Sustainable finance integrates environmental, social, and governance (ESG) criteria into banking practices to support long-term ecological and social well-being. Responsible lending focuses on ethical risk assessment and borrower capability to prevent financial distress and promote economic stability. Discover how these approaches reshape modern banking strategies for a resilient future.

Why it is important

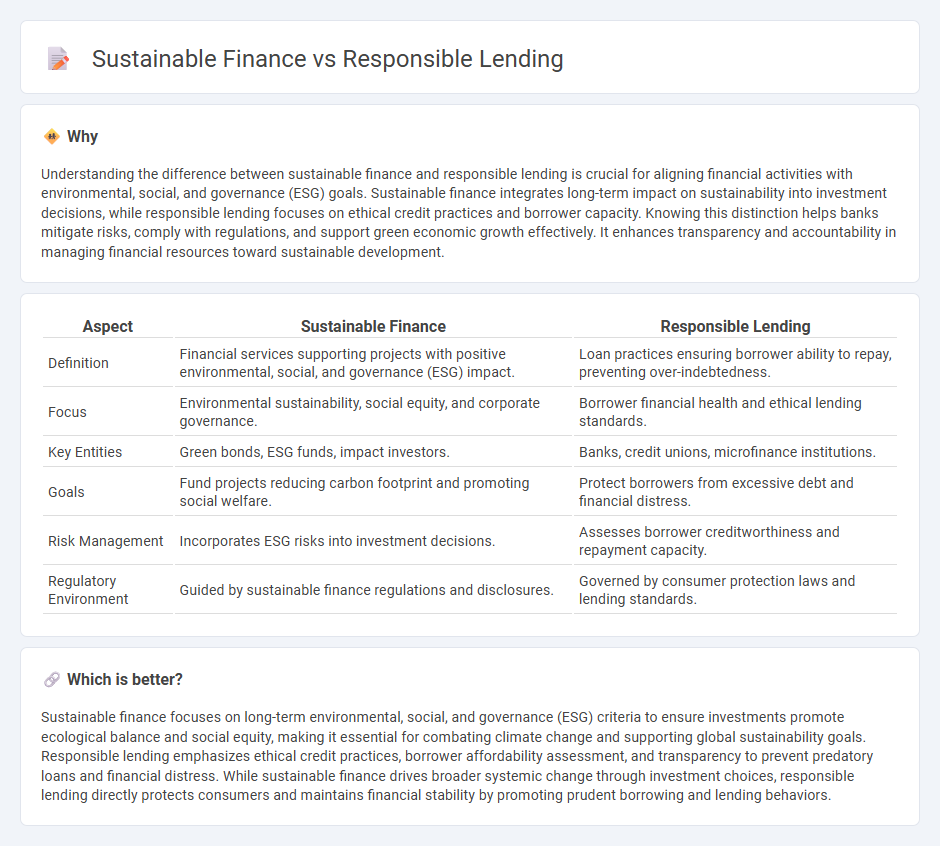

Understanding the difference between sustainable finance and responsible lending is crucial for aligning financial activities with environmental, social, and governance (ESG) goals. Sustainable finance integrates long-term impact on sustainability into investment decisions, while responsible lending focuses on ethical credit practices and borrower capacity. Knowing this distinction helps banks mitigate risks, comply with regulations, and support green economic growth effectively. It enhances transparency and accountability in managing financial resources toward sustainable development.

Comparison Table

| Aspect | Sustainable Finance | Responsible Lending |

|---|---|---|

| Definition | Financial services supporting projects with positive environmental, social, and governance (ESG) impact. | Loan practices ensuring borrower ability to repay, preventing over-indebtedness. |

| Focus | Environmental sustainability, social equity, and corporate governance. | Borrower financial health and ethical lending standards. |

| Key Entities | Green bonds, ESG funds, impact investors. | Banks, credit unions, microfinance institutions. |

| Goals | Fund projects reducing carbon footprint and promoting social welfare. | Protect borrowers from excessive debt and financial distress. |

| Risk Management | Incorporates ESG risks into investment decisions. | Assesses borrower creditworthiness and repayment capacity. |

| Regulatory Environment | Guided by sustainable finance regulations and disclosures. | Governed by consumer protection laws and lending standards. |

Which is better?

Sustainable finance focuses on long-term environmental, social, and governance (ESG) criteria to ensure investments promote ecological balance and social equity, making it essential for combating climate change and supporting global sustainability goals. Responsible lending emphasizes ethical credit practices, borrower affordability assessment, and transparency to prevent predatory loans and financial distress. While sustainable finance drives broader systemic change through investment choices, responsible lending directly protects consumers and maintains financial stability by promoting prudent borrowing and lending behaviors.

Connection

Sustainable finance integrates environmental, social, and governance (ESG) criteria into banking operations, promoting responsible lending practices that minimize negative societal and environmental impacts. Banks adhering to responsible lending assess borrowers' sustainability risks and support projects aligning with climate goals and ethical standards. This synergy drives long-term financial stability by fostering investments in sustainable development and reducing exposure to harmful practices.

Key Terms

Creditworthiness

Responsible lending emphasizes assessing borrower's creditworthiness to ensure loans are affordable and reduce default risk, promoting financial stability. Sustainable finance integrates environmental, social, and governance (ESG) factors alongside creditworthiness to support long-term economic, social, and environmental benefits. Explore further to understand how creditworthiness shapes both responsible lending and sustainable finance strategies.

Environmental, Social, and Governance (ESG)

Responsible lending emphasizes fair credit practices and borrower protection, ensuring loans do not lead to financial harm or exploitation. Sustainable finance integrates Environmental, Social, and Governance (ESG) criteria, prioritizing investments that support long-term ecological balance, social equity, and ethical governance. Explore how these frameworks shape the future of ethical financial services.

Risk Assessment

Responsible lending emphasizes thorough risk assessment to prevent borrower over-indebtedness and ensure creditworthiness, incorporating financial capacity and ethical considerations. Sustainable finance integrates environmental, social, and governance (ESG) criteria into risk assessment to mitigate long-term financial and societal risks. Explore comprehensive strategies to understand the evolving roles of risk assessment in both responsible lending and sustainable finance.

Source and External Links

Guide to Responsible Lending, Affordability & Vulnerability - This guide outlines the principles of responsible lending, highlighting the importance of affordability assessments and consumer protection in the financial industry.

A3-2-02, Responsible Lending Practices - This Fannie Mae guide details responsible lending practices for sellers/servicers, emphasizing the need for prudent business practices to avoid predatory lending.

Responsible lending - ASIC outlines the responsible lending obligations for credit licensees, focusing on ensuring credit contracts are suitable for consumers through thorough inquiries and assessments.

dowidth.com

dowidth.com