Debt recycling involves using investment loans to replace non-deductible debt with tax-deductible debt, optimizing financial growth and tax benefits. Variable-rate mortgages have interest rates that fluctuate based on market conditions, affecting repayment amounts and financial planning. Explore the differences between debt recycling and variable-rate mortgages to enhance your banking strategy.

Why it is important

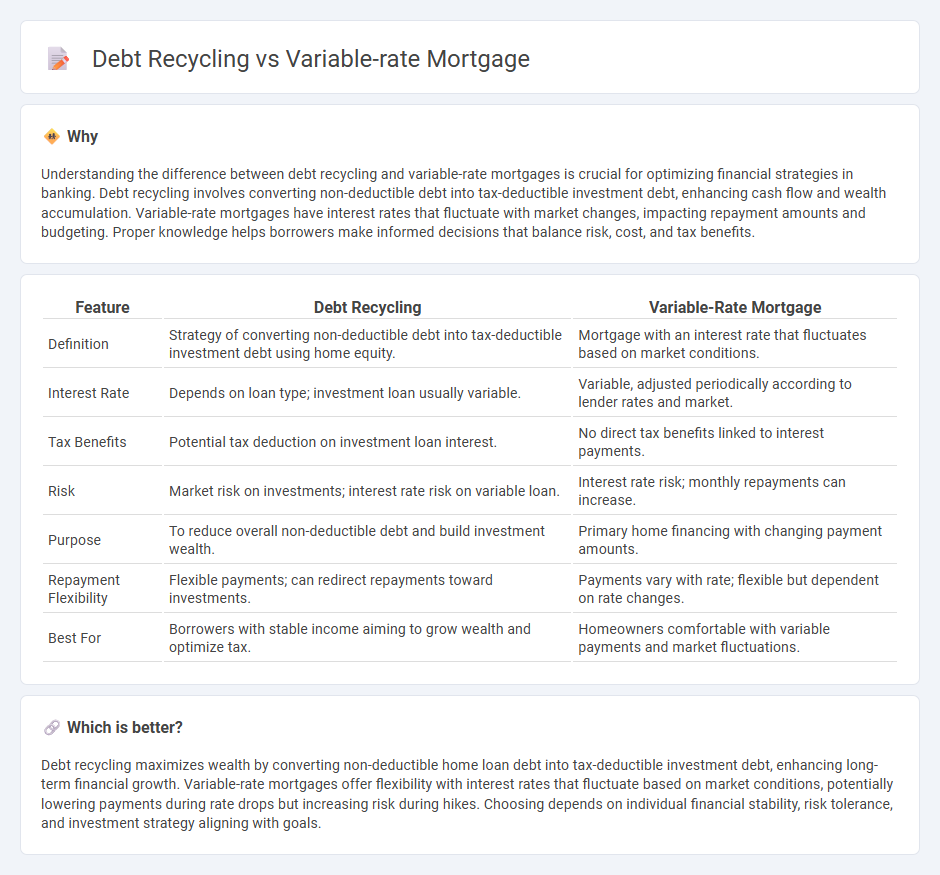

Understanding the difference between debt recycling and variable-rate mortgages is crucial for optimizing financial strategies in banking. Debt recycling involves converting non-deductible debt into tax-deductible investment debt, enhancing cash flow and wealth accumulation. Variable-rate mortgages have interest rates that fluctuate with market changes, impacting repayment amounts and budgeting. Proper knowledge helps borrowers make informed decisions that balance risk, cost, and tax benefits.

Comparison Table

| Feature | Debt Recycling | Variable-Rate Mortgage |

|---|---|---|

| Definition | Strategy of converting non-deductible debt into tax-deductible investment debt using home equity. | Mortgage with an interest rate that fluctuates based on market conditions. |

| Interest Rate | Depends on loan type; investment loan usually variable. | Variable, adjusted periodically according to lender rates and market. |

| Tax Benefits | Potential tax deduction on investment loan interest. | No direct tax benefits linked to interest payments. |

| Risk | Market risk on investments; interest rate risk on variable loan. | Interest rate risk; monthly repayments can increase. |

| Purpose | To reduce overall non-deductible debt and build investment wealth. | Primary home financing with changing payment amounts. |

| Repayment Flexibility | Flexible payments; can redirect repayments toward investments. | Payments vary with rate; flexible but dependent on rate changes. |

| Best For | Borrowers with stable income aiming to grow wealth and optimize tax. | Homeowners comfortable with variable payments and market fluctuations. |

Which is better?

Debt recycling maximizes wealth by converting non-deductible home loan debt into tax-deductible investment debt, enhancing long-term financial growth. Variable-rate mortgages offer flexibility with interest rates that fluctuate based on market conditions, potentially lowering payments during rate drops but increasing risk during hikes. Choosing depends on individual financial stability, risk tolerance, and investment strategy aligning with goals.

Connection

Debt recycling is a financial strategy that leverages a variable-rate mortgage to convert non-deductible debt into tax-deductible investment loans, improving cash flow and wealth accumulation. Variable-rate mortgages, with their fluctuating interest rates, influence the cost-effectiveness and risk level of debt recycling by affecting repayment amounts and investment returns. Understanding interest rate trends and tax implications is crucial for optimizing debt recycling through a variable-rate mortgage.

Key Terms

Interest Rate Fluctuation

Variable-rate mortgages have interest rates that fluctuate with market conditions, impacting monthly payments and overall loan costs. Debt recycling involves repurposing loan funds for investment while managing interest expenses, with variable rates potentially increasing financial risk during rate hikes. Explore deeper insights on managing interest rate fluctuations in these strategies for optimized financial planning.

Equity Leverage

Variable-rate mortgages offer flexibility with interest rates that adjust based on the market, allowing homeowners to capitalize on lower rates and potentially reduce borrowing costs. Debt recycling leverages home equity by converting non-deductible debt into tax-deductible investment debt, amplifying wealth accumulation through strategic equity leverage. Discover how these financial strategies can optimize your property investment goals by exploring their equity leverage benefits in detail.

Investment Strategy

Variable-rate mortgages provide flexibility by adjusting interest rates based on market trends, potentially lowering monthly payments and freeing up cash flow for investments. Debt recycling involves using home equity to invest, strategically converting non-deductible debt into tax-deductible investment debt, enhancing long-term wealth growth. Explore more strategies to effectively leverage these options for maximizing your investment portfolio.

Source and External Links

Understanding mortgages and interest rates | MoneyHelper - A variable-rate mortgage is one where the interest you pay each month can fluctuate, usually in line with the Bank of England base rate, causing your monthly payments to go up or down accordingly; types include tracker, standard variable, and discounted variable mortgages.

Adjustable-rate mortgage - Wikipedia - Also called adjustable-rate or tracker mortgages, these loans have interest rates periodically adjusted based on a financial index, often with an initial fixed-rate period followed by fluctuating rates, and are common in places like Singapore where rates link to benchmarks like SIBOR or SOR.

Adjustable-Rate Mortgage Loans (ARMs) from Bank of America - ARMs, or variable-rate mortgages, feature interest rates that change periodically according to a financial index, causing monthly payments to increase or decrease, with the initial fixed-rate period and adjustment frequency defined by the loan terms (e.g., 5 years fixed, then adjustments every 6 months).

dowidth.com

dowidth.com