Digital identity verification leverages biometric data, facial recognition, and document scanning to authenticate users quickly and securely in banking transactions, reducing fraud and improving customer experience. eIDAS (electronic identification, authentication, and trust services) is an EU regulation ensuring standardized, interoperable, and legally recognized digital identities across member states, enabling seamless cross-border banking services. Explore the evolving landscape of digital identity solutions and their impact on global banking security and compliance.

Why it is important

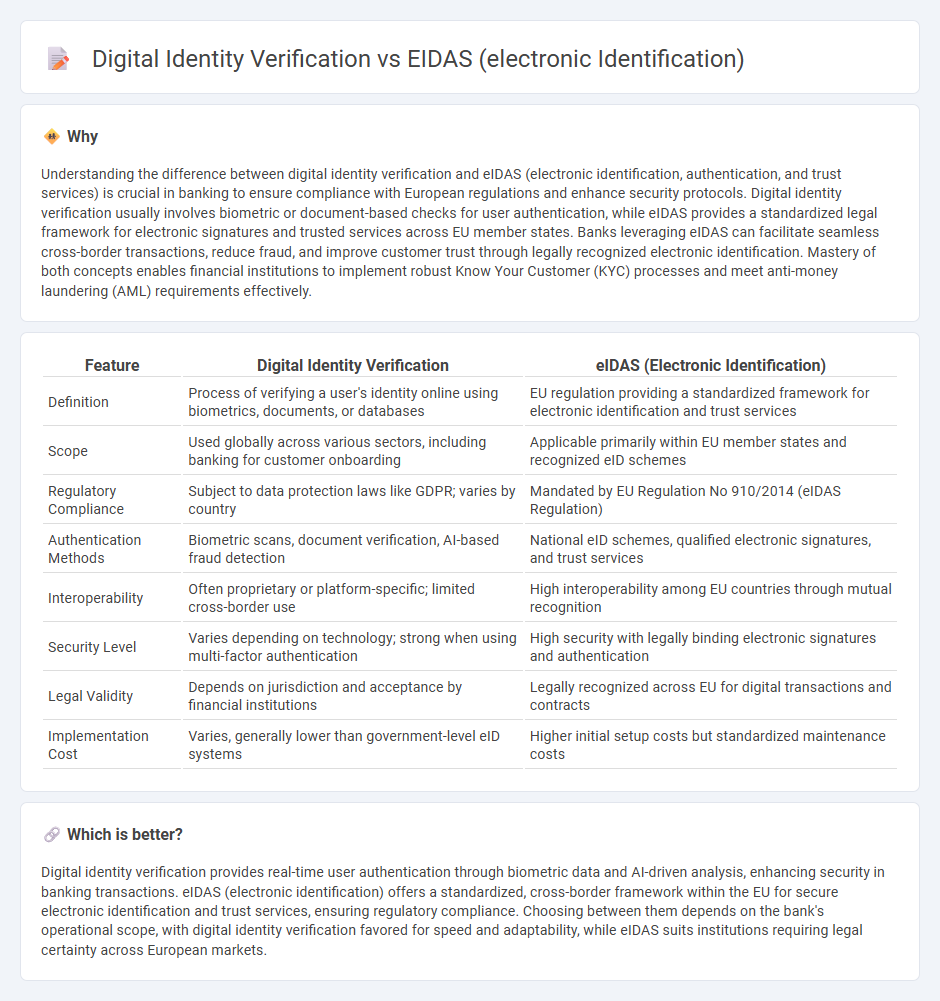

Understanding the difference between digital identity verification and eIDAS (electronic identification, authentication, and trust services) is crucial in banking to ensure compliance with European regulations and enhance security protocols. Digital identity verification usually involves biometric or document-based checks for user authentication, while eIDAS provides a standardized legal framework for electronic signatures and trusted services across EU member states. Banks leveraging eIDAS can facilitate seamless cross-border transactions, reduce fraud, and improve customer trust through legally recognized electronic identification. Mastery of both concepts enables financial institutions to implement robust Know Your Customer (KYC) processes and meet anti-money laundering (AML) requirements effectively.

