Neo banking offers fully digital banking services through licensed entities without traditional physical branches, providing enhanced user experience and innovative financial products. Mobile-only banking, a subset of neo banking, operates exclusively via smartphone apps designed for on-the-go account management and transactions. Explore the distinctions between these digital banking models to optimize your financial choices.

Why it is important

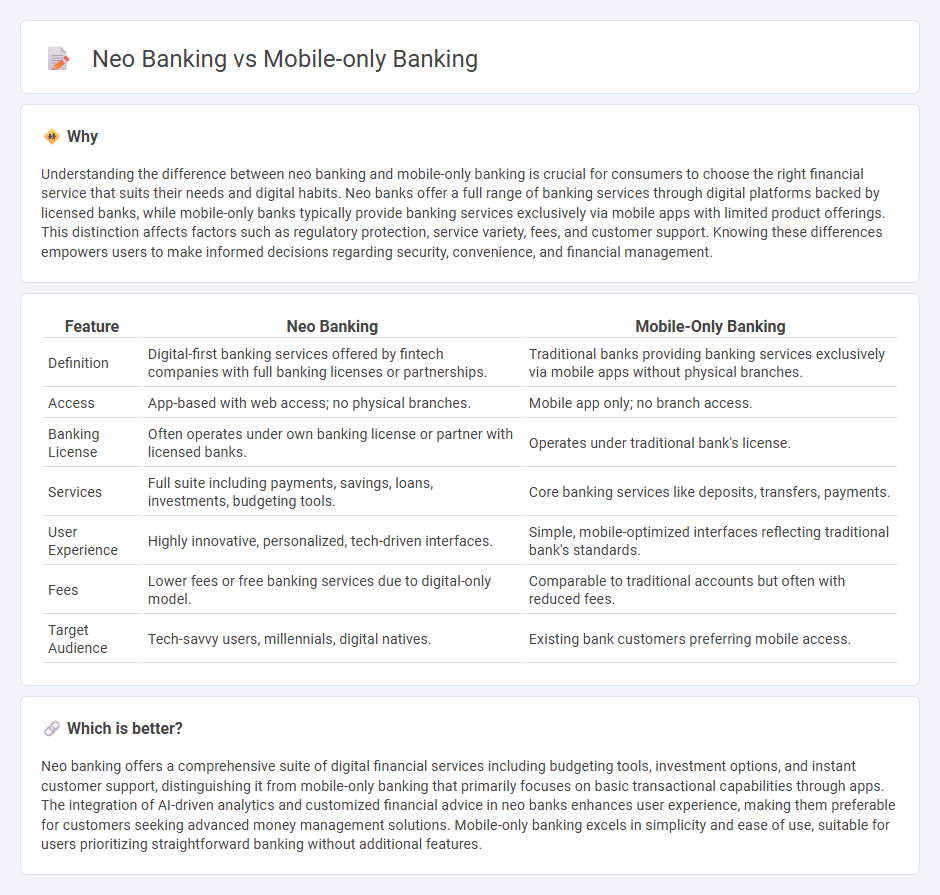

Understanding the difference between neo banking and mobile-only banking is crucial for consumers to choose the right financial service that suits their needs and digital habits. Neo banks offer a full range of banking services through digital platforms backed by licensed banks, while mobile-only banks typically provide banking services exclusively via mobile apps with limited product offerings. This distinction affects factors such as regulatory protection, service variety, fees, and customer support. Knowing these differences empowers users to make informed decisions regarding security, convenience, and financial management.

Comparison Table

| Feature | Neo Banking | Mobile-Only Banking |

|---|---|---|

| Definition | Digital-first banking services offered by fintech companies with full banking licenses or partnerships. | Traditional banks providing banking services exclusively via mobile apps without physical branches. |

| Access | App-based with web access; no physical branches. | Mobile app only; no branch access. |

| Banking License | Often operates under own banking license or partner with licensed banks. | Operates under traditional bank's license. |

| Services | Full suite including payments, savings, loans, investments, budgeting tools. | Core banking services like deposits, transfers, payments. |

| User Experience | Highly innovative, personalized, tech-driven interfaces. | Simple, mobile-optimized interfaces reflecting traditional bank's standards. |

| Fees | Lower fees or free banking services due to digital-only model. | Comparable to traditional accounts but often with reduced fees. |

| Target Audience | Tech-savvy users, millennials, digital natives. | Existing bank customers preferring mobile access. |

Which is better?

Neo banking offers a comprehensive suite of digital financial services including budgeting tools, investment options, and instant customer support, distinguishing it from mobile-only banking that primarily focuses on basic transactional capabilities through apps. The integration of AI-driven analytics and customized financial advice in neo banks enhances user experience, making them preferable for customers seeking advanced money management solutions. Mobile-only banking excels in simplicity and ease of use, suitable for users prioritizing straightforward banking without additional features.

Connection

Neo banking and mobile-only banking are interconnected through their reliance on digital platforms that eliminate the need for traditional physical branches, providing seamless financial services via smartphones. Both leverage advanced technologies such as APIs, cloud computing, and biometric security to offer enhanced user experiences, real-time transactions, and personalized financial management. This convergence drives innovation in banking by increasing accessibility, reducing operational costs, and expanding financial inclusion for underbanked populations.

Key Terms

Digital-Only Accounts

Mobile-only banking offers traditional banks' services via smartphone apps, emphasizing convenience and accessibility for everyday transactions. Neo banking, powered by fintech startups, provides fully digital-only accounts with advanced features like real-time analytics, budgeting tools, and lower fees. Explore the key differences and benefits of digital-only accounts to choose the best banking solution for your financial needs.

Fintech Platforms

Mobile-only banking offers traditional banking services exclusively through smartphone apps, prioritizing ease of access and basic financial management. Neo banking platforms leverage advanced fintech innovations, providing a broader range of digital-first services such as real-time analytics, budgeting tools, and seamless integration with other financial apps. Explore the evolving landscape of mobile-only banking and neo banking for a deeper understanding of fintech platforms' impact on modern finance.

Banking Licenses

Mobile-only banks operate under traditional banking licenses, allowing them to offer a full range of deposit and lending services regulated by central banks. Neo banks often function without direct banking licenses, partnering with licensed banks to provide financial services through digital platforms. Explore the key differences in banking licenses to understand the regulatory impact on service offerings.

Source and External Links

The Pros and Cons of Switching to a Mobile-Only Bank - Mobile-only banks let you open accounts, deposit checks, transfer money, and manage finances entirely through a smartphone app, often with lower fees but limited branch access.

Fast and Easy Online & Mobile Banking | SouthState Bank - SouthState Bank's mobile app offers mobile check deposits, real-time alerts, expense tracking, bill pay, transfers, and the ability to link all your accounts--even those from other institutions.

Online & Mobile Banking - PNC Bank - PNC's mobile banking provides free account access, bill payment, fund transfers, mobile deposits, real-time alerts, and tools to help avoid overdrafts with features like Low Cash Mode(r).

dowidth.com

dowidth.com