Open banking revolutionizes financial services by enabling secure data sharing between banks and third-party providers, fostering innovative, customer-centric solutions. Super apps integrate a wide range of services, including banking, payments, and lifestyle features, into a single platform for seamless user experience. Explore more about how open banking and super apps are transforming the future of financial technology.

Why it is important

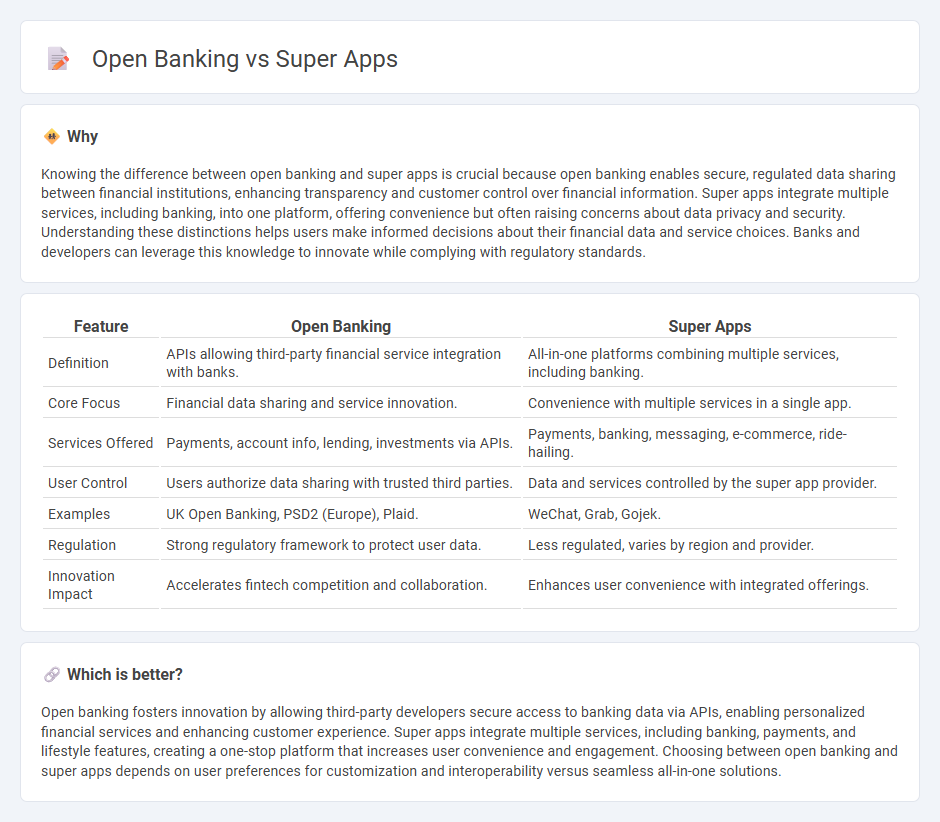

Knowing the difference between open banking and super apps is crucial because open banking enables secure, regulated data sharing between financial institutions, enhancing transparency and customer control over financial information. Super apps integrate multiple services, including banking, into one platform, offering convenience but often raising concerns about data privacy and security. Understanding these distinctions helps users make informed decisions about their financial data and service choices. Banks and developers can leverage this knowledge to innovate while complying with regulatory standards.

Comparison Table

| Feature | Open Banking | Super Apps |

|---|---|---|

| Definition | APIs allowing third-party financial service integration with banks. | All-in-one platforms combining multiple services, including banking. |

| Core Focus | Financial data sharing and service innovation. | Convenience with multiple services in a single app. |

| Services Offered | Payments, account info, lending, investments via APIs. | Payments, banking, messaging, e-commerce, ride-hailing. |

| User Control | Users authorize data sharing with trusted third parties. | Data and services controlled by the super app provider. |

| Examples | UK Open Banking, PSD2 (Europe), Plaid. | WeChat, Grab, Gojek. |

| Regulation | Strong regulatory framework to protect user data. | Less regulated, varies by region and provider. |

| Innovation Impact | Accelerates fintech competition and collaboration. | Enhances user convenience with integrated offerings. |

Which is better?

Open banking fosters innovation by allowing third-party developers secure access to banking data via APIs, enabling personalized financial services and enhancing customer experience. Super apps integrate multiple services, including banking, payments, and lifestyle features, creating a one-stop platform that increases user convenience and engagement. Choosing between open banking and super apps depends on user preferences for customization and interoperability versus seamless all-in-one solutions.

Connection

Open banking enables secure data sharing between financial institutions and third-party developers, allowing super apps to integrate diverse banking services within a single platform. Super apps leverage open banking APIs to offer seamless payment processing, account management, and personalized financial products directly to users. This interconnected ecosystem enhances customer experience by simplifying access to multiple banking functionalities and driving innovation in digital financial services.

Key Terms

Ecosystem Integration

Super apps consolidate diverse services like payments, messaging, and e-commerce into a unified platform, creating a seamless user experience through deep ecosystem integration. Open banking enables secure data sharing between financial institutions and third-party providers via APIs, fostering innovation and personalized financial services within an open ecosystem. Explore how these approaches transform digital financial landscapes by integrating ecosystems to enhance consumer engagement and service efficiency.

API Architecture

Super apps leverage centralized API architectures to integrate multiple services within a single platform, enhancing user experience and data interoperability. Open banking relies on standardized, secure API frameworks such as PSD2 to enable seamless third-party access to financial data while maintaining regulatory compliance and consumer protection. Explore more about how API architecture shapes the future of financial ecosystems through super apps and open banking innovations.

Customer Data Control

Super apps consolidate multiple services within a single platform, enabling seamless user experiences but often limiting customers' control over their personal data. Open banking frameworks empower consumers by granting direct access and control over their financial information through secure APIs, fostering transparency and innovation. Explore how these models impact data privacy and customer empowerment by learning more about their implications.

Source and External Links

What Is a Super App? - This webpage explains the concept of a super app, providing examples such as WeChat and Alipay, which offer a wide range of integrated services.

15 Most Popular Super Apps in the World - This article lists popular super apps globally, including WeChat, Alipay, Grab, and Gojek, highlighting their diverse features.

Top 10 Super Apps - This article explores top super apps like Rappi, discussing their impact on user experience and future trends in the app industry.

dowidth.com

dowidth.com