Invisible payments leverage seamless, background technology enabling transactions without explicit user input, enhancing convenience and speed in financial services. Voice-activated payments utilize speech recognition to authorize and complete transactions, offering hands-free control and accessibility for users. Explore the evolving landscape of banking innovations and discover which payment method best suits your needs.

Why it is important

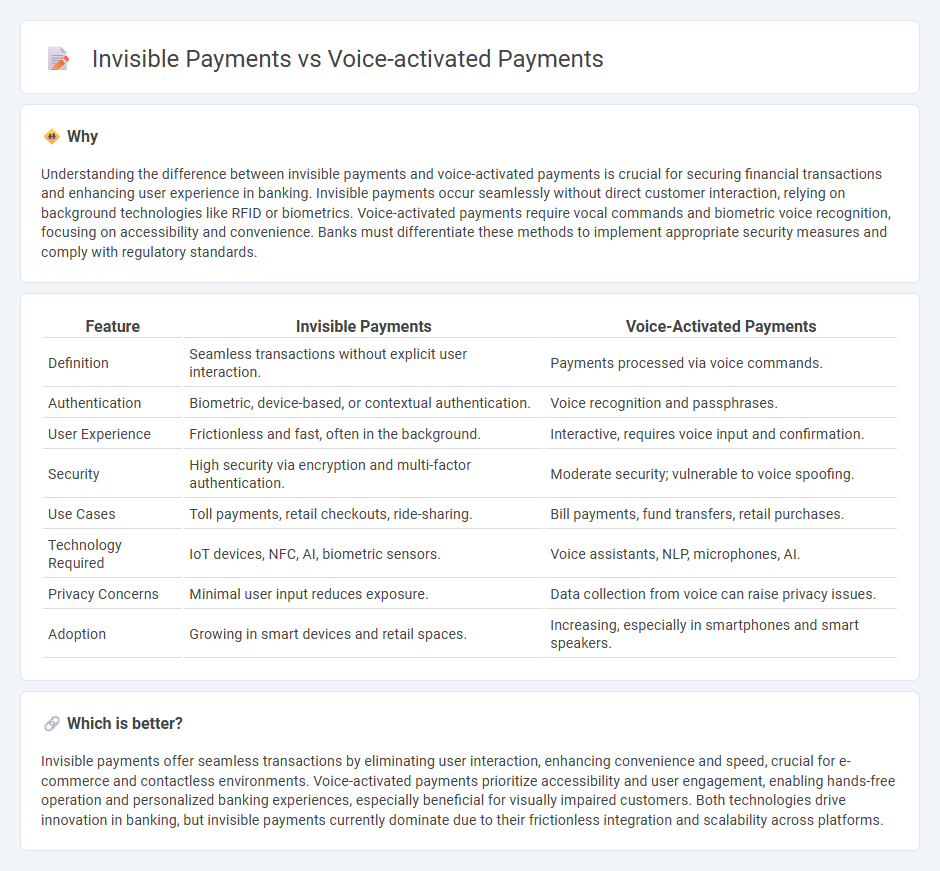

Understanding the difference between invisible payments and voice-activated payments is crucial for securing financial transactions and enhancing user experience in banking. Invisible payments occur seamlessly without direct customer interaction, relying on background technologies like RFID or biometrics. Voice-activated payments require vocal commands and biometric voice recognition, focusing on accessibility and convenience. Banks must differentiate these methods to implement appropriate security measures and comply with regulatory standards.

Comparison Table

| Feature | Invisible Payments | Voice-Activated Payments |

|---|---|---|

| Definition | Seamless transactions without explicit user interaction. | Payments processed via voice commands. |

| Authentication | Biometric, device-based, or contextual authentication. | Voice recognition and passphrases. |

| User Experience | Frictionless and fast, often in the background. | Interactive, requires voice input and confirmation. |

| Security | High security via encryption and multi-factor authentication. | Moderate security; vulnerable to voice spoofing. |

| Use Cases | Toll payments, retail checkouts, ride-sharing. | Bill payments, fund transfers, retail purchases. |

| Technology Required | IoT devices, NFC, AI, biometric sensors. | Voice assistants, NLP, microphones, AI. |

| Privacy Concerns | Minimal user input reduces exposure. | Data collection from voice can raise privacy issues. |

| Adoption | Growing in smart devices and retail spaces. | Increasing, especially in smartphones and smart speakers. |

Which is better?

Invisible payments offer seamless transactions by eliminating user interaction, enhancing convenience and speed, crucial for e-commerce and contactless environments. Voice-activated payments prioritize accessibility and user engagement, enabling hands-free operation and personalized banking experiences, especially beneficial for visually impaired customers. Both technologies drive innovation in banking, but invisible payments currently dominate due to their frictionless integration and scalability across platforms.

Connection

Invisible payments leverage seamless transaction technologies where voice-activated payments act as a critical interface, enabling customers to authorize and complete purchases using natural language commands without physical interaction. Through integration with AI-powered virtual assistants, voice-activated payments facilitate real-time authentication and transaction processing, enhancing convenience and security in digital banking ecosystems. Financial institutions increasingly adopt these technologies to streamline payment experiences, reduce friction in checkout processes, and drive adoption of contactless payment methods.

Key Terms

Biometric Authentication

Voice-activated payments utilize voice recognition technology to authenticate users, offering convenience but facing challenges with accuracy and security in noisy environments. Invisible payments, often relying on advanced biometric authentication such as fingerprint or facial recognition, provide seamless and highly secure transaction methods without explicit user interaction. Explore how biometric innovations are transforming payment experiences and enhancing security in digital commerce.

Seamless User Experience

Voice-activated payments harness natural language processing to enable users to complete transactions through spoken commands, streamlining the payment process and reducing friction. Invisible payments eliminate manual input entirely by automating transactions in the background using technologies like IoT and biometrics, creating a frictionless and truly seamless user experience. Explore the latest advancements and benefits of these innovative payment methods to enhance user convenience and security.

Payment Authorization

Voice-activated payments leverage biometric voice recognition to enhance payment authorization security, enabling users to complete transactions hands-free with a high level of trust. Invisible payments streamline the user experience by authorizing transactions seamlessly through contextual data and sensor inputs without explicit user action, prioritizing convenience and speed. Explore the evolving technologies driving secure and frictionless payment authorization in both voice-activated and invisible payment systems.

Source and External Links

Voice Payments: 7 Best Software to Use in Banking - Voice-activated payments let users initiate transactions by speaking to an AI-powered assistant, which converts commands into actions using advanced voice recognition and securely communicates with financial accounts for authorization and confirmation.

Voice Payment Trend: All You Need to Know - To make a voice payment, users activate their device's voice assistant, specify the payment action, recipient, and amount, then confirm the transaction with additional authentication, after which the payment is processed and a notification is provided.

Voice Payments: The Future of Payment Technology? - Setting up voice payments involves linking a payment method to a device, after which users simply give voice commands to authorize transactions, with options like passwords, facial recognition, or fingerprints for added security.

dowidth.com

dowidth.com