Neo banking offers fully digital financial services through mobile apps without traditional branch networks, focusing on seamless user experience and lower fees. Digital banking integrates online and mobile platforms within established banks, providing traditional banking services enhanced by technology. Explore these innovative banking models to understand their benefits and differences.

Why it is important

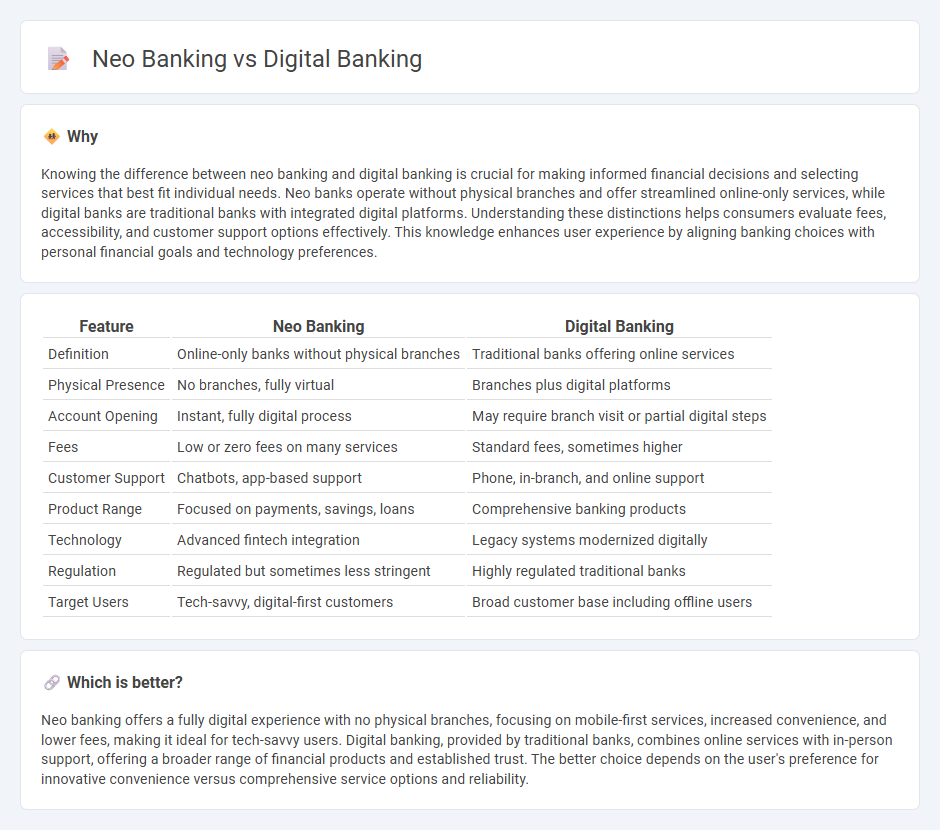

Knowing the difference between neo banking and digital banking is crucial for making informed financial decisions and selecting services that best fit individual needs. Neo banks operate without physical branches and offer streamlined online-only services, while digital banks are traditional banks with integrated digital platforms. Understanding these distinctions helps consumers evaluate fees, accessibility, and customer support options effectively. This knowledge enhances user experience by aligning banking choices with personal financial goals and technology preferences.

Comparison Table

| Feature | Neo Banking | Digital Banking |

|---|---|---|

| Definition | Online-only banks without physical branches | Traditional banks offering online services |

| Physical Presence | No branches, fully virtual | Branches plus digital platforms |

| Account Opening | Instant, fully digital process | May require branch visit or partial digital steps |

| Fees | Low or zero fees on many services | Standard fees, sometimes higher |

| Customer Support | Chatbots, app-based support | Phone, in-branch, and online support |

| Product Range | Focused on payments, savings, loans | Comprehensive banking products |

| Technology | Advanced fintech integration | Legacy systems modernized digitally |

| Regulation | Regulated but sometimes less stringent | Highly regulated traditional banks |

| Target Users | Tech-savvy, digital-first customers | Broad customer base including offline users |

Which is better?

Neo banking offers a fully digital experience with no physical branches, focusing on mobile-first services, increased convenience, and lower fees, making it ideal for tech-savvy users. Digital banking, provided by traditional banks, combines online services with in-person support, offering a broader range of financial products and established trust. The better choice depends on the user's preference for innovative convenience versus comprehensive service options and reliability.

Connection

Neo banking and digital banking are interconnected through their reliance on advanced technology to deliver financial services via digital platforms without traditional physical branches. Both utilize mobile apps, AI, and cloud computing to enhance user experience, providing 24/7 access to banking services like payments, loans, and account management. Neo banks specifically operate as fully digital entities often partnering with licensed banks, while digital banking refers broadly to traditional banks offering online and mobile services.

Key Terms

Core Banking System

Core Banking Systems (CBS) serve as the backbone for both digital and neo banking, enabling real-time transaction processing, centralized data management, and seamless customer experience across multiple channels. Digital banking relies on legacy CBS platforms often enhanced with digital interfaces, while neo banks operate on cloud-native, API-driven CBS architectures designed for higher agility and scalability. Explore how these core technologies differentiate banking models and drive innovation in financial services.

Regulatory Compliance

Digital banking operates within traditional regulatory frameworks established for conventional banks, ensuring stringent adherence to anti-money laundering (AML), know your customer (KYC), and data privacy regulations. Neo banking, as fully digital entities, often leverage advanced technology and agile processes to comply with evolving financial regulations, though they must navigate varying levels of licensing requirements depending on jurisdiction. Explore further to understand how regulatory compliance shapes the future of digital and neo banking landscapes.

Customer Experience

Digital banking offers a comprehensive suite of financial services through traditional banks' online platforms, ensuring secure and reliable customer experiences. Neo banking emphasizes user-friendly, mobile-first interfaces combined with innovative features like instant notifications and personalized financial management, delivering enhanced convenience and engagement. Discover how these approaches transform customer experience in financial services.

Source and External Links

Digital Banking: 2025 Market Overview, Trends & Insights - Digital banking is the digitization of all traditional banking products and processes, accessible via online and mobile channels, with trends including mobile banking growth, digital-only banks, AI integration, and digital payments expansion.

Digital banking - Wikipedia - Digital banking involves delivering banking services over the internet with automation and middleware solutions, providing full banking functionality across platforms including mobile, desktop, ATMs, and POS, integrating front-end, middleware, and back-end systems.

Digital banking | Online and Mobile Banking - Regions Bank - Digital banking enables customers to manage all accounts conveniently through online or mobile apps, offering features such as bill pay, mobile check deposit, money transfers, card control, and notifications to simplify banking on the go.

dowidth.com

dowidth.com