Core banking modernization involves upgrading legacy systems to improve efficiency and integrate new technologies within existing infrastructure. Cloud banking leverages cloud computing to offer scalable, flexible, and cost-effective banking solutions with enhanced data security and real-time processing. Explore the benefits and challenges of these approaches to determine the best strategy for your financial institution.

Why it is important

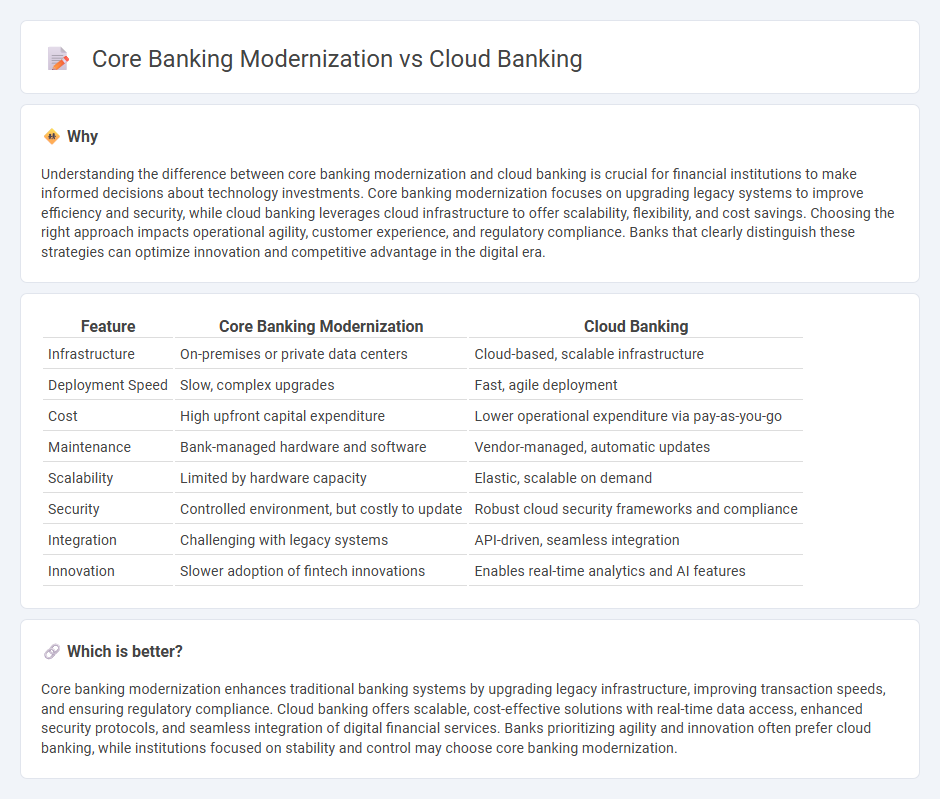

Understanding the difference between core banking modernization and cloud banking is crucial for financial institutions to make informed decisions about technology investments. Core banking modernization focuses on upgrading legacy systems to improve efficiency and security, while cloud banking leverages cloud infrastructure to offer scalability, flexibility, and cost savings. Choosing the right approach impacts operational agility, customer experience, and regulatory compliance. Banks that clearly distinguish these strategies can optimize innovation and competitive advantage in the digital era.

Comparison Table

| Feature | Core Banking Modernization | Cloud Banking |

|---|---|---|

| Infrastructure | On-premises or private data centers | Cloud-based, scalable infrastructure |

| Deployment Speed | Slow, complex upgrades | Fast, agile deployment |

| Cost | High upfront capital expenditure | Lower operational expenditure via pay-as-you-go |

| Maintenance | Bank-managed hardware and software | Vendor-managed, automatic updates |

| Scalability | Limited by hardware capacity | Elastic, scalable on demand |

| Security | Controlled environment, but costly to update | Robust cloud security frameworks and compliance |

| Integration | Challenging with legacy systems | API-driven, seamless integration |

| Innovation | Slower adoption of fintech innovations | Enables real-time analytics and AI features |

Which is better?

Core banking modernization enhances traditional banking systems by upgrading legacy infrastructure, improving transaction speeds, and ensuring regulatory compliance. Cloud banking offers scalable, cost-effective solutions with real-time data access, enhanced security protocols, and seamless integration of digital financial services. Banks prioritizing agility and innovation often prefer cloud banking, while institutions focused on stability and control may choose core banking modernization.

Connection

Core banking modernization enhances the scalability and flexibility of financial institutions by integrating cloud banking solutions that facilitate real-time transactions and seamless customer experiences. Cloud banking leverages modern cloud infrastructure to support core banking systems, enabling continuous updates, improved data security, and cost efficiency. The synergy between core banking modernization and cloud banking accelerates digital transformation, allowing banks to innovate rapidly and meet evolving regulatory requirements.

Key Terms

SaaS (Software as a Service)

Cloud banking leverages SaaS solutions to provide scalable, flexible, and cost-efficient platforms that enable real-time data processing and seamless integration with digital channels. Core banking modernization using SaaS focuses on updating legacy systems with cloud-native architectures to improve agility, security, and customer experience. Explore how SaaS-driven cloud banking transforms financial institutions by enhancing operational efficiency and innovation capabilities.

API Integration

Cloud banking leverages scalable cloud infrastructure to enhance flexibility and faster deployment, while core banking modernization focuses on updating legacy systems for improved performance and security. API integration plays a crucial role in both approaches by enabling seamless connectivity between disparate systems, facilitating real-time data exchange, and supporting third-party service integration. Explore in-depth insights on how API integration drives the digital transformation in banking technology.

Legacy Systems

Legacy systems in core banking often hinder agility and limit integration with modern digital services, causing increased maintenance costs and operational risks. Cloud banking offers scalable, flexible infrastructure that enhances innovation and speeds up deployment of new financial products while ensuring compliance and security standards. Discover how transitioning from legacy core banking to cloud platforms can revolutionize your financial institution's efficiency and customer experience.

Source and External Links

What is cloud banking? - Cloud banking refers to the on-demand delivery of banking services by financial institutions through the internet.

A Complete Guide to Cloud Banking - Cloud banking platforms operate on cloud infrastructures from providers like Microsoft Azure, offering scalable, flexible, and reliable banking services across models like IaaS, SaaS, PaaS, and BPaaS.

Cloud Banking: Financial Services and Banking of the Future - Cloud technology enables banks to break down operational silos, meet regulatory demands, optimize risk and liquidity calculations, and deliver innovative customer products faster and more efficiently.

dowidth.com

dowidth.com