Income streaming provides banks with a consistent revenue flow by consolidating multiple income sources such as interest, fees, and investments into a unified framework. Interchange fees are charges paid by merchants to banks each time customers use credit or debit cards, acting as a significant revenue stream in transaction processing. Explore the dynamics between income streaming and interchange fees to understand their impact on banking profitability.

Why it is important

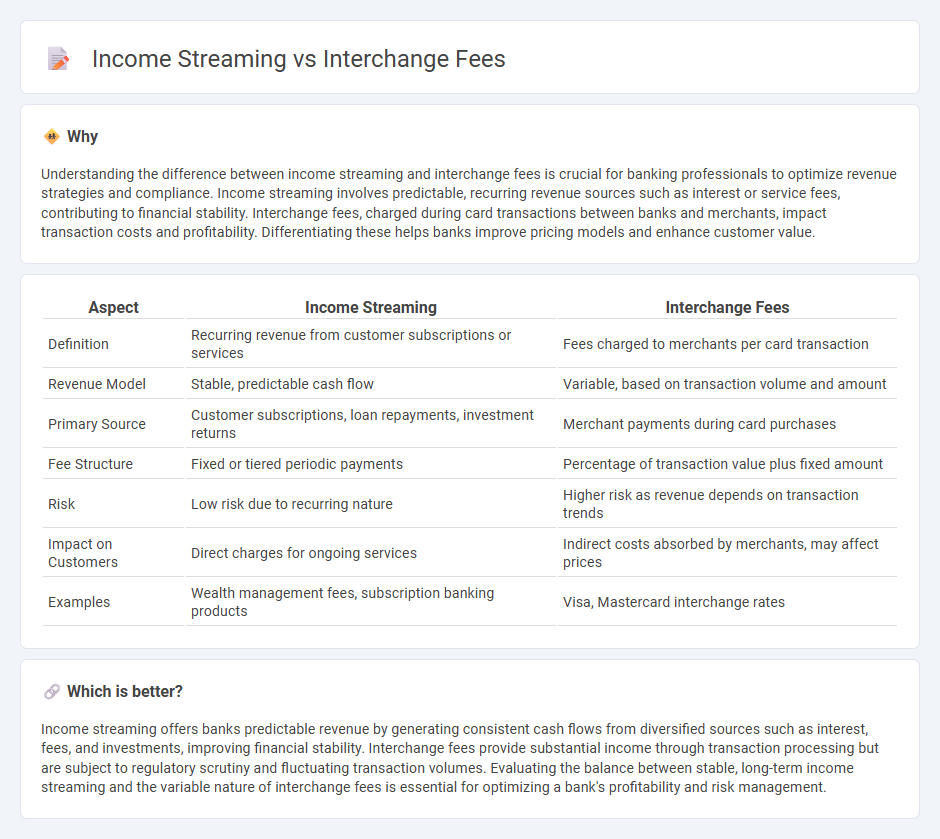

Understanding the difference between income streaming and interchange fees is crucial for banking professionals to optimize revenue strategies and compliance. Income streaming involves predictable, recurring revenue sources such as interest or service fees, contributing to financial stability. Interchange fees, charged during card transactions between banks and merchants, impact transaction costs and profitability. Differentiating these helps banks improve pricing models and enhance customer value.

Comparison Table

| Aspect | Income Streaming | Interchange Fees |

|---|---|---|

| Definition | Recurring revenue from customer subscriptions or services | Fees charged to merchants per card transaction |

| Revenue Model | Stable, predictable cash flow | Variable, based on transaction volume and amount |

| Primary Source | Customer subscriptions, loan repayments, investment returns | Merchant payments during card purchases |

| Fee Structure | Fixed or tiered periodic payments | Percentage of transaction value plus fixed amount |

| Risk | Low risk due to recurring nature | Higher risk as revenue depends on transaction trends |

| Impact on Customers | Direct charges for ongoing services | Indirect costs absorbed by merchants, may affect prices |

| Examples | Wealth management fees, subscription banking products | Visa, Mastercard interchange rates |

Which is better?

Income streaming offers banks predictable revenue by generating consistent cash flows from diversified sources such as interest, fees, and investments, improving financial stability. Interchange fees provide substantial income through transaction processing but are subject to regulatory scrutiny and fluctuating transaction volumes. Evaluating the balance between stable, long-term income streaming and the variable nature of interchange fees is essential for optimizing a bank's profitability and risk management.

Connection

Income streaming in banking relies heavily on interchange fees, which generate consistent revenue when customers use debit or credit cards for transactions. These fees, charged to merchants, are shared between banks and card networks, creating a steady income source that supports financial services and operational costs. Optimizing interchange fee structures enhances banks' income streams by maximizing revenue from payment processing activities.

Key Terms

Transaction Processing

Interchange fees generate significant revenue for payment networks by charging merchants during transaction processing, forming a critical income stream that supports operational infrastructure. Income streaming in transaction processing encompasses various revenue sources, including authorization, clearing, and settlement fees, diversifying earnings beyond interchange. Explore the dynamics between interchange fees and income streaming to understand how transaction processors maximize profitability and optimize payment ecosystems.

Revenue Diversification

Interchange fees are charges paid by merchants to card issuers for processing credit and debit card transactions, representing a significant revenue source for financial institutions. Income streaming refers to the practice of creating diverse and recurring revenue channels, such as subscription services and value-added financial products, to reduce dependency on volatile interchange fees. Explore how businesses can strategically balance interchange fees with income streaming to achieve robust revenue diversification.

Merchant Discount Rate

The Merchant Discount Rate (MDR) represents the fee merchants pay to payment processors, encompassing interchange fees and other service charges. Interchange fees are the largest component of MDR, set by card networks and paid to issuing banks, directly impacting merchants' cost structure. Explore detailed insights on how MDR influences merchant profitability and payment ecosystem dynamics.

Source and External Links

Interchange Fees Explained: What They Are and How They Work - Interchange fees are charges paid by merchants to issuing banks, covering card issuance and transaction processing costs, varying by card type and transaction conditions.

Interchange Fees 101: What They Are and How They Work - This article explains interchange fees as transaction fees between banks for processing card payments, influenced by factors like card type and transaction type.

What are interchange fees and how are they calculated? - Interchange fees are transaction fees paid by merchants to cover card payments, calculated as a flat rate plus a percentage of the sales total, varying by card type and business industry.

dowidth.com

dowidth.com