Alternative credit data expands the evaluation of creditworthiness beyond traditional employment and income records by incorporating rent payments, utility bills, and subscription histories. This approach enables lenders to assess risk more accurately for individuals with limited or unstable employment information. Explore how integrating alternative credit data can transform lending decisions and improve financial inclusion.

Why it is important

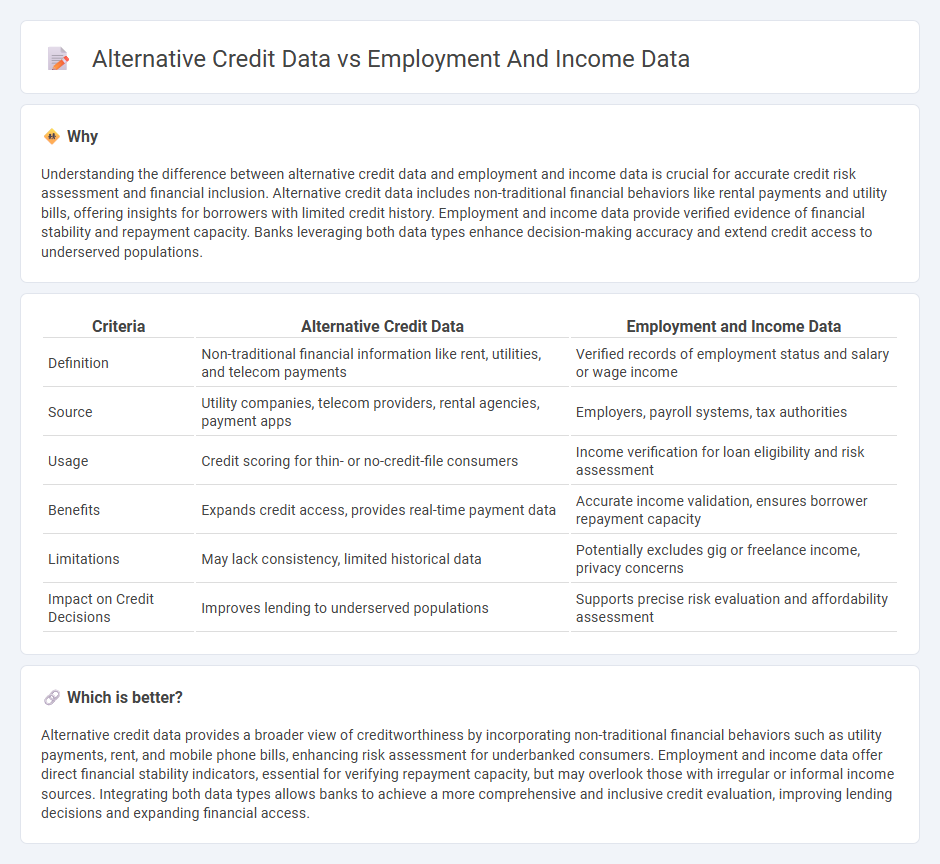

Understanding the difference between alternative credit data and employment and income data is crucial for accurate credit risk assessment and financial inclusion. Alternative credit data includes non-traditional financial behaviors like rental payments and utility bills, offering insights for borrowers with limited credit history. Employment and income data provide verified evidence of financial stability and repayment capacity. Banks leveraging both data types enhance decision-making accuracy and extend credit access to underserved populations.

Comparison Table

| Criteria | Alternative Credit Data | Employment and Income Data |

|---|---|---|

| Definition | Non-traditional financial information like rent, utilities, and telecom payments | Verified records of employment status and salary or wage income |

| Source | Utility companies, telecom providers, rental agencies, payment apps | Employers, payroll systems, tax authorities |

| Usage | Credit scoring for thin- or no-credit-file consumers | Income verification for loan eligibility and risk assessment |

| Benefits | Expands credit access, provides real-time payment data | Accurate income validation, ensures borrower repayment capacity |

| Limitations | May lack consistency, limited historical data | Potentially excludes gig or freelance income, privacy concerns |

| Impact on Credit Decisions | Improves lending to underserved populations | Supports precise risk evaluation and affordability assessment |

Which is better?

Alternative credit data provides a broader view of creditworthiness by incorporating non-traditional financial behaviors such as utility payments, rent, and mobile phone bills, enhancing risk assessment for underbanked consumers. Employment and income data offer direct financial stability indicators, essential for verifying repayment capacity, but may overlook those with irregular or informal income sources. Integrating both data types allows banks to achieve a more comprehensive and inclusive credit evaluation, improving lending decisions and expanding financial access.

Connection

Alternative credit data, such as utility payments and rental history, enhances traditional credit assessments by providing a more comprehensive view of an individual's financial behavior. Employment and income data verify financial stability and repayment capacity, directly influencing creditworthiness evaluations. Integrating these datasets allows banks to make more accurate lending decisions and expand credit access to underserved populations.

Key Terms

Verification of Employment (VOE)

Verification of Employment (VOE) provides reliable employment and income data, enabling lenders to assess borrower stability and repayment capacity accurately. Alternative credit data, such as utility payments and rental history, offers a broader financial picture for individuals lacking traditional credit records. Explore how integrating VOE with alternative credit data can enhance risk assessment and expand credit access.

Debt-to-Income Ratio (DTI)

Employment and income data traditionally serve as primary inputs for calculating the Debt-to-Income Ratio (DTI), measuring a borrower's ability to manage monthly payments and repay debts. Alternative credit data, including rental payments, utility bills, and cash flow analysis, enhance the DTI assessment by providing a more comprehensive view of financial stability, especially for individuals with limited traditional credit history. Explore how integrating these data sources can optimize credit decisions and expand access to credit.

Utility/Telecom Payment History

Employment and income data provide traditional measures of financial stability, while alternative credit data, such as utility and telecom payment history, offers valuable insights into consistent payment behavior often overlooked by conventional credit reports. Utility and telecom payments reflect ongoing financial commitments, enabling lenders to assess creditworthiness in thin-file or no-credit-file cases effectively. Explore how integrating these alternative data sources can enhance credit risk assessment and expand access to credit.

Source and External Links

Current Employment Statistics - CES (National) - The CES program by the U.S. Bureau of Labor Statistics provides detailed monthly estimates of nonfarm employment, worker hours, and earnings for the nation, states, and metro areas, based on surveys of over 121,000 businesses.

Employment by State | U.S. Bureau of Economic Analysis (BEA) - BEA produces counts of full- and part-time jobs including wage and salary jobs and self-employment for all U.S. states and D.C., incorporating data primarily from BLS and IRS.

The Work Number for Employees and Consumers - A digital service providing automated, verified access to individual employment and income data for use by verifiers in loan, job, and government benefit applications, allowing quick and secure verification without extra paperwork.

dowidth.com

dowidth.com