Banking as a Service (BaaS) enables non-bank companies to offer financial products by integrating with licensed banks through APIs, while Banking Software as a Service (SaaS) provides cloud-based banking software solutions for banks to manage their operations efficiently. BaaS focuses on delivering banking services to end customers via third-party platforms, whereas Banking SaaS centers on enhancing internal banking processes and customer management. Explore the differences in how these models revolutionize financial technology today.

Why it is important

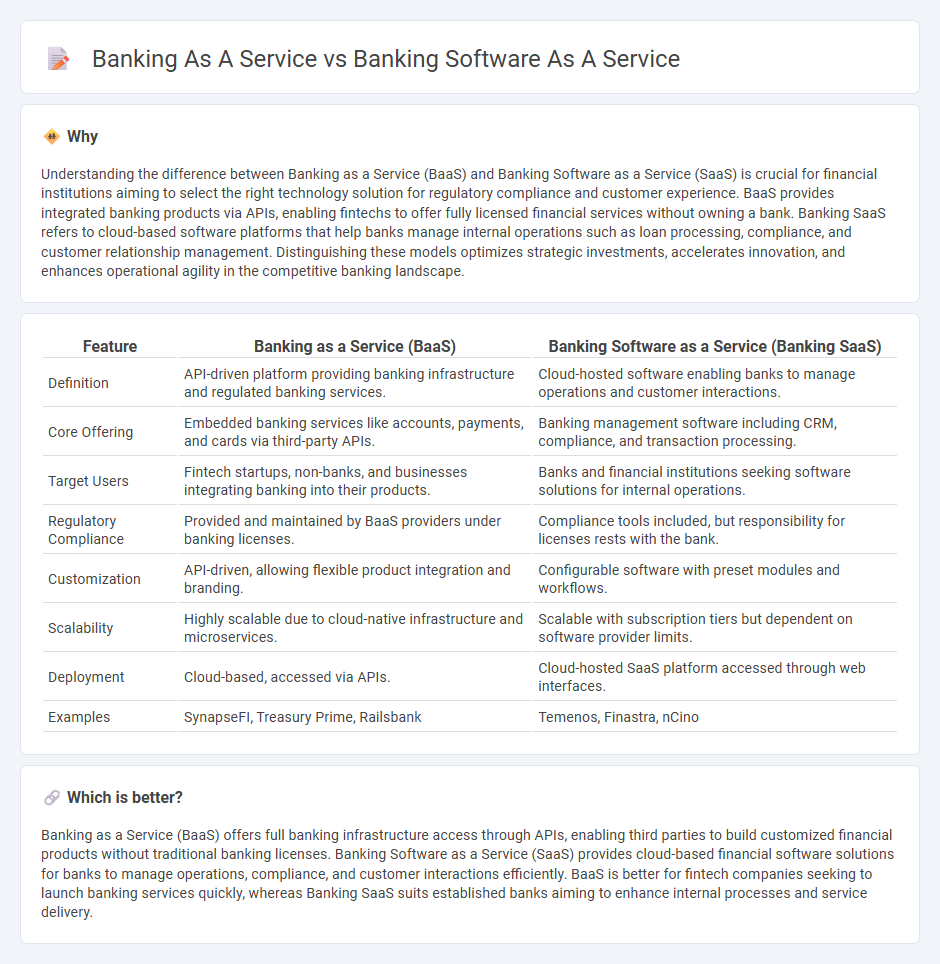

Understanding the difference between Banking as a Service (BaaS) and Banking Software as a Service (SaaS) is crucial for financial institutions aiming to select the right technology solution for regulatory compliance and customer experience. BaaS provides integrated banking products via APIs, enabling fintechs to offer fully licensed financial services without owning a bank. Banking SaaS refers to cloud-based software platforms that help banks manage internal operations such as loan processing, compliance, and customer relationship management. Distinguishing these models optimizes strategic investments, accelerates innovation, and enhances operational agility in the competitive banking landscape.

