Account aggregation consolidates financial data from multiple bank accounts into a single platform, simplifying money management and providing a comprehensive overview of financial health. Account Information Services (AIS) go beyond aggregation by enabling authorized third parties to access detailed account information, facilitating personalized financial insights and services under regulatory frameworks like PSD2. Discover how these innovations transform banking experience and enhance financial decision-making.

Why it is important

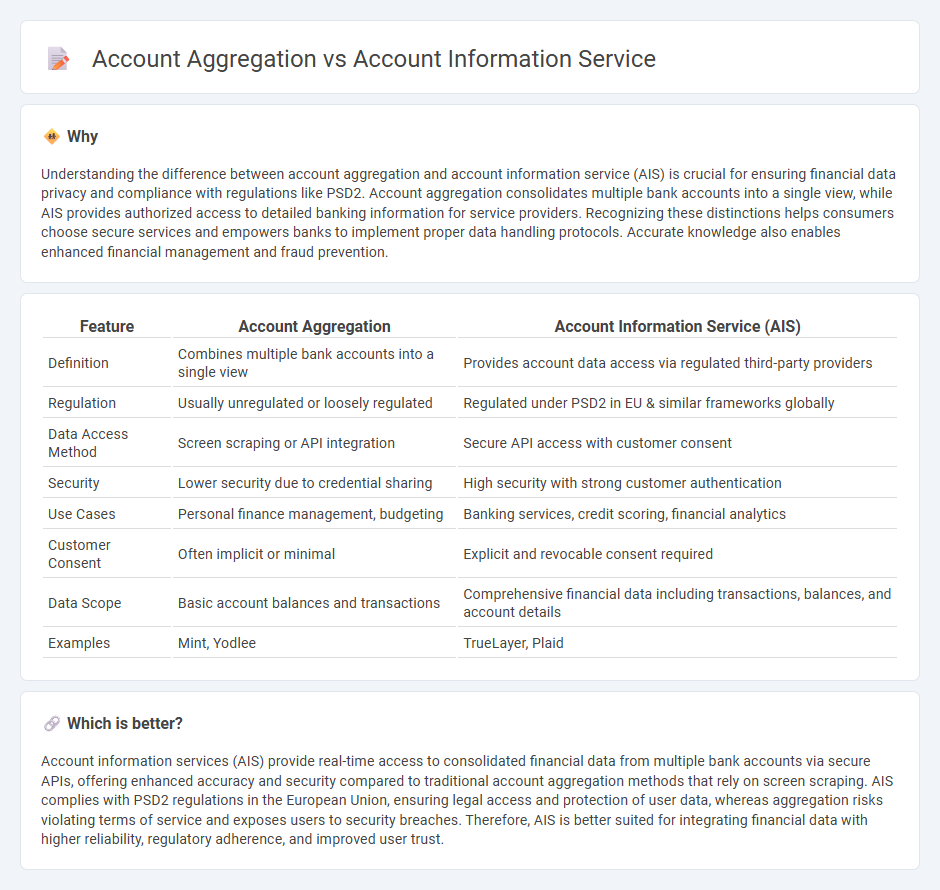

Understanding the difference between account aggregation and account information service (AIS) is crucial for ensuring financial data privacy and compliance with regulations like PSD2. Account aggregation consolidates multiple bank accounts into a single view, while AIS provides authorized access to detailed banking information for service providers. Recognizing these distinctions helps consumers choose secure services and empowers banks to implement proper data handling protocols. Accurate knowledge also enables enhanced financial management and fraud prevention.

Comparison Table

| Feature | Account Aggregation | Account Information Service (AIS) |

|---|---|---|

| Definition | Combines multiple bank accounts into a single view | Provides account data access via regulated third-party providers |

| Regulation | Usually unregulated or loosely regulated | Regulated under PSD2 in EU & similar frameworks globally |

| Data Access Method | Screen scraping or API integration | Secure API access with customer consent |

| Security | Lower security due to credential sharing | High security with strong customer authentication |

| Use Cases | Personal finance management, budgeting | Banking services, credit scoring, financial analytics |

| Customer Consent | Often implicit or minimal | Explicit and revocable consent required |

| Data Scope | Basic account balances and transactions | Comprehensive financial data including transactions, balances, and account details |

| Examples | Mint, Yodlee | TrueLayer, Plaid |

Which is better?

Account information services (AIS) provide real-time access to consolidated financial data from multiple bank accounts via secure APIs, offering enhanced accuracy and security compared to traditional account aggregation methods that rely on screen scraping. AIS complies with PSD2 regulations in the European Union, ensuring legal access and protection of user data, whereas aggregation risks violating terms of service and exposes users to security breaches. Therefore, AIS is better suited for integrating financial data with higher reliability, regulatory adherence, and improved user trust.

Connection

Account aggregation consolidates financial data from multiple accounts into a single platform, enabling users to view their complete financial status. Account Information Services (AIS) leverage this aggregated data to provide detailed insights, such as spending analysis and personalized financial advice. Both concepts rely on secure access to diverse banking data, facilitated through APIs under regulatory frameworks like PSD2.

Key Terms

Data Access

Account information service (AIS) provides regulated third-party providers with secure access to user-permitted banking data, enabling financial analysis and personalized services. Account aggregation consolidates account details from multiple banks into a single interface, improving user convenience but may lack real-time regulatory oversight. Explore the distinctions in data access and security between AIS and account aggregation to understand their impact on financial decision-making.

Consent

Account information service (AIS) enables third-party providers to access users' bank account data with explicit consent, ensuring compliance with data protection regulations like PSD2. Account aggregation consolidates financial data from multiple accounts into a unified view but requires ongoing user permission management to maintain security and privacy. Explore the differences in consent management to fully understand how these services protect your financial information.

Consolidation

Account information service (AIS) provides a comprehensive overview by securely accessing and consolidating data from multiple financial accounts into a single dashboard, enhancing financial management. Account aggregation focuses on the technical integration of account data from various institutions, enabling users to view all their balances and transactions in one place. Explore how these services differ and which consolidation method best suits your financial needs by learning more.

Source and External Links

Account Information Service (AIS) - AIS is an online service that provides consolidated information (such as balances and transaction history) on one or more payment accounts held at one or more banks, accessible only with the customer's explicit consent under open banking rules.

What is an account information service? - An account information service is an online platform that aggregates and displays data from one or more payment accounts held with different providers, offering users a comprehensive overview of their financial situation, but does not hold or move funds itself.

Account Information Services (AIS) - AIS allows customers to authorize the sharing of their account data from multiple banks with a service provider, which can then offer value-added features like account aggregation and budgeting tools, all within a regulated and secure framework.

dowidth.com

dowidth.com