Alternative data lending leverages unconventional data sources such as utility payments, rental history, and social media activity to assess creditworthiness beyond traditional credit scores. Behavioral analytics examines patterns in customer behavior, including spending habits and transaction frequency, to predict repayment risks and personalize financial products. Discover how these innovative approaches are transforming credit evaluation and enhancing risk management in modern banking.

Why it is important

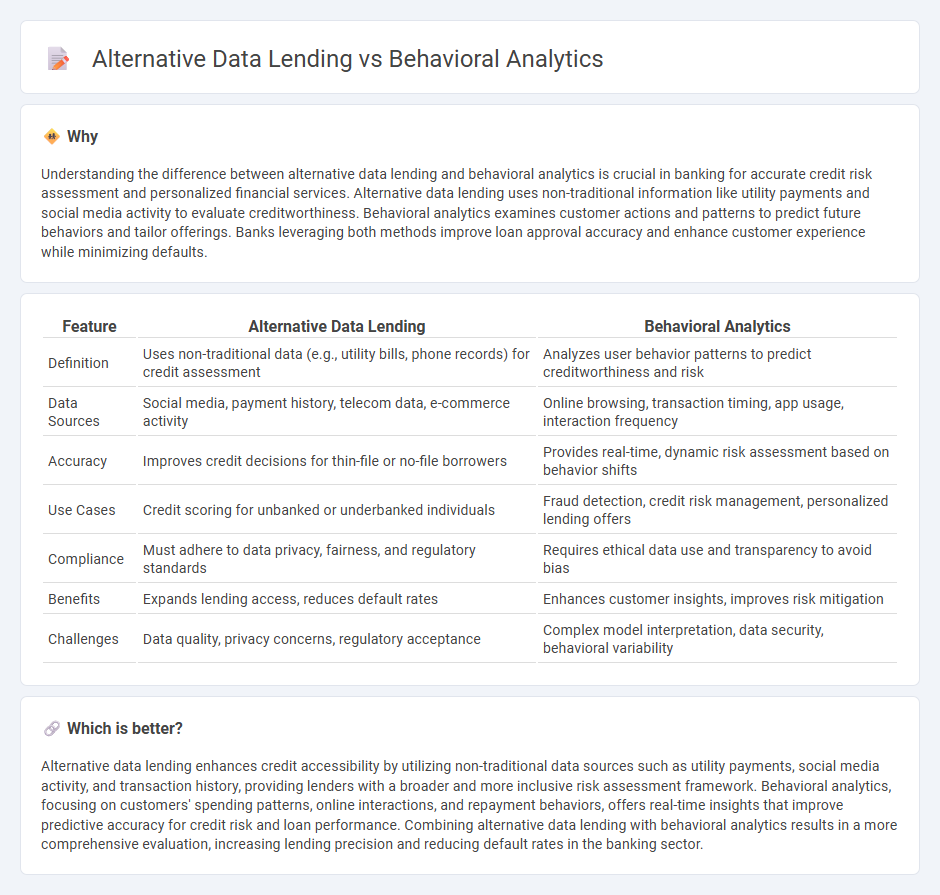

Understanding the difference between alternative data lending and behavioral analytics is crucial in banking for accurate credit risk assessment and personalized financial services. Alternative data lending uses non-traditional information like utility payments and social media activity to evaluate creditworthiness. Behavioral analytics examines customer actions and patterns to predict future behaviors and tailor offerings. Banks leveraging both methods improve loan approval accuracy and enhance customer experience while minimizing defaults.

Comparison Table

| Feature | Alternative Data Lending | Behavioral Analytics |

|---|---|---|

| Definition | Uses non-traditional data (e.g., utility bills, phone records) for credit assessment | Analyzes user behavior patterns to predict creditworthiness and risk |

| Data Sources | Social media, payment history, telecom data, e-commerce activity | Online browsing, transaction timing, app usage, interaction frequency |

| Accuracy | Improves credit decisions for thin-file or no-file borrowers | Provides real-time, dynamic risk assessment based on behavior shifts |

| Use Cases | Credit scoring for unbanked or underbanked individuals | Fraud detection, credit risk management, personalized lending offers |

| Compliance | Must adhere to data privacy, fairness, and regulatory standards | Requires ethical data use and transparency to avoid bias |

| Benefits | Expands lending access, reduces default rates | Enhances customer insights, improves risk mitigation |

| Challenges | Data quality, privacy concerns, regulatory acceptance | Complex model interpretation, data security, behavioral variability |

Which is better?

Alternative data lending enhances credit accessibility by utilizing non-traditional data sources such as utility payments, social media activity, and transaction history, providing lenders with a broader and more inclusive risk assessment framework. Behavioral analytics, focusing on customers' spending patterns, online interactions, and repayment behaviors, offers real-time insights that improve predictive accuracy for credit risk and loan performance. Combining alternative data lending with behavioral analytics results in a more comprehensive evaluation, increasing lending precision and reducing default rates in the banking sector.

Connection

Alternative data lending leverages non-traditional information sources such as utility payments, social media activity, and online behavior to assess creditworthiness beyond standard financial metrics. Behavioral analytics examines patterns in customer actions, enabling lenders to identify risk profiles and predict repayment likelihood more accurately. Combining these approaches enhances credit decision models, broadening financial inclusion while minimizing default rates in banking.

Key Terms

**Behavioral Analytics:**

Behavioral analytics leverages customer interaction data such as transaction history, online activity, and spending patterns to assess creditworthiness more accurately than traditional credit scores. This approach enhances risk management by identifying nuanced behavioral signals indicative of repayment likelihood, reducing default rates in lending portfolios. Explore in-depth methodologies and case studies to understand how behavioral analytics revolutionizes credit lending.

Transaction Patterns

Behavioral analytics leverages transaction patterns to assess borrower creditworthiness by analyzing spending habits, payment timeliness, and cash flow consistency, providing a dynamic risk profile beyond traditional credit scores. Alternative data lending incorporates diverse transaction data sources, including micropayments, utility bills, and social media activity, to supplement debit and credit history for a more inclusive evaluation. Explore deeper insights into how these methodologies transform credit risk assessment and lending strategies.

Customer Segmentation

Behavioral analytics in lending harnesses real-time data about borrower actions, such as transaction patterns and digital footprints, to create precise customer segments, enhancing credit risk assessment. Alternative data lending incorporates non-traditional data sources like utility payments, social media activity, and mobile phone records to identify creditworthy individuals often overlooked by traditional models. Explore these innovative approaches to customer segmentation for smarter lending decisions and improved credit access.

Source and External Links

What is Behavioral Analytics? - Behavioral analytics is the study and analysis of customer actions and interactions with digital products and services to uncover patterns and trends, enabling businesses to improve engagement, retention, and conversions through data-driven insights.

The Role of Behavioral Analytics in Cybersecurity - In cybersecurity, behavioral analytics uses AI and machine learning to detect unusual patterns in user and entity activities, helping organizations identify potential threats and insider risks by analyzing deviations from normal behavior.

What is Behavior Analytics? Definition, Examples & Tools - Behavioral analytics is a business intelligence method that collects and analyzes user data from digital platforms to understand interactions, optimize user experiences, and support better decision-making through tools like session replays and heatmaps.

dowidth.com

dowidth.com