Fraud orchestration integrates multiple data sources and advanced analytics to detect and respond to suspicious activities in real-time, enhancing the security framework of financial institutions. Account takeover prevention focuses on securing user credentials and monitoring account behavior to stop unauthorized access before it impacts customers and banks. Explore how combining these strategies can significantly reduce fraud losses and improve customer trust in digital banking.

Why it is important

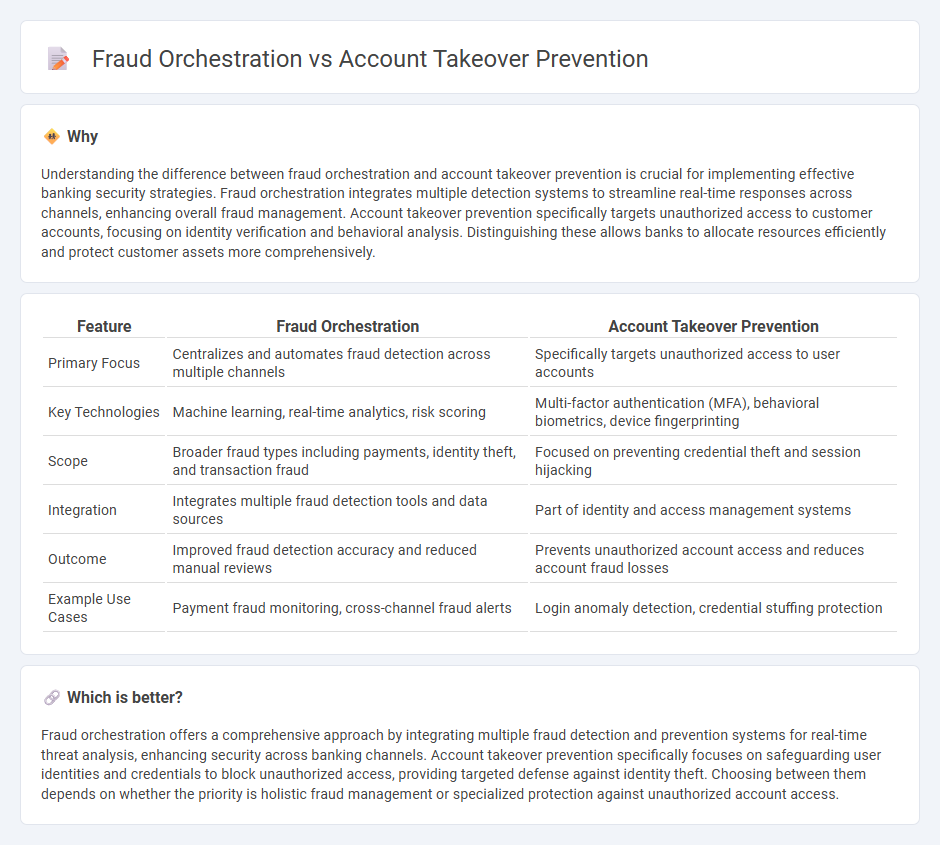

Understanding the difference between fraud orchestration and account takeover prevention is crucial for implementing effective banking security strategies. Fraud orchestration integrates multiple detection systems to streamline real-time responses across channels, enhancing overall fraud management. Account takeover prevention specifically targets unauthorized access to customer accounts, focusing on identity verification and behavioral analysis. Distinguishing these allows banks to allocate resources efficiently and protect customer assets more comprehensively.

Comparison Table

| Feature | Fraud Orchestration | Account Takeover Prevention |

|---|---|---|

| Primary Focus | Centralizes and automates fraud detection across multiple channels | Specifically targets unauthorized access to user accounts |

| Key Technologies | Machine learning, real-time analytics, risk scoring | Multi-factor authentication (MFA), behavioral biometrics, device fingerprinting |

| Scope | Broader fraud types including payments, identity theft, and transaction fraud | Focused on preventing credential theft and session hijacking |

| Integration | Integrates multiple fraud detection tools and data sources | Part of identity and access management systems |

| Outcome | Improved fraud detection accuracy and reduced manual reviews | Prevents unauthorized account access and reduces account fraud losses |

| Example Use Cases | Payment fraud monitoring, cross-channel fraud alerts | Login anomaly detection, credential stuffing protection |

Which is better?

Fraud orchestration offers a comprehensive approach by integrating multiple fraud detection and prevention systems for real-time threat analysis, enhancing security across banking channels. Account takeover prevention specifically focuses on safeguarding user identities and credentials to block unauthorized access, providing targeted defense against identity theft. Choosing between them depends on whether the priority is holistic fraud management or specialized protection against unauthorized account access.

Connection

Fraud orchestration integrates real-time analytics and machine learning to detect suspicious activities, enhancing account takeover prevention by identifying unusual login patterns and transaction anomalies. By correlating multiple fraud signals across channels, the system strengthens authentication processes and reduces the risk of unauthorized access to banking accounts. This synergy improves overall security posture and minimizes financial losses from fraudulent account breaches.

Key Terms

**Account Takeover Prevention:**

Account Takeover Prevention (ATO) targets unauthorized access to user accounts by detecting and blocking suspicious login attempts through multi-factor authentication, behavioral biometrics, and device fingerprinting. Fraud orchestration offers a broader approach by integrating multiple fraud detection tools to manage various types of fraud across payment, identity, and account channels. Discover more about how Account Takeover Prevention can secure your digital ecosystem effectively.

Multi-factor Authentication

Multi-factor Authentication (MFA) plays a critical role in account takeover prevention by requiring users to provide multiple verification factors, significantly reducing unauthorized access. Fraud orchestration leverages MFA alongside adaptive risk analytics and machine learning to create dynamic, real-time defense strategies against complex fraud patterns. Explore how integrating advanced MFA technologies can enhance both account security and fraud management frameworks.

Device Fingerprinting

Device fingerprinting plays a crucial role in account takeover prevention by uniquely identifying devices to detect unauthorized access attempts. In fraud orchestration, device fingerprinting integrates with other data signals to create a comprehensive security strategy that adapts in real-time to emerging threats. Explore how advanced device fingerprinting technology enhances both account protection and fraud management for businesses.

Source and External Links

Prevent Account Takeover Fraud - Key prevention strategies include enforcing strong password policies, implementing multi-factor authentication (MFA), regularly educating employees on phishing, promptly updating software, monitoring accounts for unusual activity, limiting access to sensitive data, upgrading network security, and having an incident response plan in place.

Account Takeover Protection: 6 Best Practices - Best practices start with assessing the risk of takeover, enforcing secure passwords, applying multi-factor authentication, educating users about phishing, and implementing mitigation strategies based on identified vulnerabilities.

Account Takeover Prevention: How to Prevent ATO & Stop ... - Prevention methods include checking credentials against breached databases, setting rate limits on login attempts, sending immediate notifications for account changes, and using specialized ATO prevention software leveraging machine learning to detect suspicious behavior.

dowidth.com

dowidth.com