Comparison Table

| Feature | Digital Identity Verification | eIDAS (Electronic Identification) |

|---|---|---|

| Definition | Process of verifying a user's identity online using biometrics, documents, or databases | EU regulation providing a standardized framework for electronic identification and trust services |

| Scope | Used globally across various sectors, including banking for customer onboarding | Applicable primarily within EU member states and recognized eID schemes |

| Regulatory Compliance | Subject to data protection laws like GDPR; varies by country | Mandated by EU Regulation No 910/2014 (eIDAS Regulation) |

| Authentication Methods | Biometric scans, document verification, AI-based fraud detection | National eID schemes, qualified electronic signatures, and trust services |

| Interoperability | Often proprietary or platform-specific; limited cross-border use | High interoperability among EU countries through mutual recognition |

| Security Level | Varies depending on technology; strong when using multi-factor authentication | High security with legally binding electronic signatures and authentication |

| Legal Validity | Depends on jurisdiction and acceptance by financial institutions | Legally recognized across EU for digital transactions and contracts |

| Implementation Cost | Varies, generally lower than government-level eID systems | Higher initial setup costs but standardized maintenance costs |

Which is better?

Digital identity verification provides real-time user authentication through biometric data and AI-driven analysis, enhancing security in banking transactions. eIDAS (electronic identification) offers a standardized, cross-border framework within the EU for secure electronic identification and trust services, ensuring regulatory compliance. Choosing between them depends on the bank's operational scope, with digital identity verification favored for speed and adaptability, while eIDAS suits institutions requiring legal certainty across European markets.

Connection

Digital identity verification in banking leverages eIDAS framework to ensure secure and trusted electronic identification across EU member states, enhancing compliance with anti-fraud regulations. eIDAS provides standardized protocols that enable banks to authenticate customers seamlessly using government-issued electronic IDs, improving onboarding efficiency and user experience. This connection supports regulatory requirements such as AML (Anti-Money Laundering) and KYC (Know Your Customer) by providing legally recognized digital identities and enabling cross-border financial services.

Key Terms

Qualified Electronic Signature (QES)

eIDAS establishes a regulatory framework for electronic identification, authentication, and trust services across EU member states, emphasizing Qualified Electronic Signatures (QES) as legally equivalent to handwritten signatures. Digital identity verification involves various methods to authenticate individuals online, but QES under eIDAS requires certified trust service providers that guarantee the highest security and legal recognition. Discover how QES enhances digital transactions and compliance with EU regulations.

Know Your Customer (KYC)

eIDAS establishes a standardized framework for electronic identification and trust services across the EU, ensuring cross-border recognition and security of digital identities. Digital identity verification in Know Your Customer (KYC) procedures leverages biometric data, document authentication, and real-time verification to comply with anti-money laundering (AML) regulations and prevent fraud. Explore how combining eIDAS compliance with advanced KYC solutions enhances regulatory adherence and customer onboarding efficiency.

Trust Service Provider (TSP)

eIDAS (electronic identification, authentication, and trust services) establishes a regulatory framework for Trust Service Providers (TSPs) to ensure secure electronic transactions across the EU, emphasizing legally recognized electronic signatures and identity verification methods. Digital identity verification, while broader and often technology-driven, relies on TSPs certified under eIDAS to guarantee compliance, security, and cross-border acceptance of identities. Explore how TSPs enhance trust and interoperability in digital identity ecosystems under eIDAS standards.

Source and External Links

eIDAS - Wikipedia -- The eIDAS Regulation is an EU law governing electronic identification and trust services for secure cross-border electronic transactions, setting standards for electronic signatures, seals, and certificates with full legal validity across member states.

eIDAS Regulation | Shaping Europe's digital future - European Union -- eIDAS establishes a framework for mutual recognition of national electronic IDs across the EU, enabling citizens and businesses to use their domestic eID to access services in any member state, thus promoting seamless and trusted digital interactions.

eIDAS - electronic identification and trust services - European Commission -- The eIDAS Regulation enhances the security and efficiency of electronic transactions for businesses and public administrations, reducing costs and administrative burdens while increasing consumer trust and cross-border opportunities.

dowidth.com

dowidth.com