Behavioral biometrics analyzes unique patterns in user behavior, such as typing rhythm and device handling, to enhance banking security far beyond traditional PIN codes. PIN codes rely solely on knowledge-based authentication, making them vulnerable to theft, phishing, and guessing attempts. Explore how behavioral biometrics revolutionizes fraud prevention in banking by offering continuous, adaptive authentication.

Why it is important

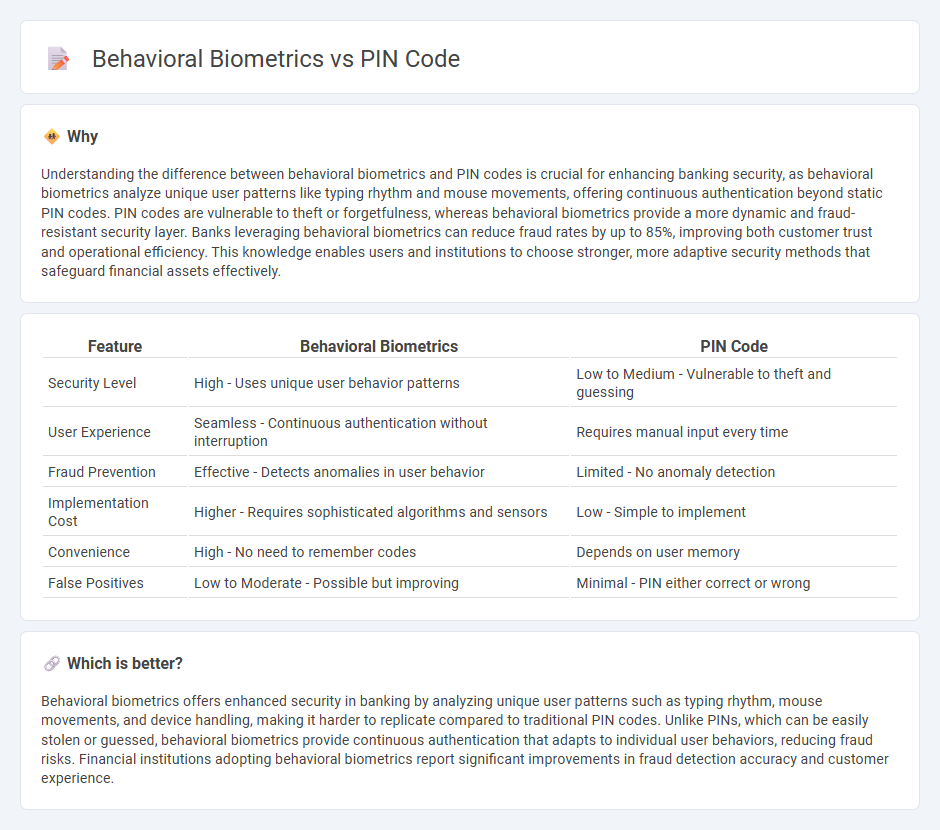

Understanding the difference between behavioral biometrics and PIN codes is crucial for enhancing banking security, as behavioral biometrics analyze unique user patterns like typing rhythm and mouse movements, offering continuous authentication beyond static PIN codes. PIN codes are vulnerable to theft or forgetfulness, whereas behavioral biometrics provide a more dynamic and fraud-resistant security layer. Banks leveraging behavioral biometrics can reduce fraud rates by up to 85%, improving both customer trust and operational efficiency. This knowledge enables users and institutions to choose stronger, more adaptive security methods that safeguard financial assets effectively.

Comparison Table

| Feature | Behavioral Biometrics | PIN Code |

|---|---|---|

| Security Level | High - Uses unique user behavior patterns | Low to Medium - Vulnerable to theft and guessing |

| User Experience | Seamless - Continuous authentication without interruption | Requires manual input every time |

| Fraud Prevention | Effective - Detects anomalies in user behavior | Limited - No anomaly detection |

| Implementation Cost | Higher - Requires sophisticated algorithms and sensors | Low - Simple to implement |

| Convenience | High - No need to remember codes | Depends on user memory |

| False Positives | Low to Moderate - Possible but improving | Minimal - PIN either correct or wrong |

Which is better?

Behavioral biometrics offers enhanced security in banking by analyzing unique user patterns such as typing rhythm, mouse movements, and device handling, making it harder to replicate compared to traditional PIN codes. Unlike PINs, which can be easily stolen or guessed, behavioral biometrics provide continuous authentication that adapts to individual user behaviors, reducing fraud risks. Financial institutions adopting behavioral biometrics report significant improvements in fraud detection accuracy and customer experience.

Connection

Behavioral biometrics enhances banking security by analyzing unique user patterns such as typing rhythm and device interaction, complementing traditional PIN code authentication. Combining these methods creates a multi-layered defense, reducing fraud risks in digital banking. Financial institutions increasingly adopt this integration to ensure seamless yet robust customer verification.

Key Terms

Authentication

PIN codes rely on static numerical passwords vulnerable to theft or guessing, while behavioral biometrics analyze unique user patterns such as typing rhythm, gait, or touchscreen interaction for dynamic authentication. Behavioral biometrics provide continuous identity verification, enhancing security by detecting anomalies in real-time user behavior. Explore more about how behavioral biometrics transform authentication for improved fraud prevention and user experience.

Security

PIN codes rely on static, easily shared numerical sequences vulnerable to theft and guessing attacks, making them less secure against unauthorized access. Behavioral biometrics analyze unique user patterns such as typing rhythm, mouse movements, and touchscreen behavior, offering dynamic, difficult-to-replicate authentication that enhances security. Discover how behavioral biometrics can transform your security approach with adaptive, fraud-resistant solutions.

Fraud prevention

PIN codes serve as a traditional standalone security measure vulnerable to theft and social engineering attacks, while behavioral biometrics analyze unique user patterns such as typing rhythm, mouse movements, and device handling to enhance fraud prevention. Behavioral biometrics offer dynamic authentication by continuously monitoring user behavior, significantly reducing false positives and detecting unauthorized access in real-time. Explore the latest advancements in fraud prevention technologies to understand how integrating behavioral biometrics can strengthen security frameworks.

Source and External Links

What is a PIN Code(Postal Index Number)? - Complete Info - A PIN code in India is a six-digit numeric code used by the postal system to simplify mail sorting, where the first digits represent specific regions, and each PIN corresponds to one delivery post office managing mail for various sub-offices.

Personal identification number - A PIN (Personal Identification Number) is a numeric or alphanumeric passcode used to authenticate a user's identity in computer and financial systems, such as ATMs and secure access controls.

Get an Identity Protection PIN (IP PIN) - An Identity Protection PIN (IP PIN) is a six-digit number issued by the IRS to prevent someone else from filing a tax return using your Social Security Number, serving as an additional layer of identity verification for tax purposes.

dowidth.com

dowidth.com