Virtual cards provide temporary, secure payment details linked directly to your bank account, reducing fraud risk for online transactions. Digital wallets store multiple payment methods, including virtual cards, enabling seamless payments via smartphones for both online and in-store purchases. Explore how virtual cards and digital wallets can enhance your banking security and convenience.

Why it is important

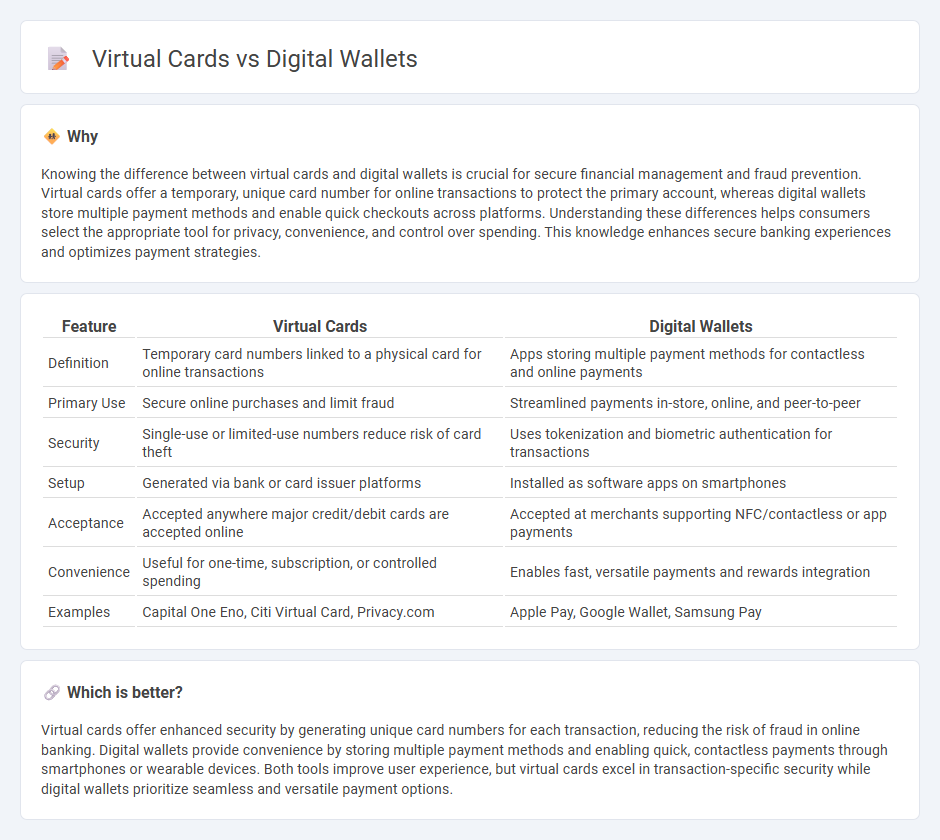

Knowing the difference between virtual cards and digital wallets is crucial for secure financial management and fraud prevention. Virtual cards offer a temporary, unique card number for online transactions to protect the primary account, whereas digital wallets store multiple payment methods and enable quick checkouts across platforms. Understanding these differences helps consumers select the appropriate tool for privacy, convenience, and control over spending. This knowledge enhances secure banking experiences and optimizes payment strategies.

Comparison Table

| Feature | Virtual Cards | Digital Wallets |

|---|---|---|

| Definition | Temporary card numbers linked to a physical card for online transactions | Apps storing multiple payment methods for contactless and online payments |

| Primary Use | Secure online purchases and limit fraud | Streamlined payments in-store, online, and peer-to-peer |

| Security | Single-use or limited-use numbers reduce risk of card theft | Uses tokenization and biometric authentication for transactions |

| Setup | Generated via bank or card issuer platforms | Installed as software apps on smartphones |

| Acceptance | Accepted anywhere major credit/debit cards are accepted online | Accepted at merchants supporting NFC/contactless or app payments |

| Convenience | Useful for one-time, subscription, or controlled spending | Enables fast, versatile payments and rewards integration |

| Examples | Capital One Eno, Citi Virtual Card, Privacy.com | Apple Pay, Google Wallet, Samsung Pay |

Which is better?

Virtual cards offer enhanced security by generating unique card numbers for each transaction, reducing the risk of fraud in online banking. Digital wallets provide convenience by storing multiple payment methods and enabling quick, contactless payments through smartphones or wearable devices. Both tools improve user experience, but virtual cards excel in transaction-specific security while digital wallets prioritize seamless and versatile payment options.

Connection

Virtual cards function as digital payment instruments linked directly to digital wallets, enabling secure online transactions without exposing physical card details. Digital wallets store virtual cards along with other payment methods, facilitating seamless and instant payments across multiple platforms. The integration enhances security by using tokenization and reduces fraud risks while offering user convenience and transaction tracking.

Key Terms

Tokenization

Tokenization is a critical security feature in digital wallets and virtual cards, replacing sensitive payment details with unique tokens during transactions to prevent fraud. Digital wallets leverage tokenization to store multiple payment methods securely, while virtual cards generate single-use tokens for specific purchases, enhancing consumer protection against unauthorized use. Explore the differences in tokenization techniques to understand how each method safeguards your financial data effectively.

Contactless Payments

Digital wallets enable seamless contactless payments by securely storing multiple payment methods on smartphones or wearable devices, allowing users to tap and pay at compatible terminals. Virtual cards generate unique, temporary card numbers tied to a primary account, enhancing security during online and in-app contactless transactions. Explore more about how digital wallets and virtual cards revolutionize fast, secure contactless payments.

Issuer Integration

Issuer integration in digital wallets enables seamless access to multiple payment methods within a single app, enhancing user convenience and transaction speed. Virtual cards, often issued through direct issuer partnerships, provide real-time issuance and control, improving security and spend management. Explore how issuer integration revolutionizes payment experiences and unlocks new opportunities.

Source and External Links

15 Types of Digital Wallets: Comprehensive Guide - DashDevs - Digital wallets are software systems that store payment information securely and include centralized wallets like PayPal and decentralized DeFi wallets such as MetaMask, facilitating online purchases, money transfers, and contactless payments with various security and control features.

What is a Digital Wallet and How to Use It? - Bill.com - A digital wallet is a secure mobile app storing payment info and more, enabling electronic payments, loyalty cards, and digital documents, using biometric security and providing real-time consumer data for smoother transactions.

Digital Wallets: Everything You Need to Know - N26 - Digital wallets allow payments via smartphone with enhanced security like encryption and biometrics, store payment data safely with virtual card numbers, and include crypto wallets to manage cryptocurrency access and spending.

dowidth.com

dowidth.com