Pay by bank enables direct transactions from bank accounts without intermediaries, offering enhanced security and reduced fraud risk compared to virtual cards, which are digital representations of physical cards used for online purchases. Virtual cards provide flexibility with temporary numbers and spending limits but can be susceptible to data breaches and misuse if compromised. Explore the benefits and differences between pay by bank and virtual card payment methods to choose the best option for your financial needs.

Why it is important

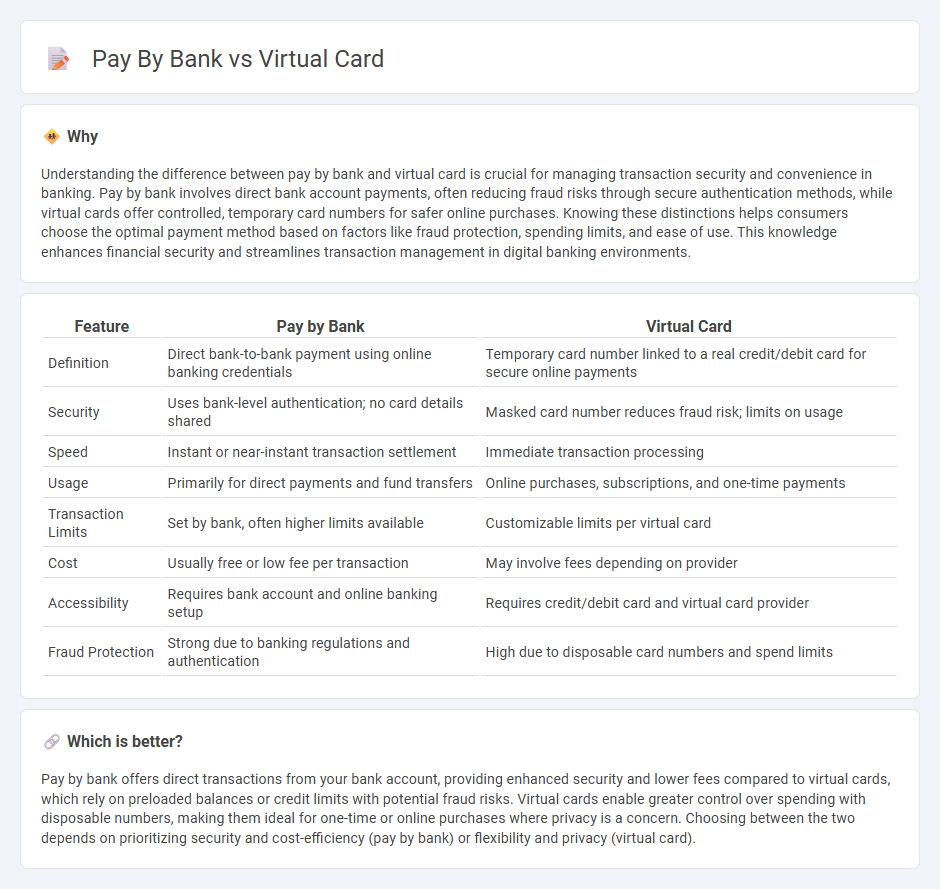

Understanding the difference between pay by bank and virtual card is crucial for managing transaction security and convenience in banking. Pay by bank involves direct bank account payments, often reducing fraud risks through secure authentication methods, while virtual cards offer controlled, temporary card numbers for safer online purchases. Knowing these distinctions helps consumers choose the optimal payment method based on factors like fraud protection, spending limits, and ease of use. This knowledge enhances financial security and streamlines transaction management in digital banking environments.

Comparison Table

| Feature | Pay by Bank | Virtual Card |

|---|---|---|

| Definition | Direct bank-to-bank payment using online banking credentials | Temporary card number linked to a real credit/debit card for secure online payments |

| Security | Uses bank-level authentication; no card details shared | Masked card number reduces fraud risk; limits on usage |

| Speed | Instant or near-instant transaction settlement | Immediate transaction processing |

| Usage | Primarily for direct payments and fund transfers | Online purchases, subscriptions, and one-time payments |

| Transaction Limits | Set by bank, often higher limits available | Customizable limits per virtual card |

| Cost | Usually free or low fee per transaction | May involve fees depending on provider |

| Accessibility | Requires bank account and online banking setup | Requires credit/debit card and virtual card provider |

| Fraud Protection | Strong due to banking regulations and authentication | High due to disposable card numbers and spend limits |

Which is better?

Pay by bank offers direct transactions from your bank account, providing enhanced security and lower fees compared to virtual cards, which rely on preloaded balances or credit limits with potential fraud risks. Virtual cards enable greater control over spending with disposable numbers, making them ideal for one-time or online purchases where privacy is a concern. Choosing between the two depends on prioritizing security and cost-efficiency (pay by bank) or flexibility and privacy (virtual card).

Connection

Pay by bank and virtual cards are connected through their use of secure digital payment methods that enhance transaction efficiency and user convenience. Pay by bank enables direct transfers from a bank account without intermediaries, while virtual cards generate unique card numbers linked to the user's bank account for online purchases. Both technologies leverage tokenization and real-time authentication protocols to reduce fraud and streamline payment processing in the banking ecosystem.

Key Terms

Tokenization

Virtual cards utilize tokenization to replace sensitive payment information with unique tokens, significantly reducing fraud risk during online transactions. Pay by bank methods also incorporate tokenization but emphasize direct bank-to-merchant data exchange, enhancing transaction security without sharing full card details. Discover how tokenization transforms payment security by exploring these digital payment innovations further.

Open Banking

Virtual cards leverage tokenization technology to provide secure, single-use card numbers for online transactions, minimizing fraud risks. Pay by bank, built on Open Banking protocols, enables direct payments from consumer bank accounts without intermediaries, increasing transaction transparency and reducing processing fees. Explore how Open Banking reshapes payment methods by enhancing security and efficiency in digital transactions.

Card Issuance

Virtual card issuance involves generating a digital card number instantly, offering enhanced security through tokenization and real-time transaction controls. Pay by bank requires linking directly to a user's bank account via secure APIs, enabling seamless payments without the need for physical or virtual card details. Discover how these payment methods transform financial transactions and improve user experience.

Source and External Links

Virtual Card for Business - Visa - A Visa virtual card is a digital payment method issued by your financial institution, designed for secure, controlled business expenses with features like custom spending limits, merchant restrictions, and easy integration with accounting systems.

Virtual Credit Cards for Online Shopping - Capital One - A virtual credit card substitutes your actual card number for online purchases, providing enhanced security by masking your real card details and reducing fraud risk during transactions.

Virtual cards 101 simplifying commercial payments - Mastercard - Mastercard virtual cards are temporary, randomly generated card numbers linked to a funding account, offering businesses customizable spending controls, instant issuance, and faster payment settlement compared to traditional methods.

dowidth.com

dowidth.com