Comparison Table

| Feature | Banking as a Service (BaaS) | Banking Software as a Service (Banking SaaS) |

|---|---|---|

| Definition | API-driven platform providing banking infrastructure and regulated banking services. | Cloud-hosted software enabling banks to manage operations and customer interactions. |

| Core Offering | Embedded banking services like accounts, payments, and cards via third-party APIs. | Banking management software including CRM, compliance, and transaction processing. |

| Target Users | Fintech startups, non-banks, and businesses integrating banking into their products. | Banks and financial institutions seeking software solutions for internal operations. |

| Regulatory Compliance | Provided and maintained by BaaS providers under banking licenses. | Compliance tools included, but responsibility for licenses rests with the bank. |

| Customization | API-driven, allowing flexible product integration and branding. | Configurable software with preset modules and workflows. |

| Scalability | Highly scalable due to cloud-native infrastructure and microservices. | Scalable with subscription tiers but dependent on software provider limits. |

| Deployment | Cloud-based, accessed via APIs. | Cloud-hosted SaaS platform accessed through web interfaces. |

| Examples | SynapseFI, Treasury Prime, Railsbank | Temenos, Finastra, nCino |

Which is better?

Banking as a Service (BaaS) offers full banking infrastructure access through APIs, enabling third parties to build customized financial products without traditional banking licenses. Banking Software as a Service (SaaS) provides cloud-based financial software solutions for banks to manage operations, compliance, and customer interactions efficiently. BaaS is better for fintech companies seeking to launch banking services quickly, whereas Banking SaaS suits established banks aiming to enhance internal processes and service delivery.

Connection

Banking as a Service (BaaS) integrates core banking functions with Banking Software as a Service (SaaS) platforms to deliver seamless financial solutions through cloud-based infrastructures. BaaS providers utilize SaaS applications to offer scalable, customizable banking features such as payments, lending, and compliance tools without the need for traditional banking infrastructure. This synergy enables fintech companies and non-bank entities to embed banking services directly into their own products, enhancing customer experience and operational efficiency.

Key Terms

Core Banking System

Banking Software as a Service (BaaS) provides financial institutions with cloud-based Core Banking System software, enabling seamless management of accounts, transactions, and customer data without the burden of on-premises infrastructure. Banking as a Service, on the other hand, offers API-driven access to complete banking functionalities, allowing third-party providers to integrate banking services directly into their applications without developing a core system from scratch. Explore further to understand which solution aligns best with your institution's digital transformation goals.

API Integration

Banking Software as a Service (BSaaS) offers comprehensive cloud-based platforms with pre-built banking functionalities, allowing financial institutions to quickly deploy end-to-end solutions without extensive infrastructure investment. Banking as a Service (BaaS) primarily focuses on API integration, enabling third-party providers to embed banking features such as payments, accounts, and compliance directly into their own applications. Explore detailed API integration capabilities to determine which model aligns best with your fintech development strategy.

Regulatory Compliance

Banking software as a service (SaaS) provides financial institutions with ready-made platforms while ensuring built-in compliance tools aligned with regulatory standards like AML and GDPR, facilitating easier updates and audits. Banking as a service (BaaS) integrates licensed banking services into third-party products, demanding rigorous adherence to provider and regulator protocols to maintain compliance across multiple jurisdictions. Explore detailed comparisons to understand how each service model navigates complex regulatory landscapes.

Source and External Links

Banking as a Service vs Banking Software Licensing - SaaS banking software removes the need for banks to maintain their own IT systems, as the vendor manages hosting, updates, and maintenance, allowing banks to focus on core services.

Top Banking as a Service Companies in 2025 - Banks using software as a service can quickly upgrade to the latest features, improve cybersecurity, and scale their operations more efficiently than with traditional on-premise solutions.

From overwhelmed to overachieving: Transforming bank operations - SaaS solutions help banks reduce costs and operational pain by outsourcing infrastructure management, maintenance, and upgrades to the software provider, increasing agility and reducing time to deploy new services.

dowidth.com

dowidth.com