Super apps integrate multiple financial services alongside everyday utilities within a single platform, enhancing user convenience and engagement. Neobanks operate exclusively as digital-only banks, offering streamlined banking services with lower fees and greater accessibility compared to traditional banks. Explore the evolving landscape of banking by understanding the distinct benefits and functionalities of super apps and neobanks.

Why it is important

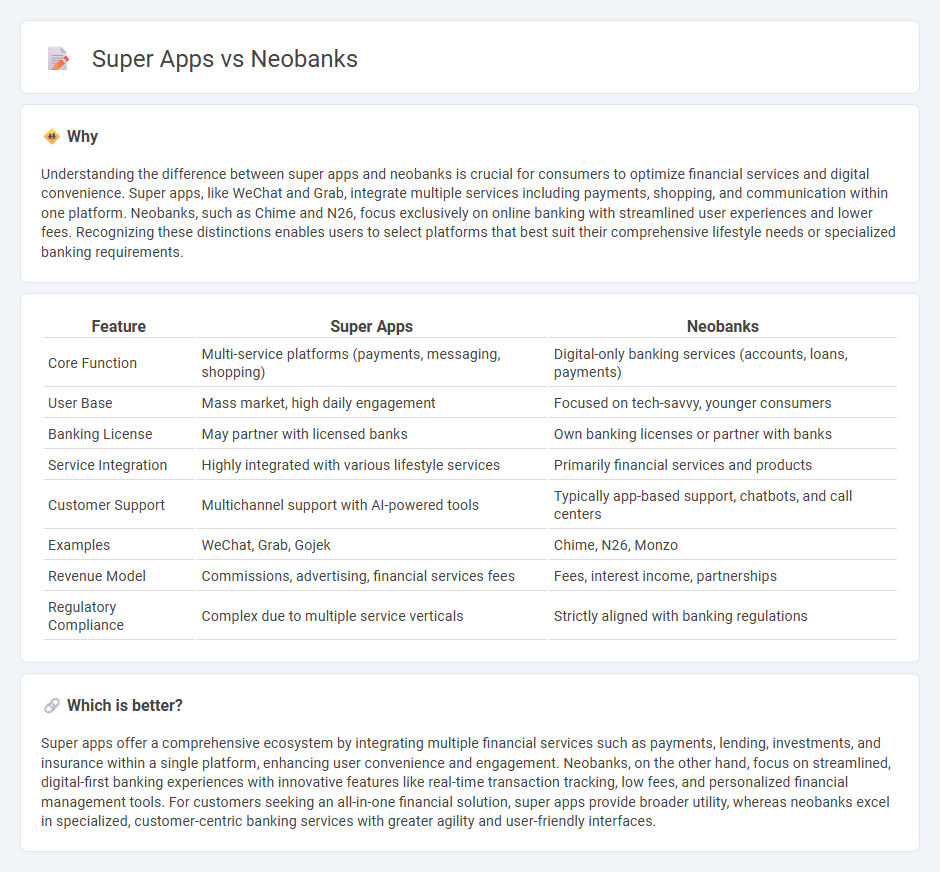

Understanding the difference between super apps and neobanks is crucial for consumers to optimize financial services and digital convenience. Super apps, like WeChat and Grab, integrate multiple services including payments, shopping, and communication within one platform. Neobanks, such as Chime and N26, focus exclusively on online banking with streamlined user experiences and lower fees. Recognizing these distinctions enables users to select platforms that best suit their comprehensive lifestyle needs or specialized banking requirements.

Comparison Table

| Feature | Super Apps | Neobanks |

|---|---|---|

| Core Function | Multi-service platforms (payments, messaging, shopping) | Digital-only banking services (accounts, loans, payments) |

| User Base | Mass market, high daily engagement | Focused on tech-savvy, younger consumers |

| Banking License | May partner with licensed banks | Own banking licenses or partner with banks |

| Service Integration | Highly integrated with various lifestyle services | Primarily financial services and products |

| Customer Support | Multichannel support with AI-powered tools | Typically app-based support, chatbots, and call centers |

| Examples | WeChat, Grab, Gojek | Chime, N26, Monzo |

| Revenue Model | Commissions, advertising, financial services fees | Fees, interest income, partnerships |

| Regulatory Compliance | Complex due to multiple service verticals | Strictly aligned with banking regulations |

Which is better?

Super apps offer a comprehensive ecosystem by integrating multiple financial services such as payments, lending, investments, and insurance within a single platform, enhancing user convenience and engagement. Neobanks, on the other hand, focus on streamlined, digital-first banking experiences with innovative features like real-time transaction tracking, low fees, and personalized financial management tools. For customers seeking an all-in-one financial solution, super apps provide broader utility, whereas neobanks excel in specialized, customer-centric banking services with greater agility and user-friendly interfaces.

Connection

Super apps integrate multiple financial services, including banking features such as payments, loans, and investment options, creating a seamless user experience within a single platform. Neobanks often collaborate with or are embedded in super apps to leverage their broad user base and enhance digital banking accessibility. This synergy accelerates the adoption of digital financial services, driving innovation and convenience in modern banking.

Key Terms

Digital-Only Banking

Neobanks specialize in providing streamlined digital-only banking services with features like instant account setup, low fees, and intuitive mobile interfaces designed to enhance customer convenience. Super apps integrate digital banking within a broader ecosystem offering payments, e-commerce, and lifestyle services, creating a one-stop platform for multiple daily needs beyond traditional banking. Explore the distinct advantages of neobanks and super apps to determine which digital financial solution best fits your lifestyle.

Embedded Financial Services

Neobanks specialize in digital-only banking services, offering seamless account management, payments, and loans primarily through mobile apps, while super apps integrate embedded financial services within a broader ecosystem of consumer activities such as ride-hailing, shopping, and social networking. Embedded financial services in super apps provide convenient access to credit, insurance, and investment options directly within non-financial platforms, enhancing user engagement and driving higher transaction volumes. Explore how embedded finance transforms digital banking landscapes and customer experiences in both neobanks and super apps.

Platform Ecosystem

Neobanks primarily offer streamlined digital banking services focusing on seamless financial transactions within a secure platform ecosystem. Super apps integrate a wide variety of services such as payments, shopping, entertainment, and financial management, creating an all-encompassing platform ecosystem that enhances user engagement and cross-service interaction. Explore the evolving dynamics of platform ecosystems in neobanks and super apps to understand their impact on user experience and market growth.

Source and External Links

Top Neobanks of 2025: Leading the Digital Banking Revolution - Neobanks like Revolut, Chime, N26, and Monzo are digital-only banks offering innovative banking services without physical branches, often partnering with licensed banks for regulatory compliance and FDIC insurance.

What is a Neobank? How It Works, Examples, Pros & Cons - Statrys - Neobanks are fintech companies providing online-only financial services through apps and websites, usually without a full banking license but ensuring customer fund security via bank partnerships, with examples including Chime, Varo, and Revolut.

What is a Neobank? How fintech is transforming banking - Plaid - Neobanks focus on digital banking products such as checking accounts and debit cards without physical locations, showing rapid growth and popular names like Revolut and Chime among the largest neobanks globally.

dowidth.com

dowidth.com