Social trading allows investors to replicate the strategies of experienced traders in real time, offering dynamic engagement and potentially faster returns. Mutual funds pool resources from multiple investors to be managed by professionals, providing diversification and reduced risk over a long-term horizon. Discover the key differences and benefits of each investment approach to make informed financial decisions.

Why it is important

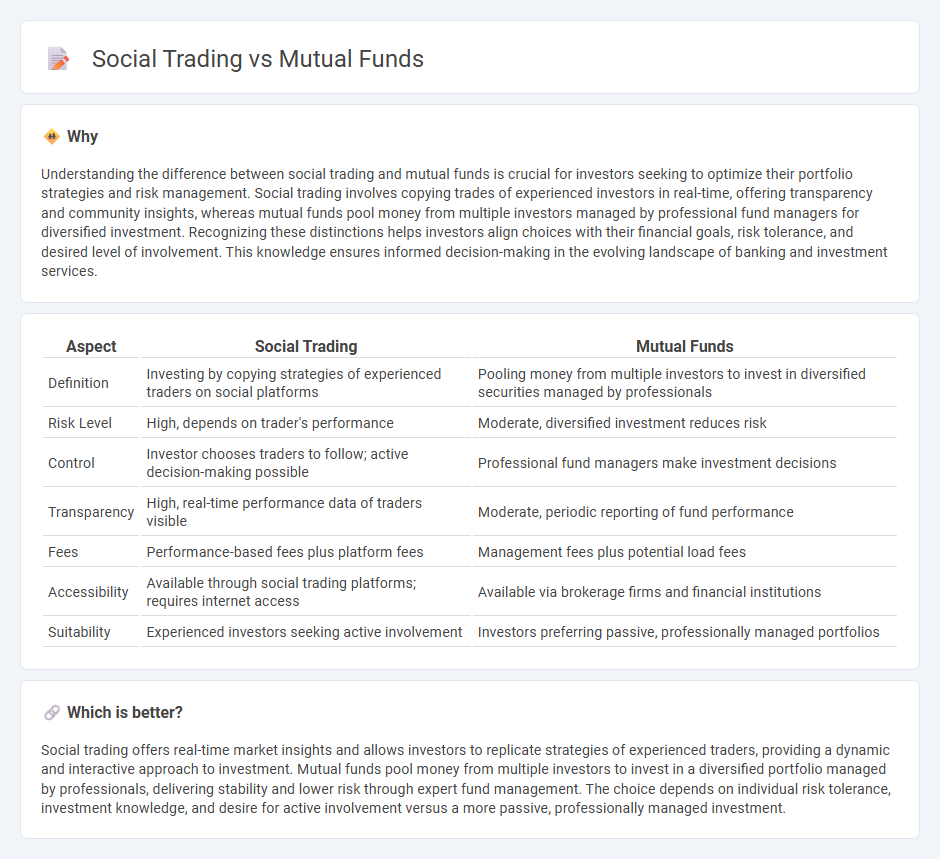

Understanding the difference between social trading and mutual funds is crucial for investors seeking to optimize their portfolio strategies and risk management. Social trading involves copying trades of experienced investors in real-time, offering transparency and community insights, whereas mutual funds pool money from multiple investors managed by professional fund managers for diversified investment. Recognizing these distinctions helps investors align choices with their financial goals, risk tolerance, and desired level of involvement. This knowledge ensures informed decision-making in the evolving landscape of banking and investment services.

Comparison Table

| Aspect | Social Trading | Mutual Funds |

|---|---|---|

| Definition | Investing by copying strategies of experienced traders on social platforms | Pooling money from multiple investors to invest in diversified securities managed by professionals |

| Risk Level | High, depends on trader's performance | Moderate, diversified investment reduces risk |

| Control | Investor chooses traders to follow; active decision-making possible | Professional fund managers make investment decisions |

| Transparency | High, real-time performance data of traders visible | Moderate, periodic reporting of fund performance |

| Fees | Performance-based fees plus platform fees | Management fees plus potential load fees |

| Accessibility | Available through social trading platforms; requires internet access | Available via brokerage firms and financial institutions |

| Suitability | Experienced investors seeking active involvement | Investors preferring passive, professionally managed portfolios |

Which is better?

Social trading offers real-time market insights and allows investors to replicate strategies of experienced traders, providing a dynamic and interactive approach to investment. Mutual funds pool money from multiple investors to invest in a diversified portfolio managed by professionals, delivering stability and lower risk through expert fund management. The choice depends on individual risk tolerance, investment knowledge, and desire for active involvement versus a more passive, professionally managed investment.

Connection

Social trading platforms facilitate collaborative investment strategies by allowing users to follow and replicate successful traders' mutual fund portfolios, enhancing market accessibility. Mutual funds benefit from social trading through increased investor engagement and diversified asset management guided by collective insights. This integration leverages real-time data sharing and behavioral analytics to optimize fund performance and investor decision-making.

Key Terms

Diversification

Mutual funds provide diversification by pooling investors' capital to buy a broad portfolio of stocks, bonds, or other assets, typically managed by professionals to balance risk and return. Social trading allows investors to diversify by following and copying multiple traders' strategies, spreading risk across various markets and investing styles. Explore more to understand which diversification method aligns with your investment goals.

Copy Trading

Copy trading in social trading platforms allows investors to automatically replicate the trades of experienced traders, offering a hands-off investment approach compared to traditional mutual funds that pool money for diversified portfolios managed by professionals. Unlike mutual funds where fund managers make decisions, copy trading provides real-time transparency and control by mimicking individual trader strategies directly. Explore how copy trading can align with your investment goals and risk tolerance to enhance your portfolio performance.

Fund Manager

Mutual funds are managed by professional Fund Managers who utilize their expertise to select a diversified portfolio of assets aiming for optimal returns and risk management. In contrast, social trading platforms allow investors to mirror the trades of experienced traders rather than relying on a dedicated Fund Manager's strategic decisions. Explore the unique advantages and strategies behind Fund Manager roles in mutual funds to make informed investment choices.

Source and External Links

Mutual Funds - Mutual funds are SEC-registered open-end investment companies that pool money from many investors to invest in stocks, bonds, and other securities, offering professional management and diversification.

Mutual Fund - A mutual fund is an investment fund that pools money from many investors to purchase securities, often categorized by investment type such as stock, bond, or hybrid funds.

What Are Mutual Funds? - Mutual funds allow investors to pool their money to purchase a collection of stocks, bonds, or other securities, providing diversification and professional management.

dowidth.com

dowidth.com