Super apps integrate multiple financial services within a single platform, offering users seamless access to payments, investments, and banking. Roboadvisors utilize AI-driven algorithms to provide personalized investment advice and automated portfolio management with minimal human intervention. Explore how these innovations are reshaping the future of banking and wealth management.

Why it is important

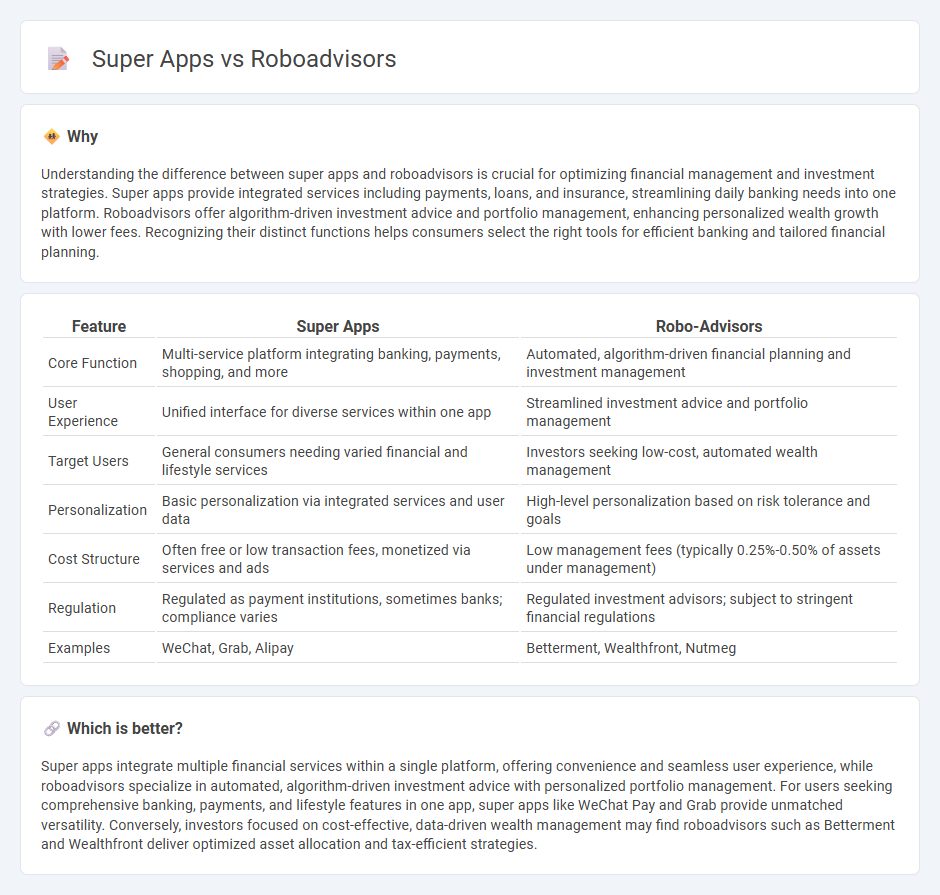

Understanding the difference between super apps and roboadvisors is crucial for optimizing financial management and investment strategies. Super apps provide integrated services including payments, loans, and insurance, streamlining daily banking needs into one platform. Roboadvisors offer algorithm-driven investment advice and portfolio management, enhancing personalized wealth growth with lower fees. Recognizing their distinct functions helps consumers select the right tools for efficient banking and tailored financial planning.

Comparison Table

| Feature | Super Apps | Robo-Advisors |

|---|---|---|

| Core Function | Multi-service platform integrating banking, payments, shopping, and more | Automated, algorithm-driven financial planning and investment management |

| User Experience | Unified interface for diverse services within one app | Streamlined investment advice and portfolio management |

| Target Users | General consumers needing varied financial and lifestyle services | Investors seeking low-cost, automated wealth management |

| Personalization | Basic personalization via integrated services and user data | High-level personalization based on risk tolerance and goals |

| Cost Structure | Often free or low transaction fees, monetized via services and ads | Low management fees (typically 0.25%-0.50% of assets under management) |

| Regulation | Regulated as payment institutions, sometimes banks; compliance varies | Regulated investment advisors; subject to stringent financial regulations |

| Examples | WeChat, Grab, Alipay | Betterment, Wealthfront, Nutmeg |

Which is better?

Super apps integrate multiple financial services within a single platform, offering convenience and seamless user experience, while roboadvisors specialize in automated, algorithm-driven investment advice with personalized portfolio management. For users seeking comprehensive banking, payments, and lifestyle features in one app, super apps like WeChat Pay and Grab provide unmatched versatility. Conversely, investors focused on cost-effective, data-driven wealth management may find roboadvisors such as Betterment and Wealthfront deliver optimized asset allocation and tax-efficient strategies.

Connection

Super apps integrate multiple financial services, including roboadvisory, to offer seamless banking experiences through AI-driven investment advice and portfolio management. Robo-advisors utilize algorithms and big data analytics to provide personalized financial planning, which enhances user engagement within super apps. This synergy boosts customer retention by delivering comprehensive, automated wealth management in a single digital platform.

Key Terms

Automation

Robo-advisors leverage advanced algorithms and artificial intelligence to automate personalized investment strategies with minimal human intervention, optimizing portfolio management and risk assessment. Super apps integrate multiple financial services, including robo-advisory, payments, and insurance, within a single platform, streamlining user experience but often with less specialization in automated investment guidance. Discover how automation in these technologies transforms financial management and which solution fits your investment needs best.

Ecosystem Integration

Robo-advisors excel in providing automated investment management through advanced algorithms and personalized portfolio optimization, seamlessly integrating with financial services ecosystems to deliver tailored wealth management solutions. Super apps offer broader ecosystem integration by combining diverse services such as payments, messaging, ride-hailing, and financial products within a single platform, enhancing user engagement and convenience across multiple daily activities. Explore how these distinct approaches to ecosystem integration shape the future of digital finance and user experience.

Personalization

Robo-advisors leverage AI algorithms and user data to deliver highly personalized investment portfolios tailored to individual risk tolerance and financial goals. Super apps integrate multiple services, including finance, lifestyle, and shopping, using cross-platform data to offer customized experiences but may lack the depth of specialized financial advice provided by robo-advisors. Discover how personalization in these platforms can transform your financial management by exploring their unique features and benefits.

Source and External Links

Robo-advisor - Wikipedia - Robo-advisors are digital financial advisers that use algorithms to provide personalized investment management with minimal human intervention, often focusing on automated asset allocation primarily through ETFs, making wealth management accessible and affordable to a broad audience.

What is a robo advisor? | Robo advisory services - Fidelity Investments - Robo-advisors automate investing by using technology to build and maintain portfolios based on user inputs like risk tolerance and financial goals, offering a low-cost, largely digital alternative to traditional financial advice with some human involvement behind the scenes.

The Best Robo-Advisors of 2025 - Morningstar - Robo-advisors blend automated asset allocation with semi-tailored investment portfolios at low cost, providing a middle ground between full DIY trading platforms and traditional wealth managers, while also offering financial planning tools and access to human advisors.

dowidth.com

dowidth.com