Invisible payments enable seamless transactions by integrating payment processing directly into the user experience, eliminating the need for manual input or visible interaction. Cryptocurrency payments leverage blockchain technology to offer decentralized, secure, and transparent transactions without reliance on traditional financial intermediaries. Explore further to understand the evolving landscape and benefits of these innovative payment methods.

Why it is important

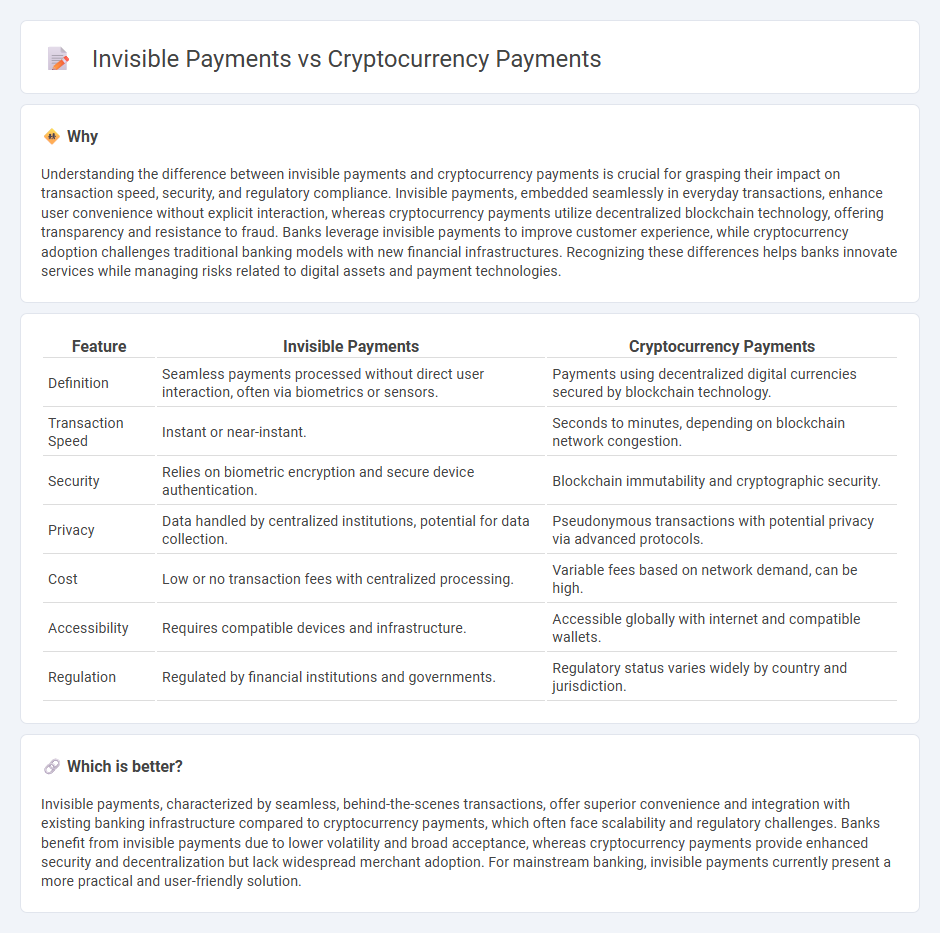

Understanding the difference between invisible payments and cryptocurrency payments is crucial for grasping their impact on transaction speed, security, and regulatory compliance. Invisible payments, embedded seamlessly in everyday transactions, enhance user convenience without explicit interaction, whereas cryptocurrency payments utilize decentralized blockchain technology, offering transparency and resistance to fraud. Banks leverage invisible payments to improve customer experience, while cryptocurrency adoption challenges traditional banking models with new financial infrastructures. Recognizing these differences helps banks innovate services while managing risks related to digital assets and payment technologies.

Comparison Table

| Feature | Invisible Payments | Cryptocurrency Payments |

|---|---|---|

| Definition | Seamless payments processed without direct user interaction, often via biometrics or sensors. | Payments using decentralized digital currencies secured by blockchain technology. |

| Transaction Speed | Instant or near-instant. | Seconds to minutes, depending on blockchain network congestion. |

| Security | Relies on biometric encryption and secure device authentication. | Blockchain immutability and cryptographic security. |

| Privacy | Data handled by centralized institutions, potential for data collection. | Pseudonymous transactions with potential privacy via advanced protocols. |

| Cost | Low or no transaction fees with centralized processing. | Variable fees based on network demand, can be high. |

| Accessibility | Requires compatible devices and infrastructure. | Accessible globally with internet and compatible wallets. |

| Regulation | Regulated by financial institutions and governments. | Regulatory status varies widely by country and jurisdiction. |

Which is better?

Invisible payments, characterized by seamless, behind-the-scenes transactions, offer superior convenience and integration with existing banking infrastructure compared to cryptocurrency payments, which often face scalability and regulatory challenges. Banks benefit from invisible payments due to lower volatility and broad acceptance, whereas cryptocurrency payments provide enhanced security and decentralization but lack widespread merchant adoption. For mainstream banking, invisible payments currently present a more practical and user-friendly solution.

Connection

Invisible payments leverage seamless, contactless technology often built on blockchain frameworks, which also underpin cryptocurrency transactions, enabling secure and transparent financial exchanges. Both payment methods prioritize speed, privacy, and reduced friction, facilitating faster settlements and minimizing the need for intermediaries in banking systems. The convergence of these technologies is transforming digital banking by integrating decentralized ledgers with automated, user-friendly payment flows.

Key Terms

Blockchain

Cryptocurrency payments leverage blockchain technology to enable secure, transparent, and decentralized transactions, eliminating the need for intermediaries and reducing transaction costs. Invisible payments utilize blockchain to facilitate seamless, background financial interactions without explicit user initiation, enhancing user experience while maintaining security and privacy. Explore the evolving landscape of blockchain-enabled payment solutions to understand how these innovations are transforming digital commerce.

Tokenization

Cryptocurrency payments leverage blockchain technology to ensure secure and transparent transactions, while invisible payments utilize tokenization to substitute sensitive payment data with unique tokens, enhancing privacy and reducing fraud risk. Tokenization in invisible payments enables seamless transactions without exposing actual card details, improving user experience and compliance with data protection standards such as PCI DSS. Explore further to understand how tokenization is transforming both cryptocurrency and traditional payment systems.

Payment Authentication

Cryptocurrency payments leverage blockchain technology to ensure secure and transparent payment authentication through decentralized verification methods, minimizing fraud and chargebacks. Invisible payments, often powered by biometric or IoT-enabled systems, prioritize frictionless user experiences by verifying transactions seamlessly without active input, enhancing convenience but raising privacy considerations. Explore the evolving landscape of payment authentication to understand security implications and user preferences.

Source and External Links

Best Crypto Payment Gateway & Processor | Accept Crypto ... - CoinGate offers a versatile crypto payment gateway enabling businesses to accept Bitcoin, stablecoins, and other cryptocurrencies with instant conversion to fiat and multiple integration options like e-commerce plugins, email billing, or payment buttons.

A new standard in global crypto payments - Coinbase Commerce provides a seamless platform for merchants to accept crypto payments worldwide with instant settlement, automatic conversion to USDC to avoid volatility, multi-chain wallet support, and low fees.

Global payment solutions for Web3 - Stripe enables businesses to process crypto payments and payouts globally, handle stablecoins, embed crypto purchases in checkout flows, and convert crypto payments into fiat, with built-in fraud prevention and broad financial rail support.

dowidth.com

dowidth.com