Core banking modernization transforms traditional banking infrastructure by implementing advanced digital platforms that enhance processing speed, scalability, and customer experience. Real-time payments enable instantaneous fund transfers and settlements, driving seamless financial transactions across banks and payment networks. Explore how integrating core banking modernization with real-time payments can revolutionize financial services and operational efficiency.

Why it is important

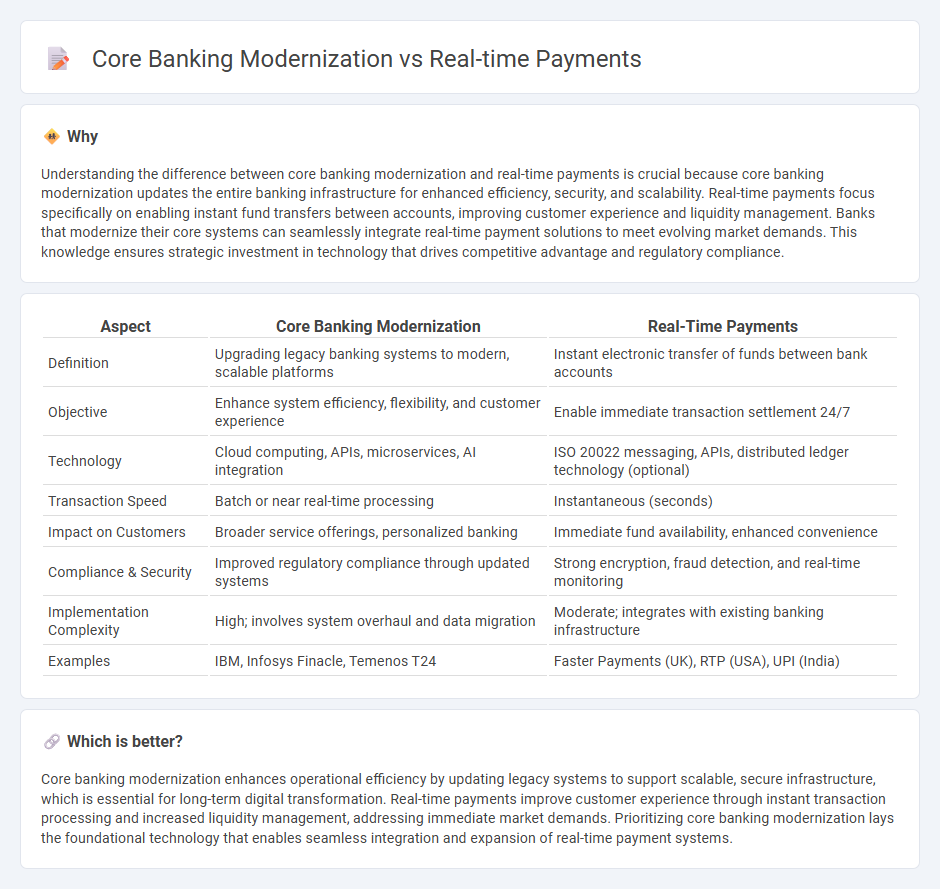

Understanding the difference between core banking modernization and real-time payments is crucial because core banking modernization updates the entire banking infrastructure for enhanced efficiency, security, and scalability. Real-time payments focus specifically on enabling instant fund transfers between accounts, improving customer experience and liquidity management. Banks that modernize their core systems can seamlessly integrate real-time payment solutions to meet evolving market demands. This knowledge ensures strategic investment in technology that drives competitive advantage and regulatory compliance.

Comparison Table

| Aspect | Core Banking Modernization | Real-Time Payments |

|---|---|---|

| Definition | Upgrading legacy banking systems to modern, scalable platforms | Instant electronic transfer of funds between bank accounts |

| Objective | Enhance system efficiency, flexibility, and customer experience | Enable immediate transaction settlement 24/7 |

| Technology | Cloud computing, APIs, microservices, AI integration | ISO 20022 messaging, APIs, distributed ledger technology (optional) |

| Transaction Speed | Batch or near real-time processing | Instantaneous (seconds) |

| Impact on Customers | Broader service offerings, personalized banking | Immediate fund availability, enhanced convenience |

| Compliance & Security | Improved regulatory compliance through updated systems | Strong encryption, fraud detection, and real-time monitoring |

| Implementation Complexity | High; involves system overhaul and data migration | Moderate; integrates with existing banking infrastructure |

| Examples | IBM, Infosys Finacle, Temenos T24 | Faster Payments (UK), RTP (USA), UPI (India) |

Which is better?

Core banking modernization enhances operational efficiency by updating legacy systems to support scalable, secure infrastructure, which is essential for long-term digital transformation. Real-time payments improve customer experience through instant transaction processing and increased liquidity management, addressing immediate market demands. Prioritizing core banking modernization lays the foundational technology that enables seamless integration and expansion of real-time payment systems.

Connection

Core banking modernization enables real-time payments by updating legacy systems to support instantaneous transaction processing and data synchronization across multiple channels. This integration enhances customer experience through faster fund transfers, improved liquidity management, and increased operational efficiency for banks. Real-time payments rely on modern core banking infrastructure to deliver seamless, secure, and reliable financial services 24/7.

Key Terms

Instant Settlement

Real-time payments enable instant settlement by processing transactions within seconds, drastically improving cash flow and customer satisfaction compared to traditional banking methods. Core banking modernization focuses on upgrading legacy systems to support seamless integration of real-time payment infrastructure and enhance operational efficiency. Explore the benefits and strategies for leveraging instant settlement in modern banking environments to transform financial services.

Legacy System Integration

Real-time payments demand seamless connectivity with legacy core banking systems to ensure instant transaction processing and enhanced customer experience. Integrating modern payment solutions with existing infrastructure requires advanced APIs and middleware to overcome compatibility challenges and maintain data integrity. Explore how effective legacy system integration can drive successful core banking modernization and real-time payment adoption.

API Technology

Real-time payments rely heavily on advanced API technology to enable instantaneous transaction processing, ensuring seamless integration with core banking systems. Core banking modernization focuses on upgrading legacy infrastructures to support scalable, secure APIs that facilitate real-time data exchange and enhance customer experience. Discover how API technology bridges real-time payments and core banking modernization for agile financial services.

Source and External Links

Instant Payments: Understanding RTP(r) and FedNow(r) Service - Real-time payments are near-instant funds transfers available 24/7 year-round, completing within seconds and providing immediate confirmation, which optimizes cash flow and improves business relationships; in the U.S., they operate mainly via the RTP(r) network and FedNow(r) Service, with similar systems present globally.

Instant Payments: RTP(r) Network and FEDNOW(r) Service - U.S. Bank - Real-time payments through the RTP network and FedNow Service enable immediate funds access, automated processing, and rich payment data 24/7/365, with RTP launched in 2017 and FedNow in 2023, offering efficient and immediate payment capabilities in the U.S.

Your real-time guide to real-time payments - Mastercard - Real-time payments are instant bank-to-bank transfers settled within seconds anytime, supporting improved transparency and money management globally, with major adoption in countries like India, Brazil, and Thailand, while the U.S. is expanding adoption with networks like RTP and FedNow.

dowidth.com

dowidth.com