Central bank digital currency (CBDC) represents a government-backed digital form of fiat money designed to enhance payment efficiency and security, while mutual fund shares are investment vehicles pooling assets to diversify risk and generate returns for shareholders. CBDCs offer direct digital transactions issued and regulated by central banks, contrasting mutual funds that rely on professional management of diversified portfolios in financial markets. Discover the key differences and unique benefits of these financial instruments to optimize your banking and investment strategies.

Why it is important

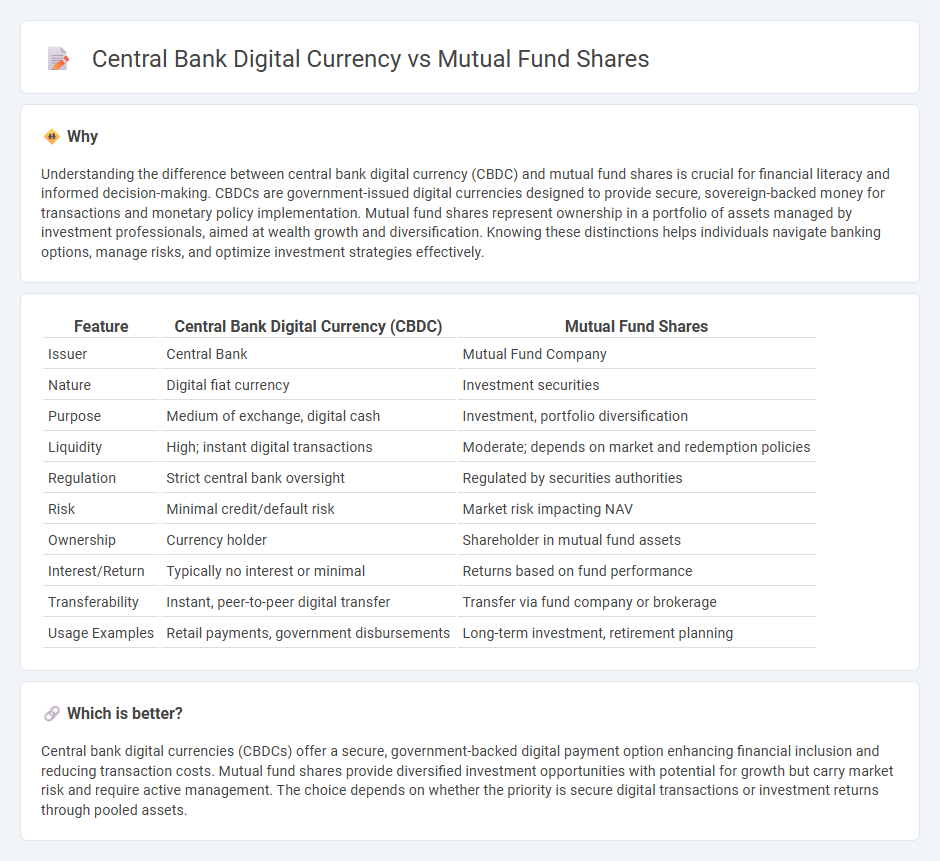

Understanding the difference between central bank digital currency (CBDC) and mutual fund shares is crucial for financial literacy and informed decision-making. CBDCs are government-issued digital currencies designed to provide secure, sovereign-backed money for transactions and monetary policy implementation. Mutual fund shares represent ownership in a portfolio of assets managed by investment professionals, aimed at wealth growth and diversification. Knowing these distinctions helps individuals navigate banking options, manage risks, and optimize investment strategies effectively.

Comparison Table

| Feature | Central Bank Digital Currency (CBDC) | Mutual Fund Shares |

|---|---|---|

| Issuer | Central Bank | Mutual Fund Company |

| Nature | Digital fiat currency | Investment securities |

| Purpose | Medium of exchange, digital cash | Investment, portfolio diversification |

| Liquidity | High; instant digital transactions | Moderate; depends on market and redemption policies |

| Regulation | Strict central bank oversight | Regulated by securities authorities |

| Risk | Minimal credit/default risk | Market risk impacting NAV |

| Ownership | Currency holder | Shareholder in mutual fund assets |

| Interest/Return | Typically no interest or minimal | Returns based on fund performance |

| Transferability | Instant, peer-to-peer digital transfer | Transfer via fund company or brokerage |

| Usage Examples | Retail payments, government disbursements | Long-term investment, retirement planning |

Which is better?

Central bank digital currencies (CBDCs) offer a secure, government-backed digital payment option enhancing financial inclusion and reducing transaction costs. Mutual fund shares provide diversified investment opportunities with potential for growth but carry market risk and require active management. The choice depends on whether the priority is secure digital transactions or investment returns through pooled assets.

Connection

Central bank digital currency (CBDC) can enhance mutual fund share transactions by enabling faster, more secure settlements and reducing counterparty risk through blockchain technology. Mutual fund shares benefit from CBDC's programmable features, allowing automated dividend payments and streamlined compliance with regulatory frameworks. Integrating CBDC into mutual funds fosters increased transparency, liquidity, and efficiency in the banking and investment ecosystem.

Key Terms

Asset Management

Mutual fund shares represent pooled investments managed by asset management firms aiming to optimize returns through diversified portfolios, whereas central bank digital currency (CBDC) functions as a government-issued digital fiat currency facilitating secure transactions and monetary policy implementation. Asset managers focus on maximizing gains, risk management, and liquidity through equities, bonds, and alternative investments, while CBDCs influence macroeconomic stability, payment systems, and financial inclusion. Explore the evolving impact of these financial instruments on asset management strategies in our detailed analysis.

Digital Currency

Mutual fund shares represent pooled investment assets managed by financial professionals offering diversification and growth potential, whereas Central Bank Digital Currency (CBDC) is a government-backed digital form of fiat currency designed for secure, efficient transactions and monetary policy implementation. CBDCs, issued by central banks like the People's Bank of China or the European Central Bank, enhance payment systems by enabling real-time settlements, financial inclusion, and reduced transaction costs without involving intermediary financial institutions. Explore the evolving dynamics of digital currency and investment vehicles to understand their impact on the global financial ecosystem.

Monetary Policy

Mutual fund shares represent pooled investments subject to market fluctuations and investor demand, while central bank digital currency (CBDC) functions as a digital form of sovereign money directly managed by monetary authorities to influence liquidity and interest rates. CBDCs enable more precise implementation of monetary policy through programmable features, instantaneous transactions, and enhanced tracking of money flow, contrasting with the indirect influence mutual funds exert via capital markets. Explore how the emergence of CBDCs is reshaping traditional monetary policy frameworks and investment landscapes.

Source and External Links

Mutual Fund Classes | Investor.gov - Mutual fund shares come in different classes (e.g., Class A, Class B) that all invest in the same portfolio but differ in fees and expenses, affecting returns over time.

The Basics of Investing in Mutual Funds - Mutual fund shares represent part ownership of the fund's portfolio, are bought directly from the fund or brokers, priced daily based on net asset value, and can be sold back to the fund any time.

Mutual Funds | Investor.gov - Buying and selling mutual fund shares occurs with the fund or via brokers at the next calculated net asset value plus fees; shares are redeemable, and investors should review the fund's prospectus before investing.

dowidth.com

dowidth.com