Central Bank Digital Currency (CBDC) represents a government-backed digital form of money designed for retail use by consumers, while wholesale money pertains to digital currency used exclusively among financial institutions for large-scale transactions. CBDCs aim to enhance payment efficiency, financial inclusion, and monetary policy implementation, whereas wholesale digital money focuses on streamlining interbank settlements and reducing counterparty risk. Discover how these distinct forms of digital currency are reshaping the future of banking.

Why it is important

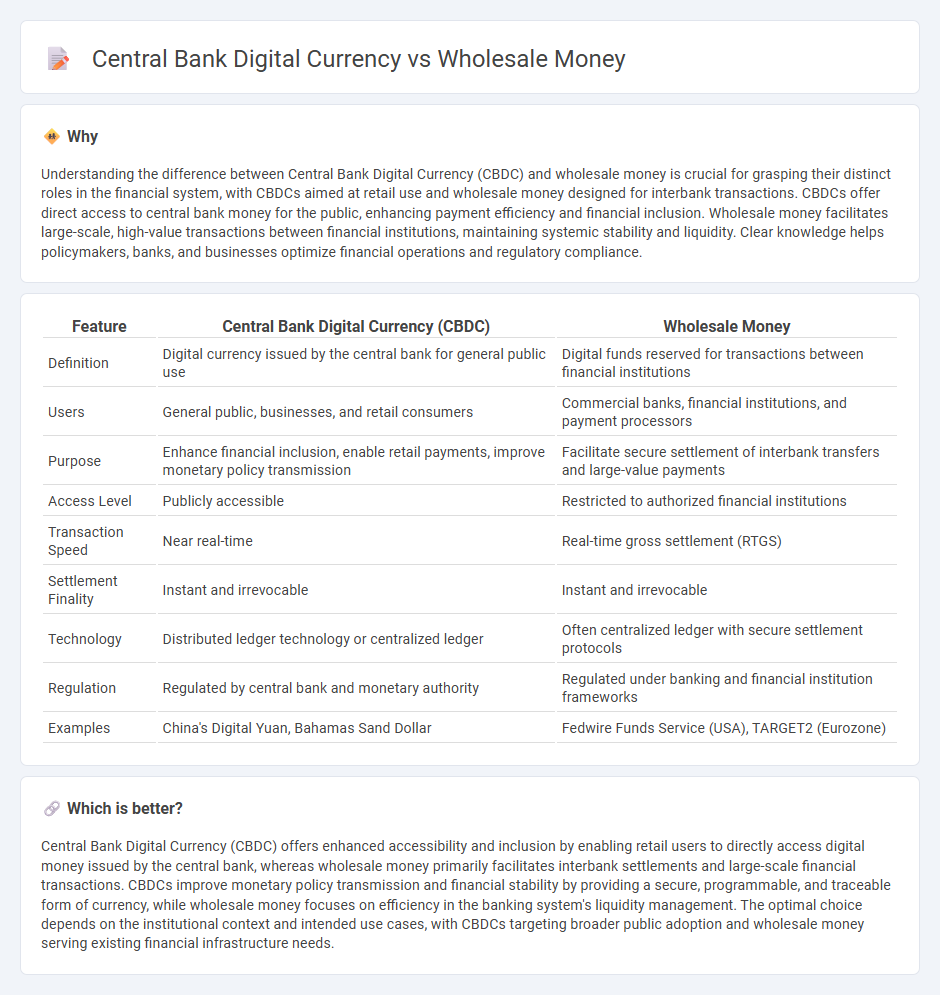

Understanding the difference between Central Bank Digital Currency (CBDC) and wholesale money is crucial for grasping their distinct roles in the financial system, with CBDCs aimed at retail use and wholesale money designed for interbank transactions. CBDCs offer direct access to central bank money for the public, enhancing payment efficiency and financial inclusion. Wholesale money facilitates large-scale, high-value transactions between financial institutions, maintaining systemic stability and liquidity. Clear knowledge helps policymakers, banks, and businesses optimize financial operations and regulatory compliance.

