Banking as a Service (BaaS) provides traditional financial institutions and fintech companies with APIs to integrate banking services directly into their platforms, enabling seamless and customizable banking experiences. Neobanking refers to fully digital banks without physical branches that deliver user-centric financial services primarily through mobile apps. Discover how these innovative models reshape the future of finance and customer engagement.

Why it is important

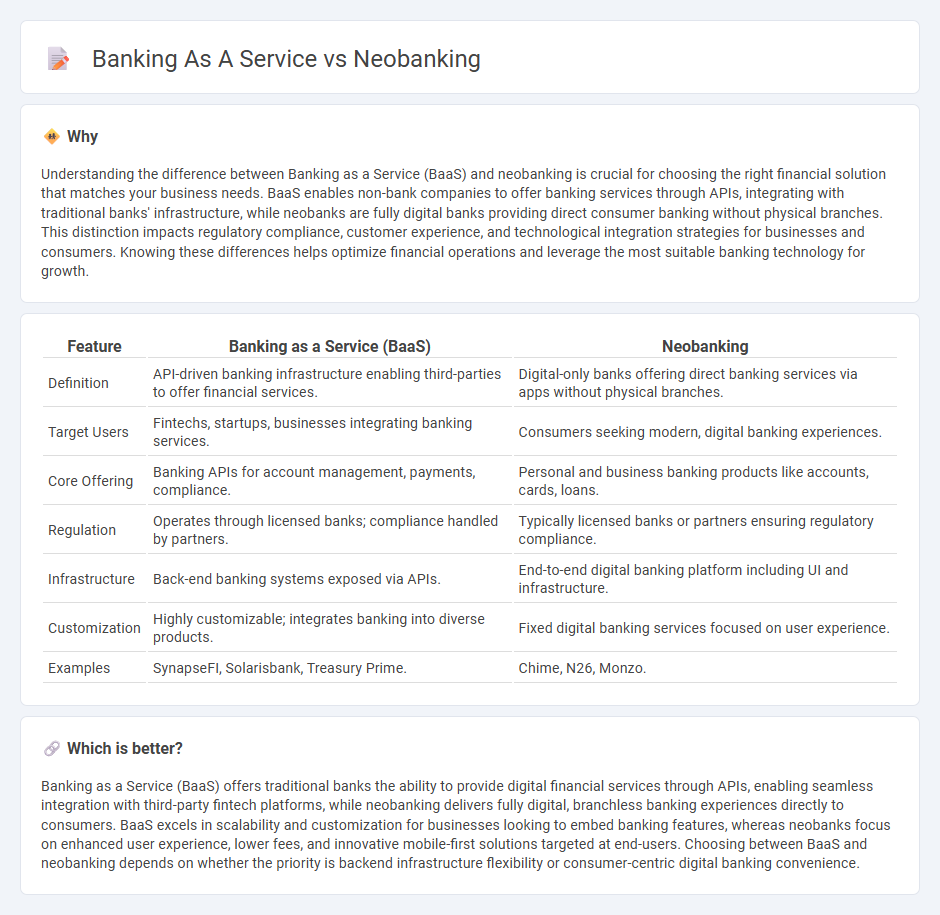

Understanding the difference between Banking as a Service (BaaS) and neobanking is crucial for choosing the right financial solution that matches your business needs. BaaS enables non-bank companies to offer banking services through APIs, integrating with traditional banks' infrastructure, while neobanks are fully digital banks providing direct consumer banking without physical branches. This distinction impacts regulatory compliance, customer experience, and technological integration strategies for businesses and consumers. Knowing these differences helps optimize financial operations and leverage the most suitable banking technology for growth.

Comparison Table

| Feature | Banking as a Service (BaaS) | Neobanking |

|---|---|---|

| Definition | API-driven banking infrastructure enabling third-parties to offer financial services. | Digital-only banks offering direct banking services via apps without physical branches. |

| Target Users | Fintechs, startups, businesses integrating banking services. | Consumers seeking modern, digital banking experiences. |

| Core Offering | Banking APIs for account management, payments, compliance. | Personal and business banking products like accounts, cards, loans. |

| Regulation | Operates through licensed banks; compliance handled by partners. | Typically licensed banks or partners ensuring regulatory compliance. |

| Infrastructure | Back-end banking systems exposed via APIs. | End-to-end digital banking platform including UI and infrastructure. |

| Customization | Highly customizable; integrates banking into diverse products. | Fixed digital banking services focused on user experience. |

| Examples | SynapseFI, Solarisbank, Treasury Prime. | Chime, N26, Monzo. |

Which is better?

Banking as a Service (BaaS) offers traditional banks the ability to provide digital financial services through APIs, enabling seamless integration with third-party fintech platforms, while neobanking delivers fully digital, branchless banking experiences directly to consumers. BaaS excels in scalability and customization for businesses looking to embed banking features, whereas neobanks focus on enhanced user experience, lower fees, and innovative mobile-first solutions targeted at end-users. Choosing between BaaS and neobanking depends on whether the priority is backend infrastructure flexibility or consumer-centric digital banking convenience.

Connection

Banking as a Service (BaaS) provides the digital infrastructure and APIs that enable neobanks to offer seamless, fully-digital financial services without traditional banking licenses. Neobanks leverage BaaS platforms to integrate core banking functionalities such as account management, payments, and compliance, accelerating product launch and scalability. This symbiotic relationship allows neobanks to focus on customer experience and innovation while relying on BaaS for backend operations and regulatory adherence.

Key Terms

Digital-Only Platform (Neobanking)

Digital-only platforms like neobanks leverage cloud-based infrastructure to offer streamlined, user-friendly banking services without physical branches, focusing on mobile-first experiences and real-time transaction processing. Banking as a Service (BaaS) enables fintech firms to integrate licensed banking functions via APIs, allowing traditional banks to extend their reach through third-party digital platforms. Explore the evolving landscape of digital financial services to understand how neobanking and BaaS reshape customer engagement and banking innovation.

API Integration (Banking as a Service)

Neobanking offers direct-to-consumer digital banking services often built on proprietary platforms, while Banking as a Service (BaaS) leverages API integration to enable third-party providers to offer banking products seamlessly within their own apps. BaaS platforms prioritize robust API frameworks that facilitate real-time data exchange, compliance, and scalability, empowering businesses to customize financial solutions without traditional banking infrastructure. Explore the benefits of API-driven Banking as a Service to revolutionize your digital financial offerings.

Licensed Banking Partner

Licensed banking partners play a crucial role in both neobanking and banking as a service (BaaS), providing the regulatory oversight and infrastructure that enable seamless financial operations. Neobanks rely on these partners to offer FDIC insurance and compliance with banking laws, while BaaS platforms use licensed banks to embed financial services into third-party products. Explore deeper insights on how Licensed Banking Partners shape the future of digital finance ecosystems.

Source and External Links

What are neobanks, and how do they work? | Stripe - Neobanks are digital-only banks that provide services like savings and checking accounts, loans, and payments via mobile apps and websites, typically with lower fees and higher interest rates since they don't operate physical branches.

What Is Neobanking and How Does It Work? - SoFi - Neobanks are fintech companies that offer digital-first banking services--such as checking and savings accounts--without their own bank licenses, instead partnering with traditional banks to provide these products.

What is a Neobank? How It Works, Examples, Pros & Cons - Statrys - Neobanks are fintechs operating exclusively online (no physical branches) and often focus on specific products and customer segments, such as startups, freelancers, or digital nomads, but may not possess full banking licenses.

dowidth.com

dowidth.com