Invisible payments use technologies like IoT and AI to process transactions seamlessly without user intervention, enhancing convenience and reducing friction at checkout. Mobile banking offers users direct control over their financial activities through apps for transfers, payments, and account management anytime, anywhere. Explore how these innovations are transforming the future of banking and payment experiences.

Why it is important

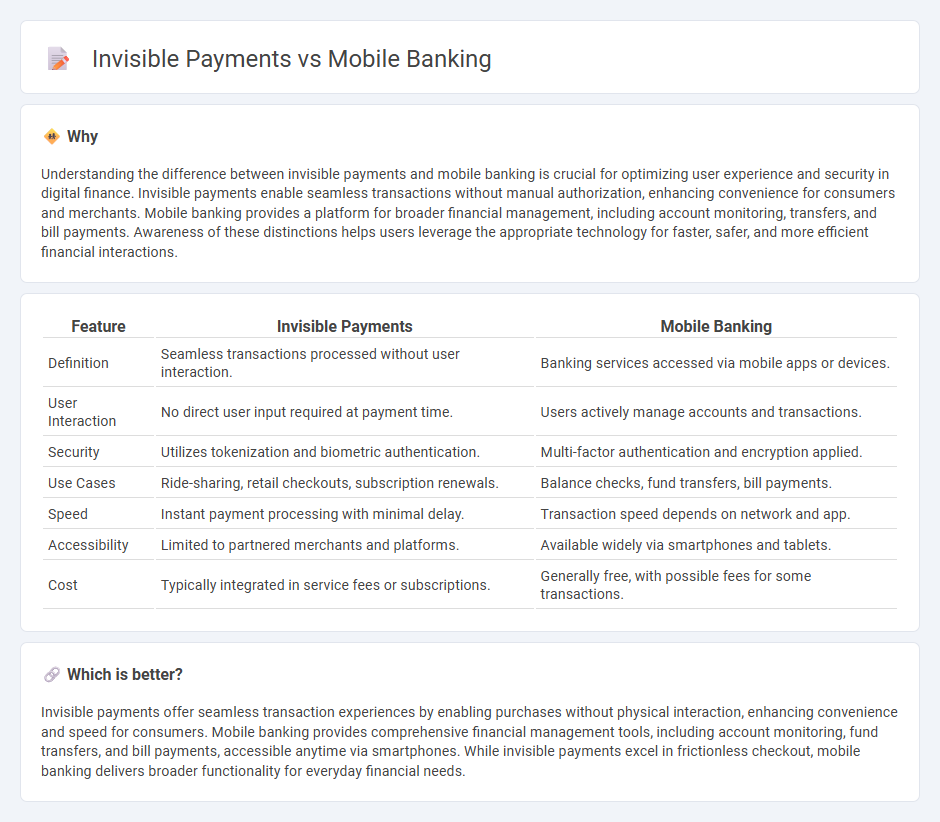

Understanding the difference between invisible payments and mobile banking is crucial for optimizing user experience and security in digital finance. Invisible payments enable seamless transactions without manual authorization, enhancing convenience for consumers and merchants. Mobile banking provides a platform for broader financial management, including account monitoring, transfers, and bill payments. Awareness of these distinctions helps users leverage the appropriate technology for faster, safer, and more efficient financial interactions.

Comparison Table

| Feature | Invisible Payments | Mobile Banking |

|---|---|---|

| Definition | Seamless transactions processed without user interaction. | Banking services accessed via mobile apps or devices. |

| User Interaction | No direct user input required at payment time. | Users actively manage accounts and transactions. |

| Security | Utilizes tokenization and biometric authentication. | Multi-factor authentication and encryption applied. |

| Use Cases | Ride-sharing, retail checkouts, subscription renewals. | Balance checks, fund transfers, bill payments. |

| Speed | Instant payment processing with minimal delay. | Transaction speed depends on network and app. |

| Accessibility | Limited to partnered merchants and platforms. | Available widely via smartphones and tablets. |

| Cost | Typically integrated in service fees or subscriptions. | Generally free, with possible fees for some transactions. |

Which is better?

Invisible payments offer seamless transaction experiences by enabling purchases without physical interaction, enhancing convenience and speed for consumers. Mobile banking provides comprehensive financial management tools, including account monitoring, fund transfers, and bill payments, accessible anytime via smartphones. While invisible payments excel in frictionless checkout, mobile banking delivers broader functionality for everyday financial needs.

Connection

Invisible payments streamline transactions by allowing mobile banking apps to process purchases seamlessly without manual input, enhancing user convenience. Mobile banking integrates secure tokenization and biometric authentication to facilitate these background transactions, boosting security and speed. The convergence of invisible payments and mobile banking drives the evolution of frictionless financial services and contactless commerce worldwide.

Key Terms

User Authentication

Mobile banking relies heavily on multi-factor authentication methods such as biometrics, OTPs, and secure PINs to ensure robust user verification and prevent fraud. Invisible payments prioritize seamless, frictionless authentication using tokenization, behavioral biometrics, and device recognition that operate in the background without user disruption. Explore the latest security innovations and technology trends driving safer, more convenient user authentication in financial services.

API Integration

Mobile banking leverages APIs to enable seamless account management, fund transfers, and real-time transaction updates within user-friendly apps. Invisible payments utilize advanced API integration to facilitate contactless, frictionless transactions without direct user interaction, often embedded in IoT devices or biometric platforms. Explore how API integration drives innovation and security in both payment systems for a comprehensive understanding.

Transaction Tracking

Mobile banking apps provide detailed transaction tracking, allowing users to view, categorize, and manage their expenses with real-time updates and customizable alerts. Invisible payments, often integrated into IoT devices or wearable tech, offer seamless transaction processing without active user input but may lack granular transaction visibility for immediate review. Explore the nuances of transaction tracking in mobile banking and invisible payments to optimize your financial management strategy.

Source and External Links

Mobile banking - Mobile banking is a service enabling customers to conduct financial transactions using a mobile device, distinct from internet banking.

Mobile Banking - PNC Bank - PNC Mobile App lets users manage accounts, deposit checks, pay bills, send/receive money via Zelle(r), customize cards, and control card security features anytime, anywhere.

Online and Mobile Banking Features and Digital Services - Bank of America's mobile banking offers secure access to checking, savings, credit, and investment accounts with features like mobile check deposit, bill pay, Zelle(r) transfers, and its virtual assistant Erica(r).

dowidth.com

dowidth.com