Alternative credit data offers a broader perspective on an individual's creditworthiness by incorporating non-traditional financial behaviors such as rent, telecommunications, and utility payment histories. Utility payment history, a key component of alternative data, provides valuable insights into consistent payment patterns, especially for those with limited or no traditional credit records. Explore how leveraging these data sources can enhance credit assessments and financial inclusivity.

Why it is important

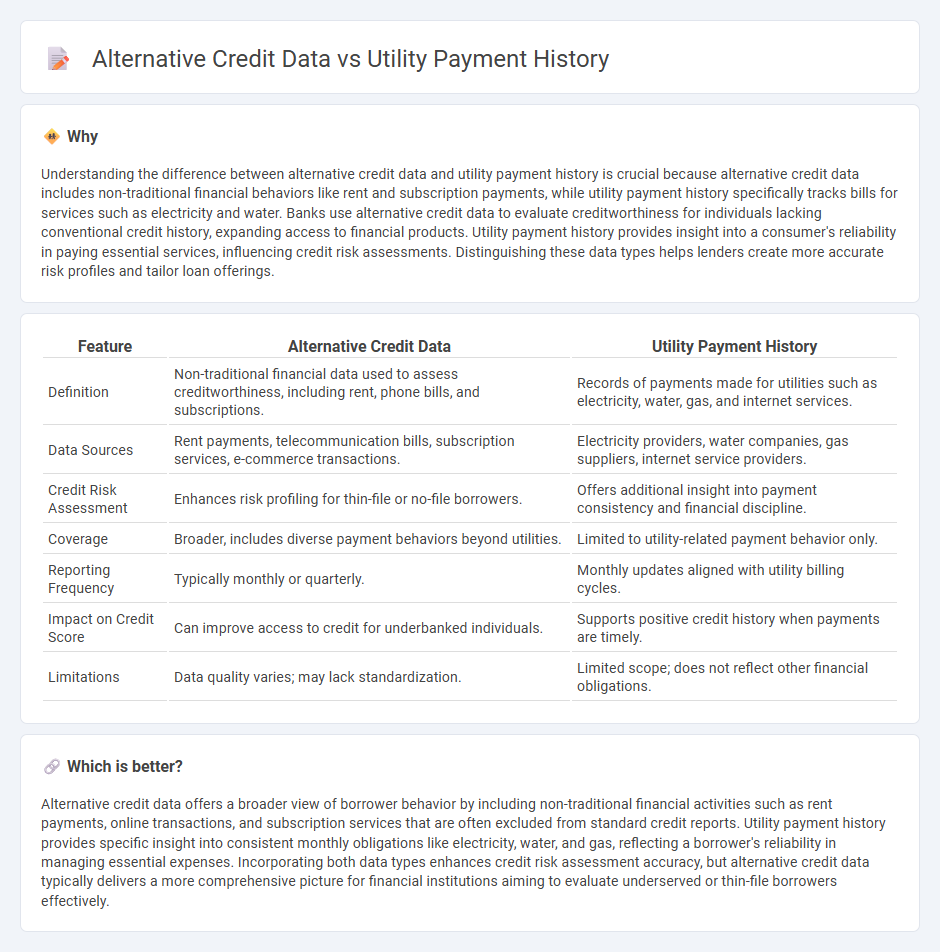

Understanding the difference between alternative credit data and utility payment history is crucial because alternative credit data includes non-traditional financial behaviors like rent and subscription payments, while utility payment history specifically tracks bills for services such as electricity and water. Banks use alternative credit data to evaluate creditworthiness for individuals lacking conventional credit history, expanding access to financial products. Utility payment history provides insight into a consumer's reliability in paying essential services, influencing credit risk assessments. Distinguishing these data types helps lenders create more accurate risk profiles and tailor loan offerings.

Comparison Table

| Feature | Alternative Credit Data | Utility Payment History |

|---|---|---|

| Definition | Non-traditional financial data used to assess creditworthiness, including rent, phone bills, and subscriptions. | Records of payments made for utilities such as electricity, water, gas, and internet services. |

| Data Sources | Rent payments, telecommunication bills, subscription services, e-commerce transactions. | Electricity providers, water companies, gas suppliers, internet service providers. |

| Credit Risk Assessment | Enhances risk profiling for thin-file or no-file borrowers. | Offers additional insight into payment consistency and financial discipline. |

| Coverage | Broader, includes diverse payment behaviors beyond utilities. | Limited to utility-related payment behavior only. |

| Reporting Frequency | Typically monthly or quarterly. | Monthly updates aligned with utility billing cycles. |

| Impact on Credit Score | Can improve access to credit for underbanked individuals. | Supports positive credit history when payments are timely. |

| Limitations | Data quality varies; may lack standardization. | Limited scope; does not reflect other financial obligations. |

Which is better?

Alternative credit data offers a broader view of borrower behavior by including non-traditional financial activities such as rent payments, online transactions, and subscription services that are often excluded from standard credit reports. Utility payment history provides specific insight into consistent monthly obligations like electricity, water, and gas, reflecting a borrower's reliability in managing essential expenses. Incorporating both data types enhances credit risk assessment accuracy, but alternative credit data typically delivers a more comprehensive picture for financial institutions aiming to evaluate underserved or thin-file borrowers effectively.

Connection

Alternative credit data, including utility payment history, plays a crucial role in enhancing credit risk assessments for banks by providing a more comprehensive view of a borrower's financial behavior. Utility payments, such as electricity and water bills, offer consistent and timely payment records that traditional credit scores might overlook, especially for thin-file or credit-invisible consumers. Incorporating this data enables financial institutions to extend credit access to underserved populations while reducing default risk through improved predictive analytics.

Key Terms

Utility payment history

Utility payment history provides a reliable indicator of an individual's financial responsibility by tracking consistent on-time payments for essential services like electricity, water, and gas. This data is frequently used by lenders and credit bureaus to enhance credit scoring models, especially for consumers with limited traditional credit history. Explore how utility payment history can improve your credit profile and access to financial opportunities.

Alternative credit data

Alternative credit data encompasses non-traditional financial information such as utility payments, rent, phone bills, and subscription services. This data offers a broader view of creditworthiness for individuals lacking traditional credit history, improving access to loans and credit. Explore how alternative credit data can enhance your financial profile and lending opportunities.

Credit scoring

Utility payment history plays a crucial role in credit scoring by providing traditional lenders with verified information about a borrower's reliability in paying essential bills on time, which can enhance creditworthiness assessments. Alternative credit data, including rent payments, mobile phone bills, and subscription services, contribute additional diverse insights that may boost scores for individuals lacking extensive credit history. Explore how integrating both data types can improve credit scoring models and increase access to credit.

Source and External Links

Finance Department Resources - Riviera Beach, Florida (FL) - Utility customers may access their utility account information, billing and payment history, and service and consumption summaries and graphs at any time.

Click2Gov Utility Billing - Citizens can review payment history, pending payments, and account status online for up-to-date utility account views.

Utility Billing & Accounts | City of Port St. Lucie, FL - Registered customers can log in to review invoice history and payment history, as well as schedule automatic payments.

dowidth.com

dowidth.com