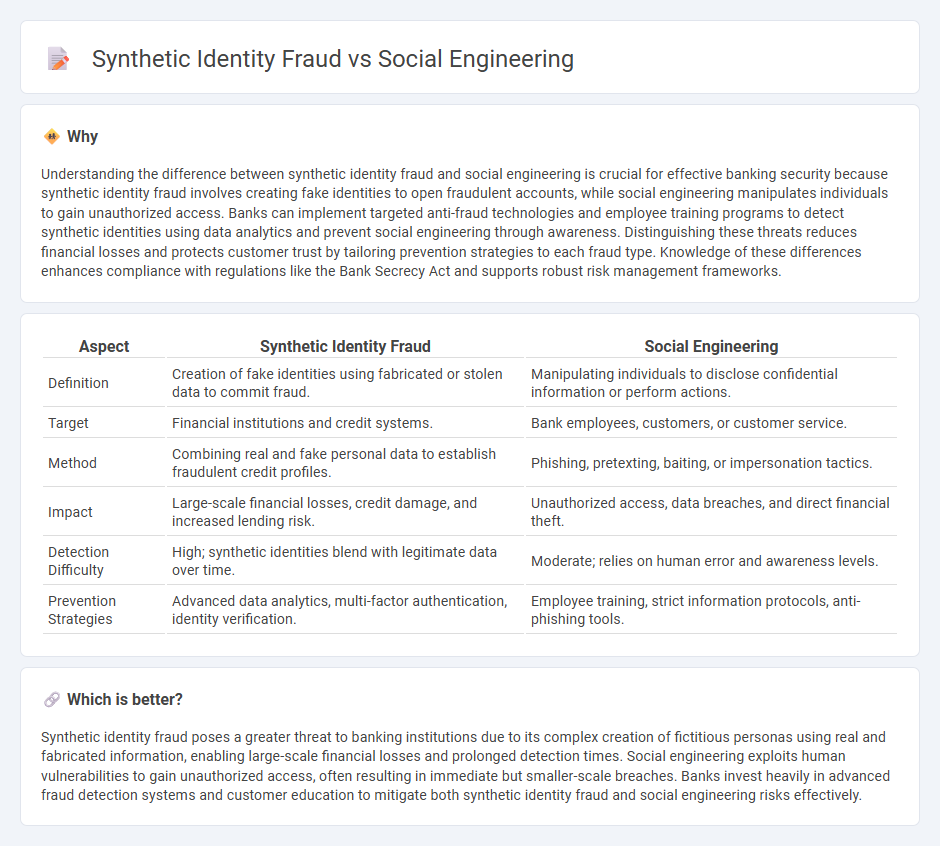

Understanding the difference between synthetic identity fraud and social engineering is crucial for effective banking security because synthetic identity fraud involves creating fake identities to open fraudulent accounts, while social engineering manipulates individuals to gain unauthorized access. Banks can implement targeted anti-fraud technologies and employee training programs to detect synthetic identities using data analytics and prevent social engineering through awareness. Distinguishing these threats reduces financial losses and protects customer trust by tailoring prevention strategies to each fraud type. Knowledge of these differences enhances compliance with regulations like the Bank Secrecy Act and supports robust risk management frameworks.

Comparison Table

| Aspect | Synthetic Identity Fraud | Social Engineering |

|---|---|---|

| Definition | Creation of fake identities using fabricated or stolen data to commit fraud. | Manipulating individuals to disclose confidential information or perform actions. |

| Target | Financial institutions and credit systems. | Bank employees, customers, or customer service. |

| Method | Combining real and fake personal data to establish fraudulent credit profiles. | Phishing, pretexting, baiting, or impersonation tactics. |

| Impact | Large-scale financial losses, credit damage, and increased lending risk. | Unauthorized access, data breaches, and direct financial theft. |

| Detection Difficulty | High; synthetic identities blend with legitimate data over time. | Moderate; relies on human error and awareness levels. |

| Prevention Strategies | Advanced data analytics, multi-factor authentication, identity verification. | Employee training, strict information protocols, anti-phishing tools. |

Which is better?

Synthetic identity fraud poses a greater threat to banking institutions due to its complex creation of fictitious personas using real and fabricated information, enabling large-scale financial losses and prolonged detection times. Social engineering exploits human vulnerabilities to gain unauthorized access, often resulting in immediate but smaller-scale breaches. Banks invest heavily in advanced fraud detection systems and customer education to mitigate both synthetic identity fraud and social engineering risks effectively.

Connection

Synthetic identity fraud exploits fabricated profiles combining real and fake information to deceive banking systems. Social engineering manipulates individuals into revealing sensitive data, enabling fraudsters to build and validate these synthetic identities. Both methods intertwine, amplifying risks to financial institutions through compromised authentication and unauthorized access.

Key Terms

Impersonation (Social Engineering)

Impersonation in social engineering involves manipulating individuals into divulging confidential information or granting unauthorized access by pretending to be a trusted entity. This tactic exploits human psychology rather than technical vulnerabilities, making it a prevalent method for acquiring sensitive data or credentials. Explore how impersonation techniques evolve within social engineering to better protect against identity threats.

Fabricated Identity (Synthetic Identity Fraud)

Synthetic identity fraud involves creating fabricated identities by combining real and fictitious information, enabling criminals to bypass traditional verification systems and commit financial crimes unnoticed. Unlike social engineering, which exploits human psychology to gain confidential information, synthetic identity fraud targets system vulnerabilities by constructing non-existent personas for fraudulent applications. Explore comprehensive strategies and tools to detect and prevent fabricated identity attacks in modern security frameworks.

Account Takeover

Account takeover occurs when fraudsters hijack legitimate user accounts, often exploiting social engineering tactics like phishing or pretexting to obtain sensitive information. Synthetic identity fraud involves creating fake identities by combining real and fabricated data, making detection challenging and enabling prolonged fraudulent activity. Explore effective strategies to differentiate and prevent these threats in account security.

Source and External Links

Social engineering (security) - Wikipedia - Social engineering involves psychological manipulation to influence people into divulging confidential information or performing certain actions, often as part of a complex fraud scheme.

What is Social Engineering? | IBM - Social engineering attacks manipulate individuals into sharing sensitive information, downloading unwanted software, or visiting malicious websites by exploiting human error and psychological weaknesses.

Social Engineering - Information Security Office - Computing Services - Social engineering is a tactic that manipulates victims to gain control over computer systems or steal personal and financial information using psychological manipulation and deception.

dowidth.com

dowidth.com