Cloud core banking leverages cloud computing to provide scalable, flexible, and cost-effective banking solutions with real-time data access and enhanced security. Modular core banking breaks down banking functions into independent, customizable modules, allowing banks to update or replace specific components without overhauling the entire system. Explore how each approach can transform your banking operations and drive innovation.

Why it is important

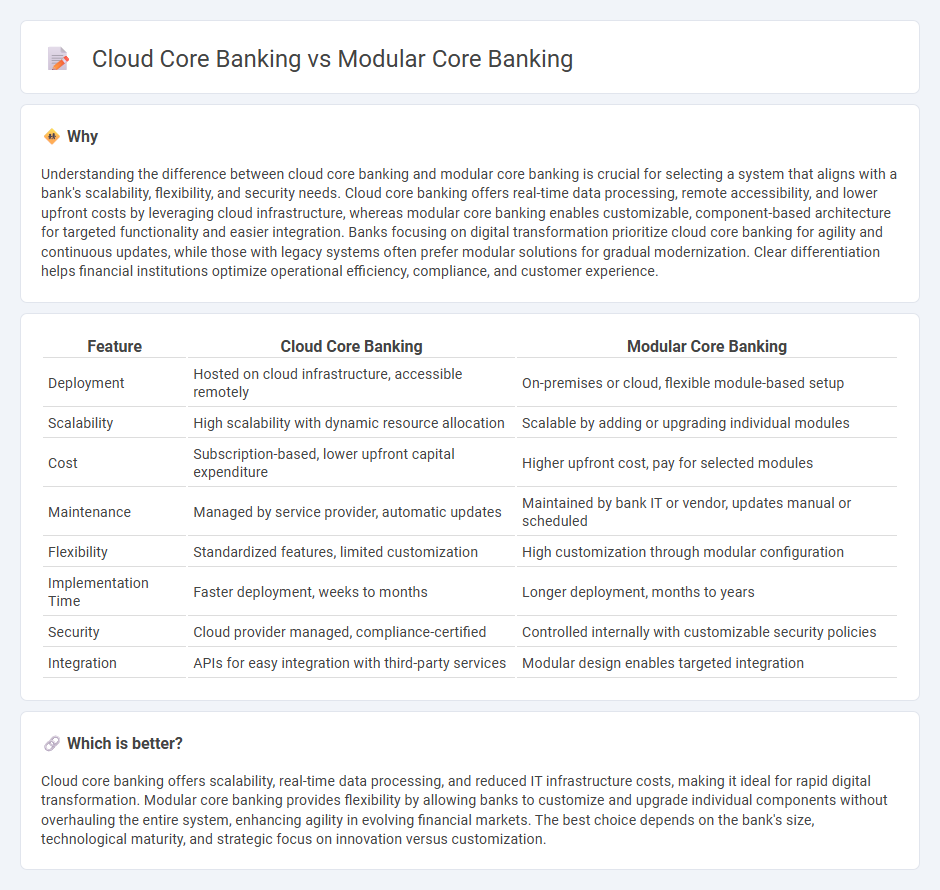

Understanding the difference between cloud core banking and modular core banking is crucial for selecting a system that aligns with a bank's scalability, flexibility, and security needs. Cloud core banking offers real-time data processing, remote accessibility, and lower upfront costs by leveraging cloud infrastructure, whereas modular core banking enables customizable, component-based architecture for targeted functionality and easier integration. Banks focusing on digital transformation prioritize cloud core banking for agility and continuous updates, while those with legacy systems often prefer modular solutions for gradual modernization. Clear differentiation helps financial institutions optimize operational efficiency, compliance, and customer experience.

Comparison Table

| Feature | Cloud Core Banking | Modular Core Banking |

|---|---|---|

| Deployment | Hosted on cloud infrastructure, accessible remotely | On-premises or cloud, flexible module-based setup |

| Scalability | High scalability with dynamic resource allocation | Scalable by adding or upgrading individual modules |

| Cost | Subscription-based, lower upfront capital expenditure | Higher upfront cost, pay for selected modules |

| Maintenance | Managed by service provider, automatic updates | Maintained by bank IT or vendor, updates manual or scheduled |

| Flexibility | Standardized features, limited customization | High customization through modular configuration |

| Implementation Time | Faster deployment, weeks to months | Longer deployment, months to years |

| Security | Cloud provider managed, compliance-certified | Controlled internally with customizable security policies |

| Integration | APIs for easy integration with third-party services | Modular design enables targeted integration |

Which is better?

Cloud core banking offers scalability, real-time data processing, and reduced IT infrastructure costs, making it ideal for rapid digital transformation. Modular core banking provides flexibility by allowing banks to customize and upgrade individual components without overhauling the entire system, enhancing agility in evolving financial markets. The best choice depends on the bank's size, technological maturity, and strategic focus on innovation versus customization.

Connection

Cloud core banking and modular core banking are interconnected through their shared goal of enhancing banking system flexibility, scalability, and efficiency. Cloud core banking leverages cloud computing to provide on-demand access and seamless integration, while modular core banking breaks down functionalities into discrete, interchangeable components that can be independently updated or scaled. This synergy enables banks to rapidly deploy new services, improve operational agility, and reduce infrastructure costs in a digitally transforming financial ecosystem.

Key Terms

Architecture

Modular core banking architecture divides banking functions into independent, interoperable modules, enabling tailored customization, faster upgrades, and reduced downtime. Cloud core banking relies on scalable, distributed cloud infrastructure, offering enhanced accessibility, real-time data processing, and cost efficiency through pay-as-you-go models. Explore detailed comparisons to understand which architecture best suits your financial institution's digital transformation goals.

Deployment

Modular core banking systems offer flexible deployment options, allowing banks to implement specific components independently, often supporting on-premises, private cloud, or hybrid environments for tailored control and customization. Cloud core banking solutions are primarily deployed on public cloud infrastructure, enabling rapid scalability, reduced hardware costs, and continuous updates managed by the service provider. Explore detailed insights on deployment strategies to determine the best fit for your banking institution's goals.

Scalability

Modular core banking systems offer scalability by enabling banks to add or customize specific modules as their needs evolve, ensuring flexibility without overhauling the entire infrastructure. Cloud core banking enhances scalability through on-demand resource allocation and elastic computing power, allowing financial institutions to swiftly adjust capacity during peak periods or growth phases. Explore detailed comparisons to understand which scalability model best suits your banking organization's future growth.

Source and External Links

Modular Banking: A Simple Guide - Modular banking breaks down traditional banking functions into independent, pre-built software modules that banks and fintechs can easily integrate and deploy to offer services like loans, payments, and fraud detection without building from scratch.

SBP Digital Core | SBS | Banking & Financing Platforms - SBP Digital Core is a cloud-native, modular, and composable core banking platform that enables banks to deliver personalized, scalable, and compliant digital banking experiences through an API-driven, open architecture.

Temenos Core Banking | Modular, Scalable Banking Platform - Temenos Core Banking offers a modular, end-to-end platform trusted by over 950 banks worldwide, providing flexible, segment-specific solutions for retail, business, corporate, and treasury operations with integrated compliance and analytics.

dowidth.com

dowidth.com