Social trading leverages collective insights by allowing investors to replicate the strategies of experienced traders through online platforms, enhancing accessibility and diversification. Manual trading requires individual decision-making and hands-on analysis, demanding higher expertise and time commitment from traders. Explore the advantages and challenges of both approaches to optimize your banking investment strategy.

Why it is important

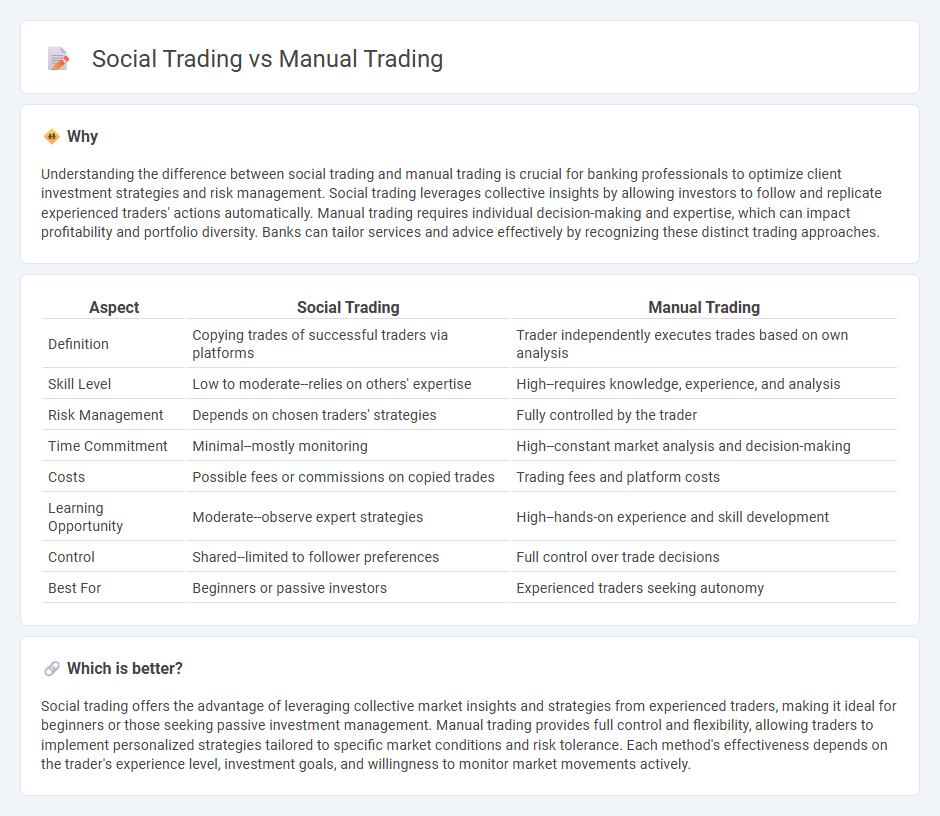

Understanding the difference between social trading and manual trading is crucial for banking professionals to optimize client investment strategies and risk management. Social trading leverages collective insights by allowing investors to follow and replicate experienced traders' actions automatically. Manual trading requires individual decision-making and expertise, which can impact profitability and portfolio diversity. Banks can tailor services and advice effectively by recognizing these distinct trading approaches.

Comparison Table

| Aspect | Social Trading | Manual Trading |

|---|---|---|

| Definition | Copying trades of successful traders via platforms | Trader independently executes trades based on own analysis |

| Skill Level | Low to moderate--relies on others' expertise | High--requires knowledge, experience, and analysis |

| Risk Management | Depends on chosen traders' strategies | Fully controlled by the trader |

| Time Commitment | Minimal--mostly monitoring | High--constant market analysis and decision-making |

| Costs | Possible fees or commissions on copied trades | Trading fees and platform costs |

| Learning Opportunity | Moderate--observe expert strategies | High--hands-on experience and skill development |

| Control | Shared--limited to follower preferences | Full control over trade decisions |

| Best For | Beginners or passive investors | Experienced traders seeking autonomy |

Which is better?

Social trading offers the advantage of leveraging collective market insights and strategies from experienced traders, making it ideal for beginners or those seeking passive investment management. Manual trading provides full control and flexibility, allowing traders to implement personalized strategies tailored to specific market conditions and risk tolerance. Each method's effectiveness depends on the trader's experience level, investment goals, and willingness to monitor market movements actively.

Connection

Social trading leverages community-driven insights and real-time data sharing, enabling manual traders to replicate strategies from experienced investors. Manual trading benefits from social trading platforms by accessing collaborative analysis and performance metrics, enhancing decision-making accuracy. Integration of social trading tools optimizes manual trade execution by providing diversified market perspectives and validated trading signals.

Key Terms

Trade Execution

Manual trading demands active decision-making and real-time market analysis, where traders execute orders based on personal strategies and discretion. Social trading leverages collective intelligence by allowing users to automatically copy trades from experienced investors, enhancing efficiency and reducing emotional bias. Explore deeper insights into how trade execution differs in these two approaches for optimized trading outcomes.

Signal Sharing

Manual trading requires individual decision-making, relying on personal analysis and market experience to execute trades. Social trading emphasizes signal sharing, allowing traders to access real-time trade ideas and strategies from experienced investors, enhancing informed decision-making. Explore the advantages and risks of signal sharing in social trading to maximize your investment potential.

Autocopy Functionality

Manual trading demands extensive market analysis and execution skills, requiring traders to place trades independently based on their strategies. Social trading's Autocopy functionality automates trade replication by enabling users to mirror experienced traders' actions in real time, enhancing efficiency and reducing decision-making workload. Explore how the Autocopy feature can transform your trading approach and optimize profitability.

Source and External Links

What is Manual Trading? Characteristics of Manual Traders - Manual trading is buying and selling financial assets based on a trader's own analysis and judgment, relying on emotional control and strategies like day trading and swing trading to capitalize on market movements.

Auto-Trading vs. Manual Trading: Which Is Best? - AvaTrade - Manual trading requires real-time active involvement and emotional resilience, offering more control but less time efficiency compared to automated trading, which operates continuously with pre-programmed rules.

Automated Trading vs. Manual Trading: Which Is Better? | Blueberry - Manual trading involves traders making and executing all decisions themselves, monitoring markets in real time and applying personal judgment, while automated trading uses pre-set rules to execute trades without constant supervision.

dowidth.com

dowidth.com