RegTech in banking enhances compliance by leveraging advanced technologies to monitor and report regulatory requirements efficiently, reducing risks and operational costs. LendingTech focuses on transforming loan origination and management through automation, data analytics, and AI to improve customer experience and credit decision accuracy. Discover how RegTech and LendingTech innovations are reshaping financial services.

Why it is important

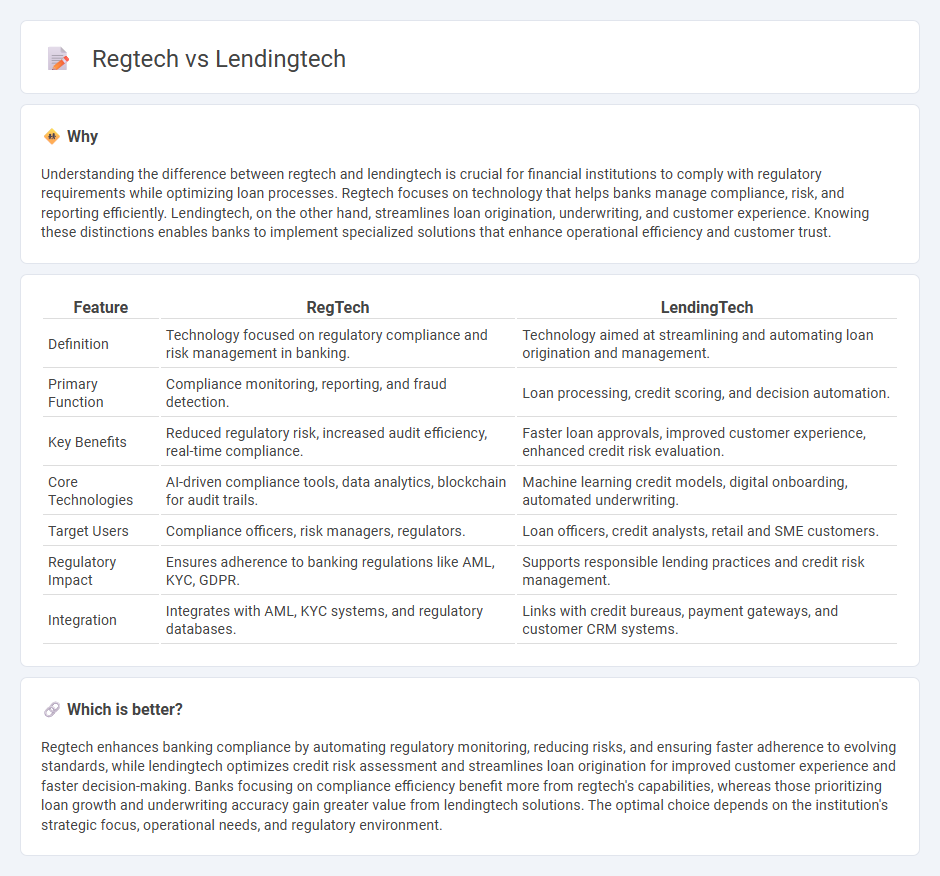

Understanding the difference between regtech and lendingtech is crucial for financial institutions to comply with regulatory requirements while optimizing loan processes. Regtech focuses on technology that helps banks manage compliance, risk, and reporting efficiently. Lendingtech, on the other hand, streamlines loan origination, underwriting, and customer experience. Knowing these distinctions enables banks to implement specialized solutions that enhance operational efficiency and customer trust.

Comparison Table

| Feature | RegTech | LendingTech |

|---|---|---|

| Definition | Technology focused on regulatory compliance and risk management in banking. | Technology aimed at streamlining and automating loan origination and management. |

| Primary Function | Compliance monitoring, reporting, and fraud detection. | Loan processing, credit scoring, and decision automation. |

| Key Benefits | Reduced regulatory risk, increased audit efficiency, real-time compliance. | Faster loan approvals, improved customer experience, enhanced credit risk evaluation. |

| Core Technologies | AI-driven compliance tools, data analytics, blockchain for audit trails. | Machine learning credit models, digital onboarding, automated underwriting. |

| Target Users | Compliance officers, risk managers, regulators. | Loan officers, credit analysts, retail and SME customers. |

| Regulatory Impact | Ensures adherence to banking regulations like AML, KYC, GDPR. | Supports responsible lending practices and credit risk management. |

| Integration | Integrates with AML, KYC systems, and regulatory databases. | Links with credit bureaus, payment gateways, and customer CRM systems. |

Which is better?

Regtech enhances banking compliance by automating regulatory monitoring, reducing risks, and ensuring faster adherence to evolving standards, while lendingtech optimizes credit risk assessment and streamlines loan origination for improved customer experience and faster decision-making. Banks focusing on compliance efficiency benefit more from regtech's capabilities, whereas those prioritizing loan growth and underwriting accuracy gain greater value from lendingtech solutions. The optimal choice depends on the institution's strategic focus, operational needs, and regulatory environment.

Connection

Regtech enhances lendingtech by automating compliance processes and risk assessments, ensuring faster and more secure loan approvals. Advanced data analytics in regtech improve credit scoring models within lendingtech platforms, reducing default rates. Integration of real-time regulatory updates streamlines loan origination and monitoring, promoting transparency and trust in banking services.

Key Terms

**LendingTech:**

LendingTech leverages advanced algorithms, AI, and big data analytics to streamline loan origination, credit underwriting, and risk assessment processes, significantly reducing approval times and enhancing borrower experience. This technology fosters financial inclusion by enabling alternative credit scoring models that assess non-traditional data points, expanding lending access to underserved populations. Explore the latest innovations in LendingTech to understand how digital transformation is reshaping the lending landscape.

Credit Scoring

LendingTech leverages advanced algorithms and machine learning to enhance credit scoring accuracy by analyzing diverse data sources including transaction histories and social behavior patterns. RegTech emphasizes compliance-driven credit scoring models that ensure adherence to regulatory standards like the Fair Credit Reporting Act (FCRA) and Anti-Money Laundering (AML) requirements. Explore how integrating these technologies revolutionizes risk assessment and credit decision-making processes.

Loan Origination

LendingTech streamlines loan origination by automating credit assessment, borrower verification, and loan processing, enhancing efficiency and reducing approval times. RegTech ensures compliance with financial regulations throughout the loan origination process by monitoring fraud prevention, data privacy, and regulatory reporting. Explore how integrating LendingTech and RegTech solutions can optimize your loan origination workflow.

Source and External Links

Lending Technology Reveals New Credit Sources & Efficiences | LLR - LendingTech uses digital platforms and sophisticated algorithms to improve loan underwriting and approval rates, bridging supply and demand gaps in credit access, especially for small businesses and consumers, by enhancing digital lending capabilities across traditional and new lenders.

What is LendTech? - Storm2 - LendTech refers to digital lending technology that allows loans and banking services to be provided securely online, offering consumers a faster, more convenient alternative to traditional bank loans, often through FinTech platforms including peer-to-peer lenders.

Lending Tech Solutions | Loan Management & Lending Tech App - Credility provides end-to-end digital lending solutions including lead management, digital onboarding, and automated loan origination tools designed to streamline lending operations for financial institutions, enabling paperless and efficient loan processes.

dowidth.com

dowidth.com