Cloud core banking leverages cloud computing infrastructure to deliver scalable, flexible, and cost-effective banking solutions with real-time data access and enhanced security. Digital core banking integrates advanced digital technologies such as AI, machine learning, and APIs to streamline operations, personalize customer experiences, and accelerate innovation within financial institutions. Discover how these transformative banking models redefine efficiency and customer engagement in the modern financial landscape.

Why it is important

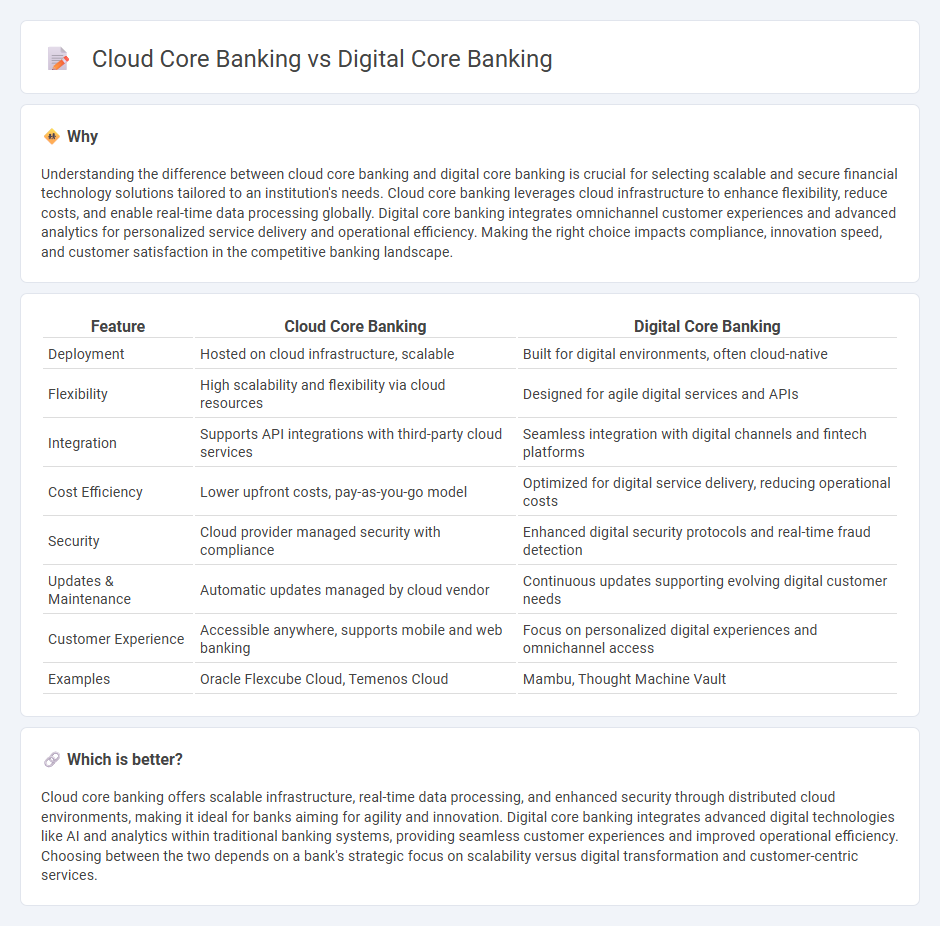

Understanding the difference between cloud core banking and digital core banking is crucial for selecting scalable and secure financial technology solutions tailored to an institution's needs. Cloud core banking leverages cloud infrastructure to enhance flexibility, reduce costs, and enable real-time data processing globally. Digital core banking integrates omnichannel customer experiences and advanced analytics for personalized service delivery and operational efficiency. Making the right choice impacts compliance, innovation speed, and customer satisfaction in the competitive banking landscape.

Comparison Table

| Feature | Cloud Core Banking | Digital Core Banking |

|---|---|---|

| Deployment | Hosted on cloud infrastructure, scalable | Built for digital environments, often cloud-native |

| Flexibility | High scalability and flexibility via cloud resources | Designed for agile digital services and APIs |

| Integration | Supports API integrations with third-party cloud services | Seamless integration with digital channels and fintech platforms |

| Cost Efficiency | Lower upfront costs, pay-as-you-go model | Optimized for digital service delivery, reducing operational costs |

| Security | Cloud provider managed security with compliance | Enhanced digital security protocols and real-time fraud detection |

| Updates & Maintenance | Automatic updates managed by cloud vendor | Continuous updates supporting evolving digital customer needs |

| Customer Experience | Accessible anywhere, supports mobile and web banking | Focus on personalized digital experiences and omnichannel access |

| Examples | Oracle Flexcube Cloud, Temenos Cloud | Mambu, Thought Machine Vault |

Which is better?

Cloud core banking offers scalable infrastructure, real-time data processing, and enhanced security through distributed cloud environments, making it ideal for banks aiming for agility and innovation. Digital core banking integrates advanced digital technologies like AI and analytics within traditional banking systems, providing seamless customer experiences and improved operational efficiency. Choosing between the two depends on a bank's strategic focus on scalability versus digital transformation and customer-centric services.

Connection

Cloud core banking and digital core banking are interconnected through their focus on leveraging cloud computing technologies to enhance banking operations, scalability, and customer experience. Cloud core banking platforms enable digital core banking systems by providing flexible, secure, and cost-effective infrastructure for real-time data processing, seamless integration of financial services, and robust API ecosystems. This integration supports banks in delivering personalized digital services, accelerating innovation, and optimizing operational efficiency across channels.

Key Terms

**Digital Core Banking:**

Digital Core Banking integrates essential banking functions into a centralized, software-driven platform, enabling efficient transaction processing, customer management, and real-time data analytics. It emphasizes on-premises infrastructure or private cloud setups, offering robust security and compliance tailored to regulatory requirements. Explore the advantages of Digital Core Banking solutions to enhance operational agility and customer experience.

API Integration

Digital core banking platforms prioritize API integration to enable seamless connectivity with fintech applications, third-party services, and legacy systems, facilitating enhanced customer experiences and operational efficiency. Cloud core banking further elevates this capability by offering scalable, flexible, and secure API ecosystems that streamline real-time data exchange and accelerate innovation through microservices architecture. Explore how API integration differentiates digital and cloud core banking solutions to transform your financial institution's technology strategy.

Real-time Processing

Real-time processing in digital core banking enables instant transaction updates and improved customer experiences through on-premise or hybrid infrastructure. Cloud core banking offers scalable, cloud-based platforms that enhance real-time data synchronization, minimize latency, and support agile service deployment. Discover how real-time processing differences impact efficiency and innovation in core banking systems.

Source and External Links

What is Core Banking? - IBM - Core banking is a centralized system that connects multiple bank branches to process real-time transactions and digital banking services, enhancing operational efficiency, customer experience, security, and regulatory compliance.

SBP Digital Core | SBS | Banking & Financing Platforms - SBP Digital Core is a modular, cloud-native, API-driven core banking solution delivered as SaaS, designed to provide personalized, flexible, and scalable digital banking experiences globally with strong compliance and support.

Digital Core Banking For Fintechs Explained | Advapay - Digital core banking is a back-end system powering fintechs and digital banks by automating banking operations such as customer onboarding, account management, payments, and reporting, reducing costs and extending digital reach.

dowidth.com

dowidth.com