Pay by bank offers direct transactions through established financial institutions, ensuring regulated security and widespread acceptance. Cryptocurrency operates on decentralized blockchain technology, providing fast, borderless payments with enhanced privacy but higher volatility. Discover the key differences and advantages to choose the best payment method for your needs.

Why it is important

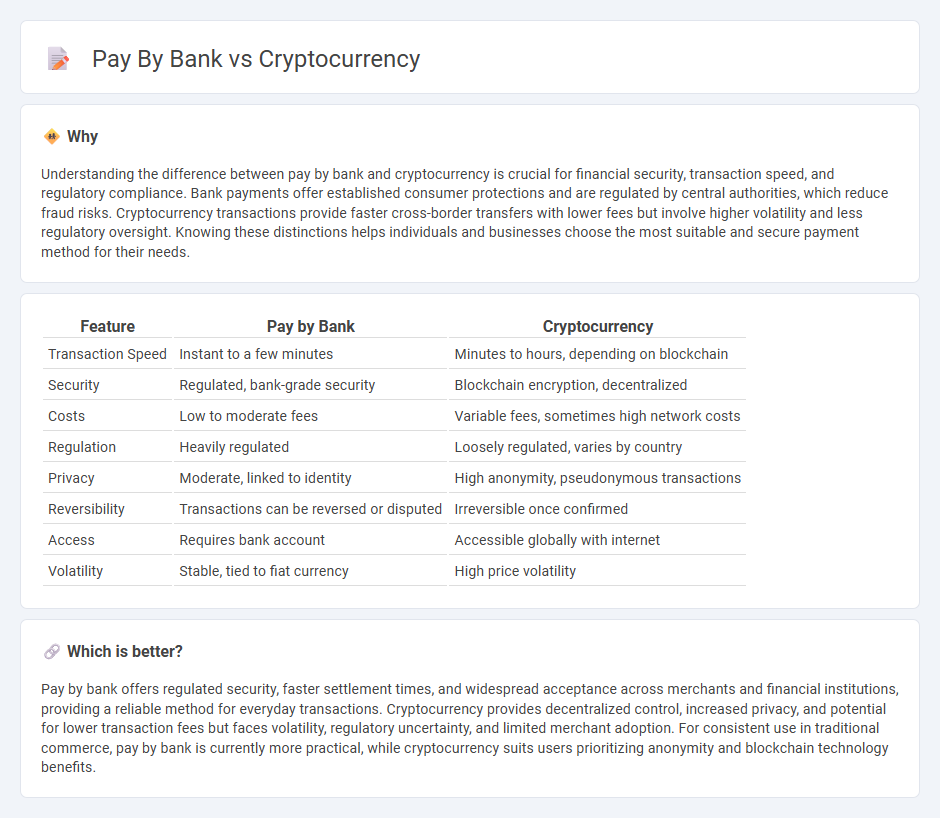

Understanding the difference between pay by bank and cryptocurrency is crucial for financial security, transaction speed, and regulatory compliance. Bank payments offer established consumer protections and are regulated by central authorities, which reduce fraud risks. Cryptocurrency transactions provide faster cross-border transfers with lower fees but involve higher volatility and less regulatory oversight. Knowing these distinctions helps individuals and businesses choose the most suitable and secure payment method for their needs.

Comparison Table

| Feature | Pay by Bank | Cryptocurrency |

|---|---|---|

| Transaction Speed | Instant to a few minutes | Minutes to hours, depending on blockchain |

| Security | Regulated, bank-grade security | Blockchain encryption, decentralized |

| Costs | Low to moderate fees | Variable fees, sometimes high network costs |

| Regulation | Heavily regulated | Loosely regulated, varies by country |

| Privacy | Moderate, linked to identity | High anonymity, pseudonymous transactions |

| Reversibility | Transactions can be reversed or disputed | Irreversible once confirmed |

| Access | Requires bank account | Accessible globally with internet |

| Volatility | Stable, tied to fiat currency | High price volatility |

Which is better?

Pay by bank offers regulated security, faster settlement times, and widespread acceptance across merchants and financial institutions, providing a reliable method for everyday transactions. Cryptocurrency provides decentralized control, increased privacy, and potential for lower transaction fees but faces volatility, regulatory uncertainty, and limited merchant adoption. For consistent use in traditional commerce, pay by bank is currently more practical, while cryptocurrency suits users prioritizing anonymity and blockchain technology benefits.

Connection

Pay by bank and cryptocurrency transactions are connected through blockchain technology, enabling secure and transparent digital asset transfers between bank accounts and crypto wallets. Financial institutions increasingly integrate APIs to facilitate direct bank payments for cryptocurrency purchases, enhancing liquidity and user accessibility. This convergence supports real-time settlement, reduces transaction fees, and bridges traditional banking systems with decentralized finance.

Key Terms

Decentralization

Cryptocurrency operates on decentralized blockchain networks, eliminating intermediaries and enabling peer-to-peer transactions with increased transparency and security. Pay by bank relies on centralized banking systems where transactions are processed through financial institutions, which manage and control the flow of funds. Explore how decentralization impacts transaction speed, security, and user control in both payment methods.

Settlement Speed

Cryptocurrency transactions leverage blockchain technology to achieve near-instant settlement speeds, often completing within minutes regardless of cross-border factors. Pay by bank methods, relying on traditional banking infrastructure and interbank networks, typically require several hours to days for settlement, especially for international transfers. Explore the detailed comparison of settlement speeds and their impact on transaction efficiency to understand which payment method suits your needs best.

Regulatory Compliance

Cryptocurrency transactions face evolving regulatory compliance challenges due to decentralized networks and varying international laws, requiring adherence to anti-money laundering (AML) and know your customer (KYC) policies. Pay by bank solutions operate under stringent banking regulations and financial authorities, offering enhanced transparency, reduced fraud risks, and secure customer data protection. Explore how regulatory frameworks shape the future of digital payments and banking integration.

Source and External Links

What is Cryptocurrency and How Does it Work? - Cryptocurrency is a digital payment system that operates on a decentralized blockchain without banks, using encryption to secure transactions and enable peer-to-peer transfers globally.

Cryptocurrency - Cryptocurrencies are digital currencies that function via computer networks without central authorities, with ownership recorded on blockchains secured by consensus mechanisms like proof of work or proof of stake.

Digital Currencies | Explainer | Education - Cryptocurrencies such as Bitcoin use blockchain technology to record transactions on a public ledger verified by network participants who solve cryptographic puzzles in a process called mining.

dowidth.com

dowidth.com