Loyalty fintech platforms enhance banking relationships by offering rewards and personalized financial incentives that increase customer retention and engagement. Peer-to-peer lending platforms disrupt traditional banking by connecting borrowers directly with investors, enabling faster loan approvals and often lower interest rates. Explore how these innovations are reshaping the financial landscape and transforming customer experiences.

Why it is important

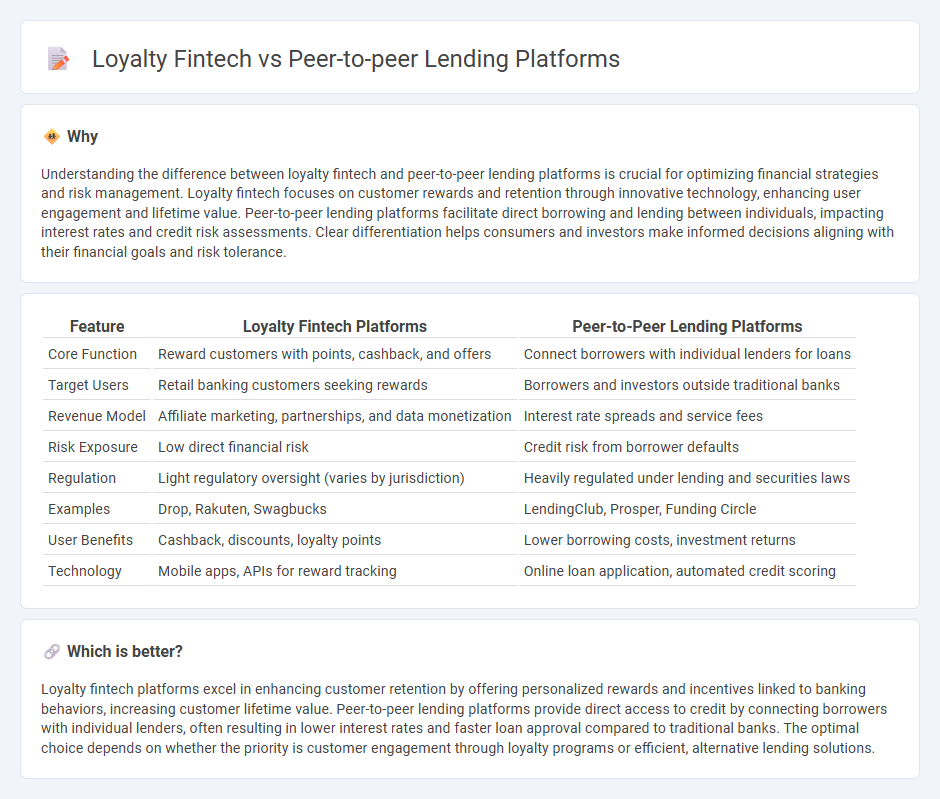

Understanding the difference between loyalty fintech and peer-to-peer lending platforms is crucial for optimizing financial strategies and risk management. Loyalty fintech focuses on customer rewards and retention through innovative technology, enhancing user engagement and lifetime value. Peer-to-peer lending platforms facilitate direct borrowing and lending between individuals, impacting interest rates and credit risk assessments. Clear differentiation helps consumers and investors make informed decisions aligning with their financial goals and risk tolerance.

Comparison Table

| Feature | Loyalty Fintech Platforms | Peer-to-Peer Lending Platforms |

|---|---|---|

| Core Function | Reward customers with points, cashback, and offers | Connect borrowers with individual lenders for loans |

| Target Users | Retail banking customers seeking rewards | Borrowers and investors outside traditional banks |

| Revenue Model | Affiliate marketing, partnerships, and data monetization | Interest rate spreads and service fees |

| Risk Exposure | Low direct financial risk | Credit risk from borrower defaults |

| Regulation | Light regulatory oversight (varies by jurisdiction) | Heavily regulated under lending and securities laws |

| Examples | Drop, Rakuten, Swagbucks | LendingClub, Prosper, Funding Circle |

| User Benefits | Cashback, discounts, loyalty points | Lower borrowing costs, investment returns |

| Technology | Mobile apps, APIs for reward tracking | Online loan application, automated credit scoring |

Which is better?

Loyalty fintech platforms excel in enhancing customer retention by offering personalized rewards and incentives linked to banking behaviors, increasing customer lifetime value. Peer-to-peer lending platforms provide direct access to credit by connecting borrowers with individual lenders, often resulting in lower interest rates and faster loan approval compared to traditional banks. The optimal choice depends on whether the priority is customer engagement through loyalty programs or efficient, alternative lending solutions.

Connection

Loyalty fintech and peer-to-peer lending platforms intersect by leveraging customer data to personalize financial products and reward user engagement, enhancing trust and retention in digital banking ecosystems. Peer-to-peer lending benefits from loyalty fintech programs by incentivizing repeat borrowing and lending activities through cashback and points, which increase platform user base and transaction volume. This synergy drives innovation in customer acquisition strategies, improving financial inclusion and profitability in decentralized banking models.

Key Terms

**Peer-to-Peer Lending Platforms:**

Peer-to-peer lending platforms connect individual borrowers directly with investors, eliminating traditional banks and offering competitive interest rates with faster approval times. These platforms rely on advanced algorithms to assess credit risk, providing greater accessibility for underserved borrowers and diversified investment opportunities for lenders. Explore how peer-to-peer lending revolutionizes finance by enabling efficient capital allocation and personalized credit solutions.

Credit Risk Assessment

Peer-to-peer lending platforms utilize advanced credit risk assessment models that analyze borrower data, transaction history, and social behavior to predict default probabilities, enabling personalized loan offers with risk-adjusted interest rates. Loyalty fintech solutions integrate credit risk evaluation with consumer spending patterns and reward behaviors, leveraging real-time transactional data to assess creditworthiness while incentivizing responsible financial actions. Explore the nuances between these credit risk methodologies to understand how technology transforms lending and loyalty ecosystems.

Investor-Borrower Matching

Peer-to-peer lending platforms enhance investor-borrower matching through sophisticated risk assessment algorithms and real-time credit data, enabling more accurate loan pricing and higher return potential. Loyalty fintech integrates investment opportunities with customer rewards, offering a seamless experience where user spending behavior informs personalized investment products, thus improving engagement and matching precision. Explore the evolving dynamics between these models to understand their impact on optimizing investor-borrower connections.

Source and External Links

Top 10 Peer-to-Peer Lending Platforms | FinTech Magazine - Peer-to-peer lending platforms connect borrowers directly with lenders, bypassing banks, offering lower rates to borrowers and better returns to investors, with leading platforms including Peerform, Mintos, and Kiva among others.

Peer-to-Peer Lending for Your Startup - The Hartford Insurance - P2P lending involves pooling small amounts of money from multiple lenders to loan to a borrower, often with lower interest rates than banks and loan amounts usually ranging from $1,000 to $40,000, facilitated by online platforms that match borrowers and lenders after credit verification.

P2P Lending Software - LenderKit - LenderKit provides customizable software solutions to launch and scale peer-to-peer lending platforms, including features for onboarding users, automating loan management, and evolving from prototype to full-scale operations to grow P2P lending businesses efficiently.

dowidth.com

dowidth.com