Hyperpersonalization in banking leverages data analytics and AI to tailor financial products and services uniquely to each customer's needs and behaviors, enhancing customer satisfaction and loyalty. In contrast, up-selling focuses on encouraging customers to purchase higher-value products or add-ons, often prioritizing revenue growth over individual preferences. Explore how integrating hyperpersonalization can transform up-selling strategies and drive both customer value and business success.

Why it is important

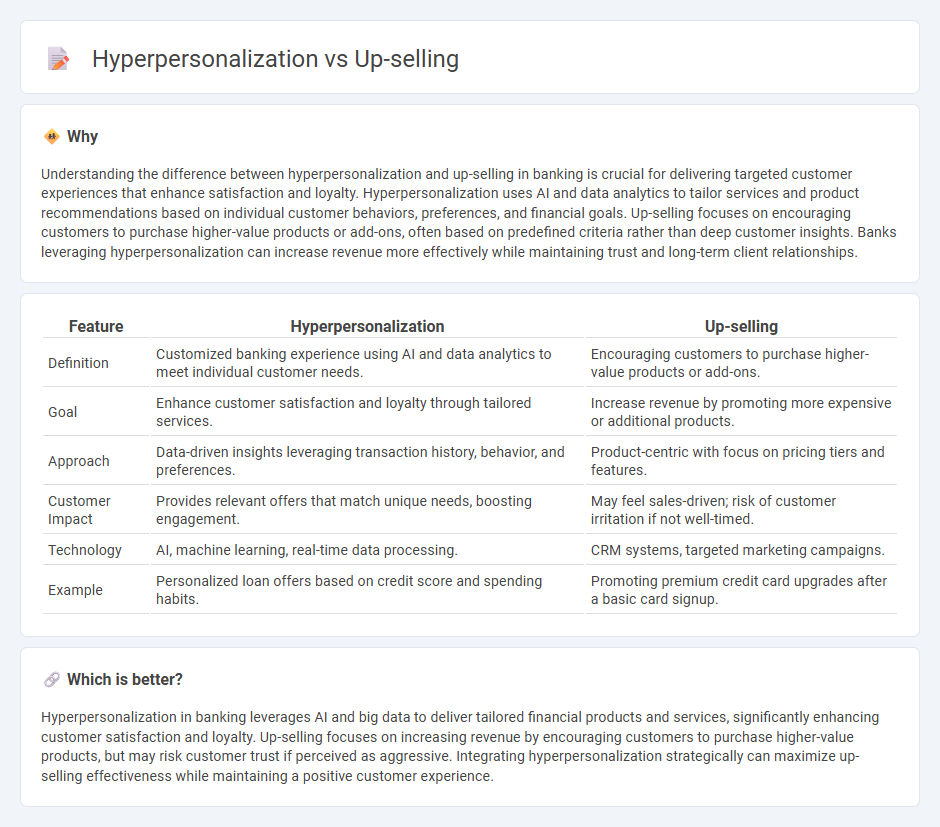

Understanding the difference between hyperpersonalization and up-selling in banking is crucial for delivering targeted customer experiences that enhance satisfaction and loyalty. Hyperpersonalization uses AI and data analytics to tailor services and product recommendations based on individual customer behaviors, preferences, and financial goals. Up-selling focuses on encouraging customers to purchase higher-value products or add-ons, often based on predefined criteria rather than deep customer insights. Banks leveraging hyperpersonalization can increase revenue more effectively while maintaining trust and long-term client relationships.

Comparison Table

| Feature | Hyperpersonalization | Up-selling |

|---|---|---|

| Definition | Customized banking experience using AI and data analytics to meet individual customer needs. | Encouraging customers to purchase higher-value products or add-ons. |

| Goal | Enhance customer satisfaction and loyalty through tailored services. | Increase revenue by promoting more expensive or additional products. |

| Approach | Data-driven insights leveraging transaction history, behavior, and preferences. | Product-centric with focus on pricing tiers and features. |

| Customer Impact | Provides relevant offers that match unique needs, boosting engagement. | May feel sales-driven; risk of customer irritation if not well-timed. |

| Technology | AI, machine learning, real-time data processing. | CRM systems, targeted marketing campaigns. |

| Example | Personalized loan offers based on credit score and spending habits. | Promoting premium credit card upgrades after a basic card signup. |

Which is better?

Hyperpersonalization in banking leverages AI and big data to deliver tailored financial products and services, significantly enhancing customer satisfaction and loyalty. Up-selling focuses on increasing revenue by encouraging customers to purchase higher-value products, but may risk customer trust if perceived as aggressive. Integrating hyperpersonalization strategically can maximize up-selling effectiveness while maintaining a positive customer experience.

Connection

Hyperpersonalization in banking leverages AI and customer data analytics to tailor financial products and services to individual preferences and behaviors, enhancing customer engagement and satisfaction. This targeted approach creates opportunities for strategic up-selling by presenting relevant, personalized offers that meet specific customer needs and financial goals. Banks implementing hyperpersonalized up-selling strategies experience increased revenue and stronger client relationships through precise product recommendations.

Key Terms

Cross-Selling

Cross-selling enhances revenue by recommending complementary products aligned with the customer's current purchase intent, increasing basket size and customer satisfaction. Hyperpersonalization leverages real-time data and AI to tailor cross-selling offers uniquely to each individual's preferences and behavior, driving higher conversion rates and loyalty. Explore how integrating up-selling strategies with hyperpersonalized cross-selling can maximize customer value and business growth.

Customer Segmentation

Customer segmentation is central to both up-selling and hyperpersonalization strategies, enabling businesses to target specific groups more effectively. Up-selling leverages segmentation to identify customers with higher spending potential, encouraging larger purchases through tailored offers, while hyperpersonalization uses granular data points within segments to craft individualized experiences and product recommendations. Explore how advanced customer segmentation techniques can enhance your marketing effectiveness and drive revenue growth.

Data Analytics

Up-selling leverages data analytics by analyzing customer purchase history and behavior to recommend higher-value products, enhancing revenue per transaction. Hyperpersonalization employs advanced data analytics techniques, including real-time data and AI-driven insights, to tailor experiences uniquely to individual customer preferences and needs, driving engagement and loyalty. Discover how mastering data analytics can transform your up-selling and hyperpersonalization strategies for maximum business impact.

Source and External Links

Upselling - Wikipedia - Upselling is a sales technique where a seller encourages the customer to purchase more expensive items, upgrades, or add-ons to increase revenue, distinct from cross-selling which offers additional complementary products.

What Is Upselling? Definition, Examples, & Expert Tips - Plaky - Upselling involves offering a higher-end, upgraded version of a product or service to meet customer needs better, aiming to boost sales revenue, customer retention, and improve brand reputation.

What Is Upselling? Upselling Definition and Examples - Shopify - Upselling is a powerful strategy to encourage customers to buy a more expensive item or upgrade, often improving customer experience and increasing average order value or lifetime value.

dowidth.com

dowidth.com