Comparison Table

| Feature | Central Bank Digital Currency (CBDC) | Wholesale Money |

|---|---|---|

| Definition | Digital currency issued by the central bank for general public use | Digital funds reserved for transactions between financial institutions |

| Users | General public, businesses, and retail consumers | Commercial banks, financial institutions, and payment processors |

| Purpose | Enhance financial inclusion, enable retail payments, improve monetary policy transmission | Facilitate secure settlement of interbank transfers and large-value payments |

| Access Level | Publicly accessible | Restricted to authorized financial institutions |

| Transaction Speed | Near real-time | Real-time gross settlement (RTGS) |

| Settlement Finality | Instant and irrevocable | Instant and irrevocable |

| Technology | Distributed ledger technology or centralized ledger | Often centralized ledger with secure settlement protocols |

| Regulation | Regulated by central bank and monetary authority | Regulated under banking and financial institution frameworks |

| Examples | China's Digital Yuan, Bahamas Sand Dollar | Fedwire Funds Service (USA), TARGET2 (Eurozone) |

Which is better?

Central Bank Digital Currency (CBDC) offers enhanced accessibility and inclusion by enabling retail users to directly access digital money issued by the central bank, whereas wholesale money primarily facilitates interbank settlements and large-scale financial transactions. CBDCs improve monetary policy transmission and financial stability by providing a secure, programmable, and traceable form of currency, while wholesale money focuses on efficiency in the banking system's liquidity management. The optimal choice depends on the institutional context and intended use cases, with CBDCs targeting broader public adoption and wholesale money serving existing financial infrastructure needs.

Connection

Central bank digital currency (CBDC) and wholesale money are intricately connected as CBDCs serve as a digital form of central bank reserves, primarily used for large-value interbank transactions and settlements. Wholesale CBDCs streamline the transfer of wholesale money by enhancing transaction speed, security, and transparency among financial institutions. This connection promotes more efficient liquidity management and reduces counterparty risks in the banking system.

Key Terms

Interbank Lending

Wholesale money, primarily used for large-scale interbank lending and financial market transactions, offers banks immediate liquidity and settlement finality. Central Bank Digital Currency (CBDC) introduces a secure, programmable alternative for interbank transfers, enhancing transparency and reducing counterparty risks. Explore how these innovations reshape interbank lending dynamics and financial stability.

Settlement Systems

Wholesale money primarily facilitates high-value transactions between financial institutions via interbank payment systems, enhancing efficiency and liquidity management within the financial sector. Central Bank Digital Currency (CBDC), in a wholesale context, is designed to streamline settlement systems by providing a secure, programmable digital asset issued by the central bank, reducing settlement times and counterparty risks. Explore the evolving role of wholesale CBDCs in transforming global settlement infrastructures for detailed insights.

Digital Ledger

Wholesale money operates primarily within interbank settlements, leveraging traditional central bank reserves, whereas central bank digital currency (CBDC) utilizes a digital ledger to enhance transaction transparency and efficiency. Digital ledger technology (DLT) underpins CBDC frameworks by enabling immutable records and real-time settlement, facilitating improved liquidity management among financial institutions. Explore the transformative impact of digital ledger systems on wholesale money and CBDC integration to understand the future of digital finance.

Source and External Links

What is wholesale finance and how it helps businesses grow - Wholesale money refers to high-value financial instruments used mostly for short-term transactions between financial institutions, involving products like inventory financing, floor planning, and factoring to provide liquidity and support business growth.

Wholesale funding - Wikipedia - Wholesale funding is a banking method supplementing core deposits to finance operations and loans, including sources like federal funds and brokered deposits, but involves liquidity risk sensitive to credit profile and interest rate changes.

Wholesale Funding: An Essential Element of Asset Liability Management - Wholesale funding offers banks strategic tools such as Federal Home Loan Bank advances and brokered deposits to manage liquidity, interest rate risk, and cost optimization, playing a key role in long-term planning and stability.

dowidth.com

dowidth.com