Credit builder cards report your payment activity to major credit bureaus, helping you establish or improve your credit score through responsible use. Prepaid cards require you to load funds in advance and do not affect your credit history, serving primarily as a budgeting or spending tool without credit risk. Explore more to determine which card fits your financial goals and credit-building needs.

Why it is important

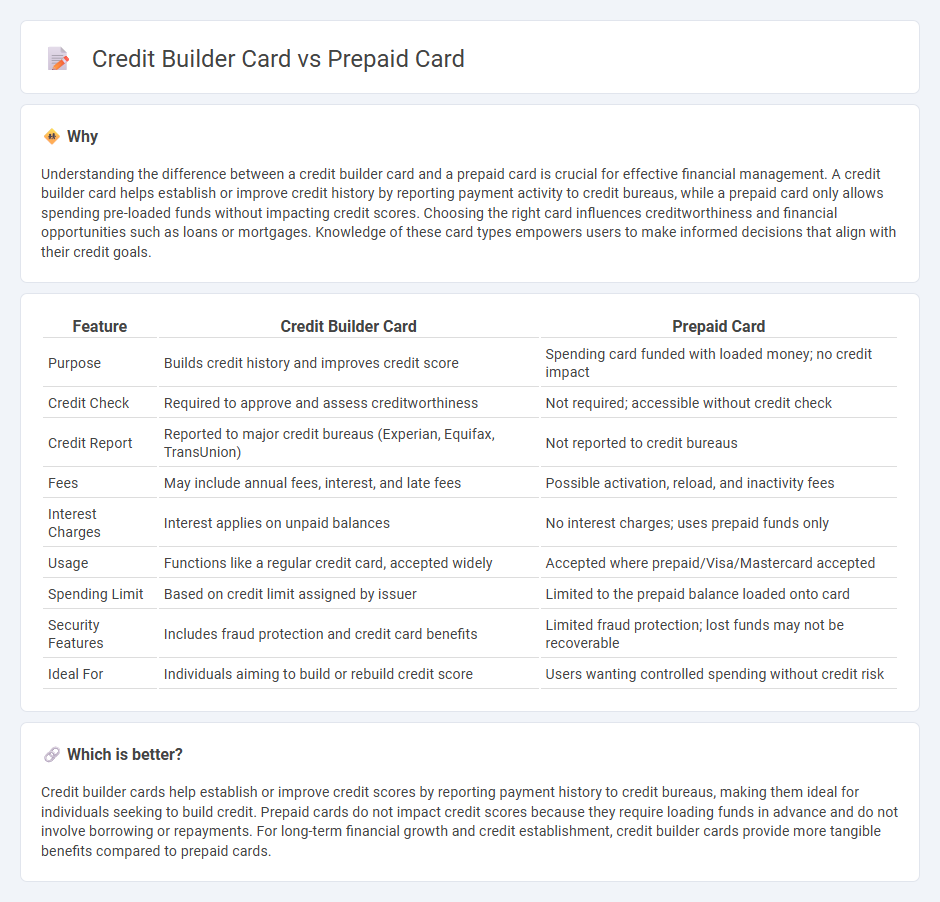

Understanding the difference between a credit builder card and a prepaid card is crucial for effective financial management. A credit builder card helps establish or improve credit history by reporting payment activity to credit bureaus, while a prepaid card only allows spending pre-loaded funds without impacting credit scores. Choosing the right card influences creditworthiness and financial opportunities such as loans or mortgages. Knowledge of these card types empowers users to make informed decisions that align with their credit goals.

Comparison Table

| Feature | Credit Builder Card | Prepaid Card |

|---|---|---|

| Purpose | Builds credit history and improves credit score | Spending card funded with loaded money; no credit impact |

| Credit Check | Required to approve and assess creditworthiness | Not required; accessible without credit check |

| Credit Report | Reported to major credit bureaus (Experian, Equifax, TransUnion) | Not reported to credit bureaus |

| Fees | May include annual fees, interest, and late fees | Possible activation, reload, and inactivity fees |

| Interest Charges | Interest applies on unpaid balances | No interest charges; uses prepaid funds only |

| Usage | Functions like a regular credit card, accepted widely | Accepted where prepaid/Visa/Mastercard accepted |

| Spending Limit | Based on credit limit assigned by issuer | Limited to the prepaid balance loaded onto card |

| Security Features | Includes fraud protection and credit card benefits | Limited fraud protection; lost funds may not be recoverable |

| Ideal For | Individuals aiming to build or rebuild credit score | Users wanting controlled spending without credit risk |

Which is better?

Credit builder cards help establish or improve credit scores by reporting payment history to credit bureaus, making them ideal for individuals seeking to build credit. Prepaid cards do not impact credit scores because they require loading funds in advance and do not involve borrowing or repayments. For long-term financial growth and credit establishment, credit builder cards provide more tangible benefits compared to prepaid cards.

Connection

Credit builder cards and prepaid cards are connected through their roles in managing personal finances and credit building. Credit builder cards function by reporting payment activity to credit bureaus, helping users establish or improve credit scores, while prepaid cards require loading funds in advance without impacting credit history. Both card types provide alternatives to traditional credit cards, catering to individuals seeking financial control or credit development.

Key Terms

Funding Source

A prepaid card requires loading funds in advance, limiting spending to the amount available, ideal for budgeting without risking debt. Credit builder cards extend a revolving line of credit, reporting payments to credit bureaus to help establish or improve credit scores, but require responsible repayment of borrowed amounts. Explore detailed comparisons to find the best option aligned with your financial goals.

Credit Reporting

Prepaid cards do not report to credit bureaus, offering no impact on credit scores, while credit builder cards regularly report payment activity to major credit agencies, facilitating credit history improvement. Credit builder cards require on-time payments and responsible use to positively affect credit reports, whereas prepaid cards function solely as a spending tool without credit benefits. Discover how choosing the right card can strategically enhance your credit profile.

Spending Limit

Prepaid cards impose a spending limit based on the amount of funds loaded onto the card, preventing overspending and helping with budget management. Credit builder cards offer a preset credit line, typically ranging from $200 to $1,000, allowing users to build credit by making timely payments and keeping utilization low. Explore the differences further to choose the best option for your financial goals.

Source and External Links

What Is a Prepaid Card and How Does It Work? - A prepaid card is loaded with money in advance and can be used for purchases until the balance is spent, unlike credit or debit cards linked to bank accounts.

How do I shop for and buy a prepaid card? - Prepaid cards can be bought online or in stores and should be registered for protection, requiring personal details for identity verification and eligibility for features like reloading and deposit insurance.

Visa Prepaid Cards - Visa prepaid cards are reloadable, secure, and can be used anywhere Visa debit cards are accepted without overdraft risks, offering a convenient spending option without credit checks.

dowidth.com

dowidth.com