Social trading enables investors to mimic the strategies of experienced traders by following their trades in real time, offering a collaborative approach to market participation. Portfolio management involves the professional selection and oversight of diverse assets to achieve personalized investment goals, emphasizing risk management and asset allocation. Discover how these distinct strategies can enhance your financial growth and investment experience.

Why it is important

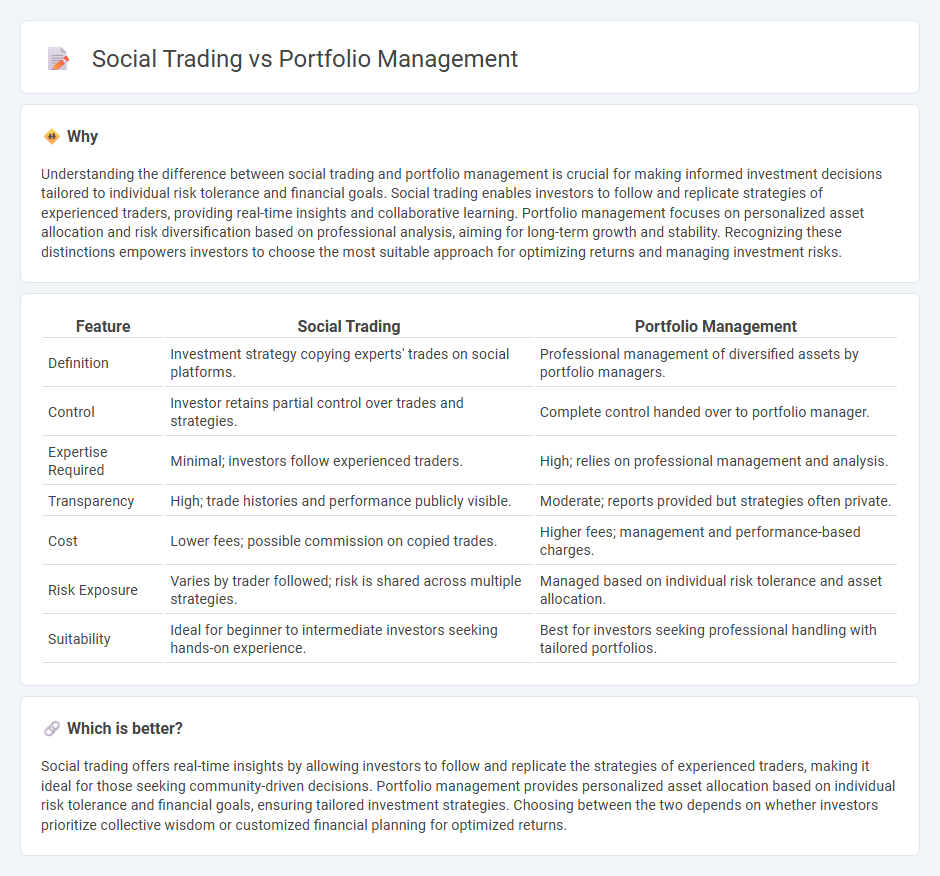

Understanding the difference between social trading and portfolio management is crucial for making informed investment decisions tailored to individual risk tolerance and financial goals. Social trading enables investors to follow and replicate strategies of experienced traders, providing real-time insights and collaborative learning. Portfolio management focuses on personalized asset allocation and risk diversification based on professional analysis, aiming for long-term growth and stability. Recognizing these distinctions empowers investors to choose the most suitable approach for optimizing returns and managing investment risks.

Comparison Table

| Feature | Social Trading | Portfolio Management |

|---|---|---|

| Definition | Investment strategy copying experts' trades on social platforms. | Professional management of diversified assets by portfolio managers. |

| Control | Investor retains partial control over trades and strategies. | Complete control handed over to portfolio manager. |

| Expertise Required | Minimal; investors follow experienced traders. | High; relies on professional management and analysis. |

| Transparency | High; trade histories and performance publicly visible. | Moderate; reports provided but strategies often private. |

| Cost | Lower fees; possible commission on copied trades. | Higher fees; management and performance-based charges. |

| Risk Exposure | Varies by trader followed; risk is shared across multiple strategies. | Managed based on individual risk tolerance and asset allocation. |

| Suitability | Ideal for beginner to intermediate investors seeking hands-on experience. | Best for investors seeking professional handling with tailored portfolios. |

Which is better?

Social trading offers real-time insights by allowing investors to follow and replicate the strategies of experienced traders, making it ideal for those seeking community-driven decisions. Portfolio management provides personalized asset allocation based on individual risk tolerance and financial goals, ensuring tailored investment strategies. Choosing between the two depends on whether investors prioritize collective wisdom or customized financial planning for optimized returns.

Connection

Social trading leverages collective market insights by enabling investors to follow and copy the trades of successful peers, directly influencing portfolio management strategies. Portfolio management integrates these social trading signals to diversify asset allocation and optimize risk-adjusted returns. This synergy enhances decision-making accuracy and adapts investment strategies based on real-time market sentiment shared across the social trading community.

Key Terms

Portfolio Management:

Portfolio management involves the strategic allocation of assets to maximize returns while managing risk, utilizing techniques such as diversification, asset allocation, and continuous performance analysis to achieve investment goals. It requires active or passive monitoring of market trends, economic indicators, and individual asset performance to optimize portfolio growth and ensure alignment with investor objectives. Discover deeper insights into portfolio management strategies and how they can enhance your investment outcomes.

Asset Allocation

Portfolio management emphasizes strategic asset allocation based on individual risk tolerance and investment goals, using diversified assets to optimize returns and manage risk. Social trading allows investors to follow and replicate the asset allocation strategies of experienced traders, providing real-time insights and collaborative decision-making. Explore how integrating both approaches can enhance asset allocation strategies and investment outcomes.

Risk Assessment

Portfolio management involves systematic risk assessment using diversification, asset allocation, and quantitative analysis to mitigate potential losses and optimize returns. Social trading amplifies risk exposure by copying multiple traders, making continuous evaluation of leader performance and market conditions essential to avoid correlated risks. Explore detailed strategies and tools to enhance risk assessment in both portfolio management and social trading.

Source and External Links

An Introduction to Portfolio Management - Portfolio management involves asset allocation, security selection, and execution, culminating in ongoing performance evaluation to maximize returns relative to risk preferences.

Portfolio management: What it is and how to do it - Vanguard - Portfolio management is the process of creating and managing your investments, focusing on goal assessment, asset allocation, and diversification to balance risk and return, whether through passive or active strategies.

Project portfolio management - Project portfolio management (PPM) is the centralized management of multiple projects, using processes and tools to optimize resource allocation, scheduling, and alignment with organizational goals.

dowidth.com

dowidth.com