Pay by bank offers a fast and secure digital alternative to traditional cheque payments, eliminating delays and reducing fraud risks associated with physical cheques. This method leverages real-time fund transfers directly between bank accounts, enhancing transaction transparency and convenience. Explore the advantages and applications of pay by bank to streamline your payment processes.

Why it is important

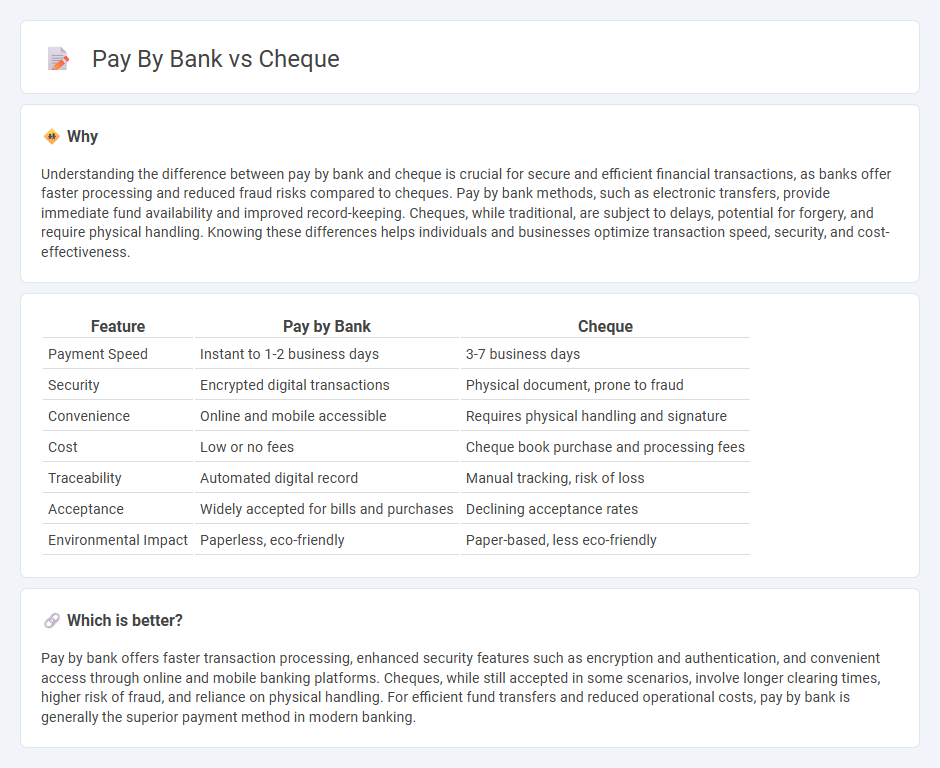

Understanding the difference between pay by bank and cheque is crucial for secure and efficient financial transactions, as banks offer faster processing and reduced fraud risks compared to cheques. Pay by bank methods, such as electronic transfers, provide immediate fund availability and improved record-keeping. Cheques, while traditional, are subject to delays, potential for forgery, and require physical handling. Knowing these differences helps individuals and businesses optimize transaction speed, security, and cost-effectiveness.

Comparison Table

| Feature | Pay by Bank | Cheque |

|---|---|---|

| Payment Speed | Instant to 1-2 business days | 3-7 business days |

| Security | Encrypted digital transactions | Physical document, prone to fraud |

| Convenience | Online and mobile accessible | Requires physical handling and signature |

| Cost | Low or no fees | Cheque book purchase and processing fees |

| Traceability | Automated digital record | Manual tracking, risk of loss |

| Acceptance | Widely accepted for bills and purchases | Declining acceptance rates |

| Environmental Impact | Paperless, eco-friendly | Paper-based, less eco-friendly |

Which is better?

Pay by bank offers faster transaction processing, enhanced security features such as encryption and authentication, and convenient access through online and mobile banking platforms. Cheques, while still accepted in some scenarios, involve longer clearing times, higher risk of fraud, and reliance on physical handling. For efficient fund transfers and reduced operational costs, pay by bank is generally the superior payment method in modern banking.

Connection

Pay by bank and cheque are connected through the banking system, where pay by bank involves electronic transfers directly between bank accounts, while cheques represent a written, paper-based authorization to debit funds from one account to another. Both methods rely on the bank's processing infrastructure to verify funds, clear payments, and update account balances securely. The integration of these payment modes ensures flexibility and traceability in financial transactions within banking services.

Key Terms

Drawer

The drawer in a cheque transaction physically signs the cheque to authorize payment from their bank account, creating a direct paper trail and a formal payment instruction. When paying by bank, the drawer initiates an electronic transfer through online banking or mobile apps, offering faster processing and real-time fund verification. Discover the key differences in security and convenience between these payment methods by exploring more details.

Clearing

Cheque clearance involves manual processing, including physical verification and bank branch handling, often taking several business days to complete. Pay by bank utilizes electronic funds transfer with immediate or same-day clearing, enhancing transaction speed and reducing the risk of fraud. Discover how pay by bank systems streamline clearing for faster, safer payments.

Direct Transfer

Direct transfer offers faster and more secure payment compared to cheques, eliminating the risk of cheque fraud and reducing processing times. Banks facilitate instant fund movements through direct transfers, enhancing transaction efficiency for both individuals and businesses. Discover more about the advantages of direct transfers over cheque payments and how they streamline your financial operations.

Source and External Links

Cheque - Wikipedia - A cheque is a document that orders a bank to pay a specific amount of money from the drawer's account to the payee, and typically includes the drawer's and payee's names, the drawee bank, amount in words and figures, and the drawer's signature.

What is Cheque & Different Types of Cheque - HDFC Bank - A cheque is a negotiable instrument issued to a bank, directing it to pay a specified sum to the person named on the cheque, and comes in various types such as bearer cheques, which are payable to whoever presents them.

Cheque vs Check | Definition, Use & Examples - QuillBot - The term "cheque" is used in British English for a bank-issued payment document, while "check" is the American English spelling for the same financial instrument.

dowidth.com

dowidth.com