Wealthtech integrates advanced technology with financial services to enhance wealth management through AI-driven investment strategies and personalized financial planning. Tradetech focuses on optimizing trade finance and supply chain processes using blockchain, automation, and real-time data analytics to reduce risk and increase efficiency. Explore the evolving landscape of financial technology to understand how these innovations transform banking operations.

Why it is important

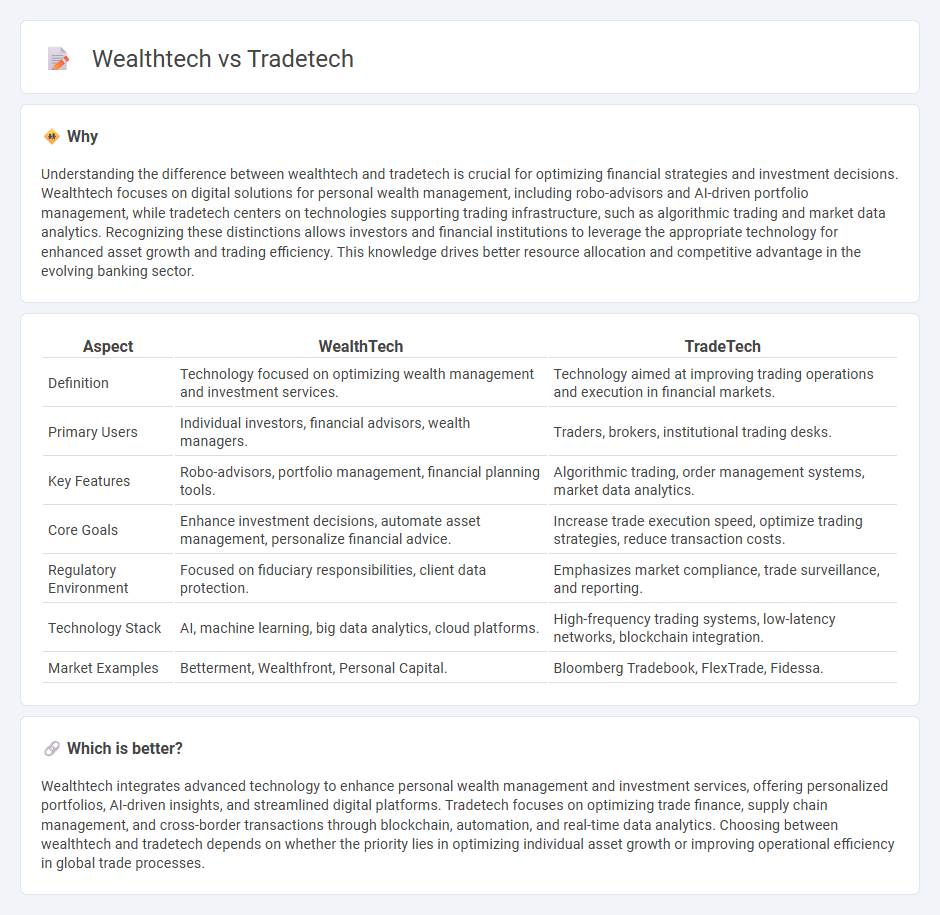

Understanding the difference between wealthtech and tradetech is crucial for optimizing financial strategies and investment decisions. Wealthtech focuses on digital solutions for personal wealth management, including robo-advisors and AI-driven portfolio management, while tradetech centers on technologies supporting trading infrastructure, such as algorithmic trading and market data analytics. Recognizing these distinctions allows investors and financial institutions to leverage the appropriate technology for enhanced asset growth and trading efficiency. This knowledge drives better resource allocation and competitive advantage in the evolving banking sector.

Comparison Table

| Aspect | WealthTech | TradeTech |

|---|---|---|

| Definition | Technology focused on optimizing wealth management and investment services. | Technology aimed at improving trading operations and execution in financial markets. |

| Primary Users | Individual investors, financial advisors, wealth managers. | Traders, brokers, institutional trading desks. |

| Key Features | Robo-advisors, portfolio management, financial planning tools. | Algorithmic trading, order management systems, market data analytics. |

| Core Goals | Enhance investment decisions, automate asset management, personalize financial advice. | Increase trade execution speed, optimize trading strategies, reduce transaction costs. |

| Regulatory Environment | Focused on fiduciary responsibilities, client data protection. | Emphasizes market compliance, trade surveillance, and reporting. |

| Technology Stack | AI, machine learning, big data analytics, cloud platforms. | High-frequency trading systems, low-latency networks, blockchain integration. |

| Market Examples | Betterment, Wealthfront, Personal Capital. | Bloomberg Tradebook, FlexTrade, Fidessa. |

Which is better?

Wealthtech integrates advanced technology to enhance personal wealth management and investment services, offering personalized portfolios, AI-driven insights, and streamlined digital platforms. Tradetech focuses on optimizing trade finance, supply chain management, and cross-border transactions through blockchain, automation, and real-time data analytics. Choosing between wealthtech and tradetech depends on whether the priority lies in optimizing individual asset growth or improving operational efficiency in global trade processes.

Connection

Wealthtech leverages advanced data analytics and AI to optimize investment strategies, while tradetech incorporates digital platforms and automation to streamline financial transactions and trade execution. Both sectors integrate real-time data processing and algorithmic decision-making to enhance portfolio management and facilitate efficient market access. This synergy enables seamless connectivity between asset management and trading infrastructures, driving innovation across the banking ecosystem.

Key Terms

Trade Execution (Tradetech)

TradeTech specializes in optimizing trade execution through advanced algorithms, real-time data analytics, and low-latency trading platforms, enabling faster and more efficient order processing. WealthTech focuses on portfolio management, financial planning, and personalized investment strategies rather than the technical precision of trade execution. Explore the nuances between TradeTech and WealthTech to understand their distinct value propositions in financial technology.

Portfolio Management (Wealthtech)

Wealthtech platforms specializing in portfolio management utilize AI-driven analytics and algorithmic trading to optimize asset allocation, risk assessment, and personalized financial planning. These solutions integrate real-time market data and client-specific goals to enhance decision-making processes and improve investment outcomes. Discover more about how wealthtech innovations are transforming portfolio management efficiency and client engagement.

Risk Assessment

TradeTech and WealthTech employ advanced risk assessment algorithms to analyze market volatility and portfolio risks respectively. TradeTech leverages real-time data and machine learning to predict trade execution risks, while WealthTech focuses on client-specific risk tolerance and asset allocation optimization. Explore further to understand how these technologies revolutionize financial risk management.

Source and External Links

Trade Tech: Logistics Management and Supply Chain Management - TradeTech provides advanced logistics and supply chain management solutions designed to optimize efficiency and competitiveness in these sectors.

TradeTech: Catalysing Innovation - The World Economic Forum - TradeTech represents the integration of innovative technologies like AI, robotics, and automation to transform global trade by addressing key challenges and promoting collaboration in the trade ecosystem.

TradeTech Europe 2026 | Europe's Equity Trading Conference - TradeTech Europe is a leading industry event that gathers senior buy-side and sell-side equity trading professionals to discuss technology and market liquidity challenges in equity trading.

dowidth.com

dowidth.com