Blockchain remittance leverages decentralized ledger technology to enable faster, cost-effective, and transparent cross-border payments compared to traditional Money Transfer Operators (MTOs) like Western Union and MoneyGram, which often impose higher fees and longer processing times. By eliminating intermediaries, blockchain remittance offers enhanced security and real-time transaction tracking, addressing common pain points faced by MTO users. Explore how blockchain is transforming international money transfers and revolutionizing the banking landscape.

Why it is important

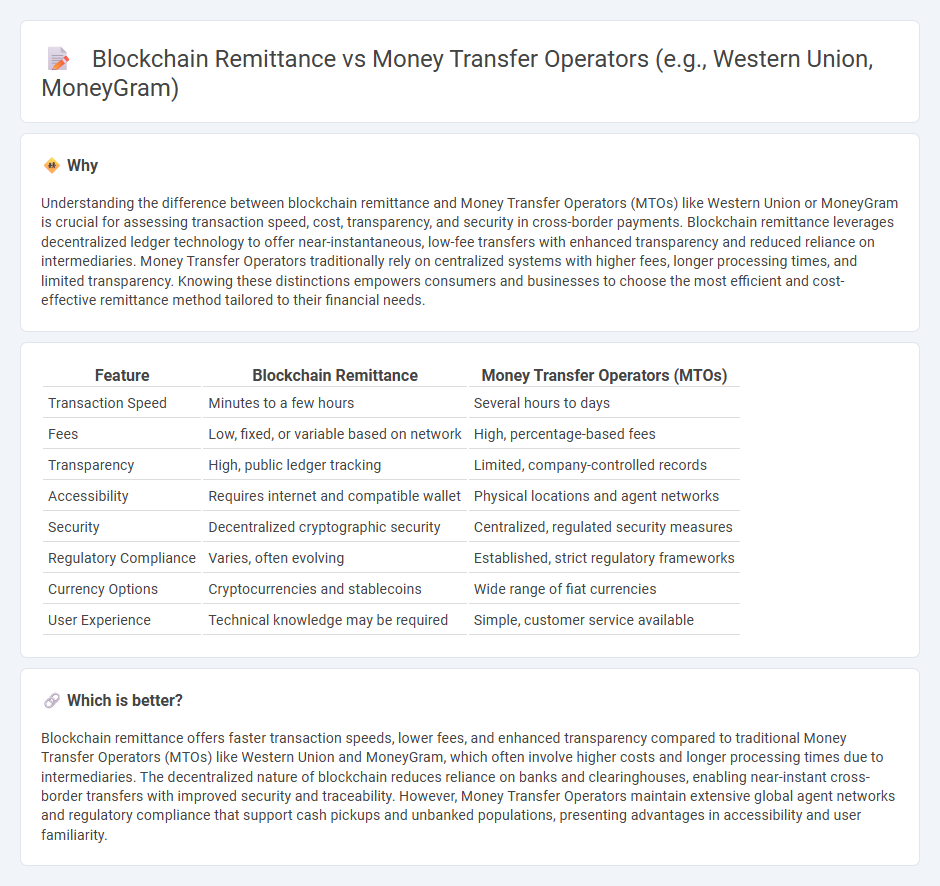

Understanding the difference between blockchain remittance and Money Transfer Operators (MTOs) like Western Union or MoneyGram is crucial for assessing transaction speed, cost, transparency, and security in cross-border payments. Blockchain remittance leverages decentralized ledger technology to offer near-instantaneous, low-fee transfers with enhanced transparency and reduced reliance on intermediaries. Money Transfer Operators traditionally rely on centralized systems with higher fees, longer processing times, and limited transparency. Knowing these distinctions empowers consumers and businesses to choose the most efficient and cost-effective remittance method tailored to their financial needs.

Comparison Table

| Feature | Blockchain Remittance | Money Transfer Operators (MTOs) |

|---|---|---|

| Transaction Speed | Minutes to a few hours | Several hours to days |

| Fees | Low, fixed, or variable based on network | High, percentage-based fees |

| Transparency | High, public ledger tracking | Limited, company-controlled records |

| Accessibility | Requires internet and compatible wallet | Physical locations and agent networks |

| Security | Decentralized cryptographic security | Centralized, regulated security measures |

| Regulatory Compliance | Varies, often evolving | Established, strict regulatory frameworks |

| Currency Options | Cryptocurrencies and stablecoins | Wide range of fiat currencies |

| User Experience | Technical knowledge may be required | Simple, customer service available |

Which is better?

Blockchain remittance offers faster transaction speeds, lower fees, and enhanced transparency compared to traditional Money Transfer Operators (MTOs) like Western Union and MoneyGram, which often involve higher costs and longer processing times due to intermediaries. The decentralized nature of blockchain reduces reliance on banks and clearinghouses, enabling near-instant cross-border transfers with improved security and traceability. However, Money Transfer Operators maintain extensive global agent networks and regulatory compliance that support cash pickups and unbanked populations, presenting advantages in accessibility and user familiarity.

Connection

Blockchain technology enhances remittance services by providing secure, transparent, and cost-effective cross-border money transfers, addressing inefficiencies faced by traditional Money Transfer Operators (MTOs) like Western Union and MoneyGram. These MTOs integrate blockchain to streamline transaction processing, reduce settlement times, and minimize fees, thereby improving customer experience and expanding access to financial services globally. The synergy between blockchain and MTOs fosters increased trust and regulatory compliance within the international remittance ecosystem.

Key Terms

Intermediaries

Money Transfer Operators like Western Union and MoneyGram rely on intermediaries such as banks and agents to facilitate cross-border transactions, often resulting in higher fees and longer processing times. Blockchain remittance eliminates many intermediaries by using decentralized ledgers, enabling faster, more transparent, and cost-effective transfers. Explore how blockchain technology is revolutionizing global remittance and reducing dependency on traditional intermediaries.

Settlement speed

Money Transfer Operators like Western Union and MoneyGram typically complete settlements within minutes to a few hours, leveraging established banking networks and agent locations for near-instant transfers. Blockchain remittance solutions utilize decentralized ledgers and smart contracts, enabling settlement times that can range from a few seconds to under an hour depending on the blockchain protocol and network congestion. Explore detailed comparisons to understand how settlement speed impacts global remittance efficiency.

Transparency

Money Transfer Operators like Western Union and MoneyGram provide established networks with regulated transparency and compliance, yet often involve hidden fees and longer settlement times. Blockchain remittance leverages decentralized ledger technology to offer transparent, real-time tracking of transactions and reduced costs by eliminating intermediaries. Explore how blockchain solutions enhance transparency and efficiency in international remittances.

Source and External Links

Money Transfer Operator (MTO) - Faisal Khan - A Money Transfer Operator (MTO) is a financial service specialist that transfers money between people or locations, operating via physical outlets or digital platforms, commonly used for remittances, business transactions, and personal transfers globally.

Western Union vs MoneyGram: What are the differences? | Blog - Western Union and MoneyGram are leading global MTOs with extensive worldwide coverage, with Western Union having broader geographic reach and more agent locations, both offering fast and secure international money transfers.

How Do Money Transfer Operators Work? - Remit Anywhere - Money Transfer Operators assist with domestic and international financial transactions, offering quick, affordable, and accessible money transfers often preferred over banks, and increasingly leveraging digital platforms and smartphone apps to connect customers worldwide efficiently.

dowidth.com

dowidth.com