Sustainable finance integrates environmental, social, and governance (ESG) factors into financial decision-making to promote long-term positive impact on society and the environment. ESG investing specifically focuses on selecting investments based on companies' performance in these three critical areas, aiming to balance profit with purpose. Explore how sustainable finance and ESG investing shape the future of ethical banking.

Why it is important

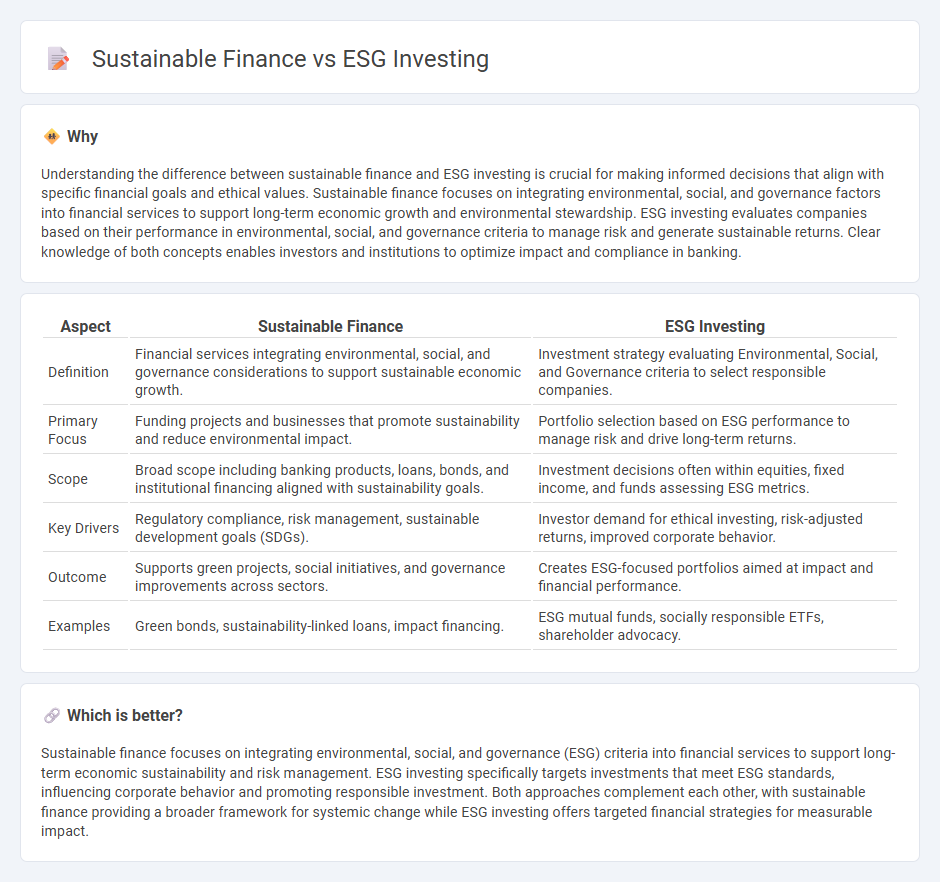

Understanding the difference between sustainable finance and ESG investing is crucial for making informed decisions that align with specific financial goals and ethical values. Sustainable finance focuses on integrating environmental, social, and governance factors into financial services to support long-term economic growth and environmental stewardship. ESG investing evaluates companies based on their performance in environmental, social, and governance criteria to manage risk and generate sustainable returns. Clear knowledge of both concepts enables investors and institutions to optimize impact and compliance in banking.

Comparison Table

| Aspect | Sustainable Finance | ESG Investing |

|---|---|---|

| Definition | Financial services integrating environmental, social, and governance considerations to support sustainable economic growth. | Investment strategy evaluating Environmental, Social, and Governance criteria to select responsible companies. |

| Primary Focus | Funding projects and businesses that promote sustainability and reduce environmental impact. | Portfolio selection based on ESG performance to manage risk and drive long-term returns. |

| Scope | Broad scope including banking products, loans, bonds, and institutional financing aligned with sustainability goals. | Investment decisions often within equities, fixed income, and funds assessing ESG metrics. |

| Key Drivers | Regulatory compliance, risk management, sustainable development goals (SDGs). | Investor demand for ethical investing, risk-adjusted returns, improved corporate behavior. |

| Outcome | Supports green projects, social initiatives, and governance improvements across sectors. | Creates ESG-focused portfolios aimed at impact and financial performance. |

| Examples | Green bonds, sustainability-linked loans, impact financing. | ESG mutual funds, socially responsible ETFs, shareholder advocacy. |

Which is better?

Sustainable finance focuses on integrating environmental, social, and governance (ESG) criteria into financial services to support long-term economic sustainability and risk management. ESG investing specifically targets investments that meet ESG standards, influencing corporate behavior and promoting responsible investment. Both approaches complement each other, with sustainable finance providing a broader framework for systemic change while ESG investing offers targeted financial strategies for measurable impact.

Connection

Sustainable finance integrates environmental, social, and governance (ESG) criteria into banking decisions to promote long-term economic stability and responsible investment. ESG investing directs capital toward companies with strong sustainability practices, reducing risks related to climate change and social impact. Banks leveraging ESG frameworks enhance trust, mitigate financial risks, and align portfolios with global sustainability goals.

Key Terms

Environmental, Social, and Governance (ESG) Criteria

ESG investing integrates Environmental, Social, and Governance criteria to evaluate companies' ethical impact and sustainability performance, aiming to generate long-term financial returns and positive societal effects. Sustainable finance encompasses a broader approach, including ESG factors alongside climate risk assessments, green bonds, and impact investing to support environmental preservation and social well-being. Explore further to understand how ESG investing and sustainable finance drive responsible capital allocation and corporate accountability.

Green Bonds

Green bonds represent a pivotal instrument in both ESG investing and sustainable finance, channeling capital specifically into environmentally beneficial projects such as renewable energy, clean transportation, and climate resilience. Unlike traditional bonds, green bonds are designated to fund initiatives that deliver measurable environmental benefits, aligning with Environmental, Social, and Governance (ESG) criteria to mitigate climate risks and promote sustainable development. Explore how green bonds drive impactful investment strategies and contribute to achieving global sustainability goals.

Impact Investing

Impact investing targets measurable social and environmental outcomes alongside financial returns, distinguishing itself within the broader scope of ESG investing and sustainable finance. ESG investing integrates environmental, social, and governance criteria into traditional investment analysis, while sustainable finance incorporates strategies supporting long-term ecological and social sustainability. Explore how impact investing drives positive change by aligning capital with purpose-driven objectives.

Source and External Links

Embracing Sustainable Investment Practices with ESG Investing - ESG investing is an investment strategy that evaluates environmental, social, and governance risks of businesses, showing strong growth and resilience, with ESG assets representing about $4 trillion globally.

Environmental, social, and governance - ESG investing prioritizes environmental, social, and governance factors through methods like positive selection, activism, engagement, and exclusion, but can introduce risks such as concentration in certain industries.

What is ESG Investing? - ESG investing, also known as socially responsible or sustainable investing, integrates environmental, social, and governance considerations to align investments with ethical and financial goals, guided by frameworks like the UN Principles for Responsible Investments.

dowidth.com

dowidth.com