Composable banking leverages modular technology components, enabling financial institutions to tailor and quickly adapt their services to meet evolving customer needs. Universal banking integrates a wide range of financial services under one roof, offering convenience but often facing challenges in agility and customization. Explore the benefits and trade-offs between composable and universal banking to understand the future of financial service delivery.

Why it is important

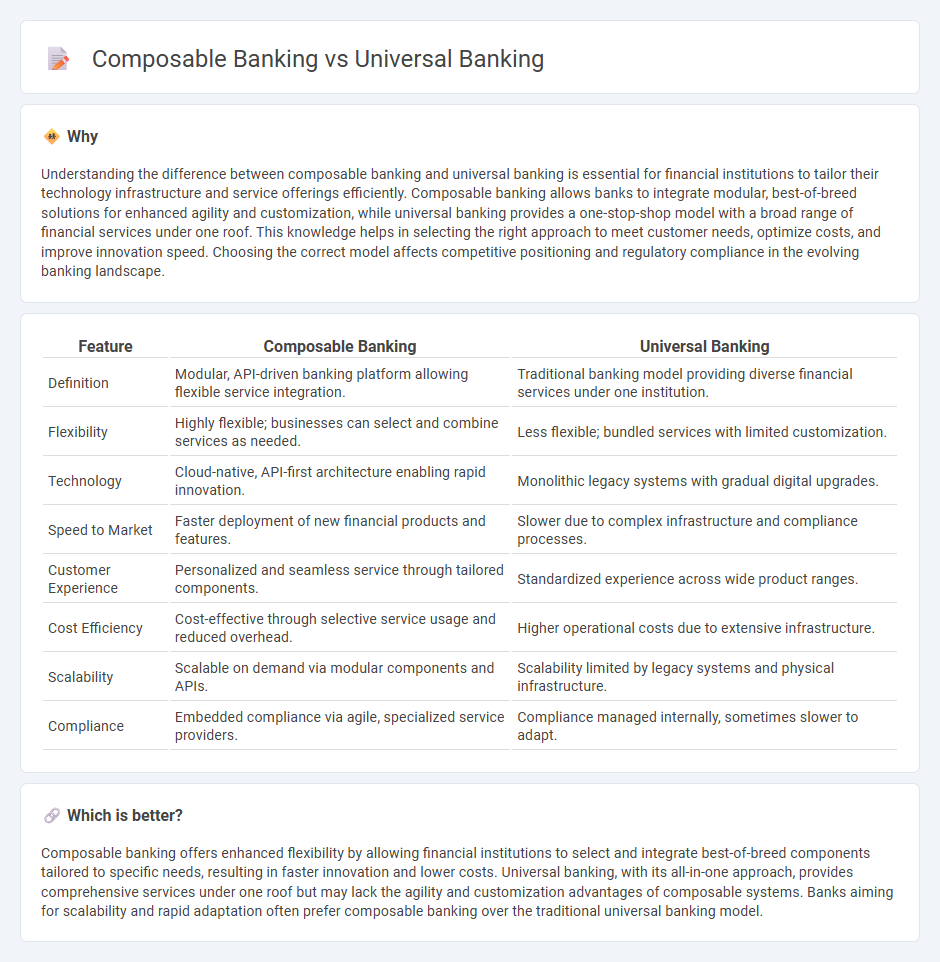

Understanding the difference between composable banking and universal banking is essential for financial institutions to tailor their technology infrastructure and service offerings efficiently. Composable banking allows banks to integrate modular, best-of-breed solutions for enhanced agility and customization, while universal banking provides a one-stop-shop model with a broad range of financial services under one roof. This knowledge helps in selecting the right approach to meet customer needs, optimize costs, and improve innovation speed. Choosing the correct model affects competitive positioning and regulatory compliance in the evolving banking landscape.

Comparison Table

| Feature | Composable Banking | Universal Banking |

|---|---|---|

| Definition | Modular, API-driven banking platform allowing flexible service integration. | Traditional banking model providing diverse financial services under one institution. |

| Flexibility | Highly flexible; businesses can select and combine services as needed. | Less flexible; bundled services with limited customization. |

| Technology | Cloud-native, API-first architecture enabling rapid innovation. | Monolithic legacy systems with gradual digital upgrades. |

| Speed to Market | Faster deployment of new financial products and features. | Slower due to complex infrastructure and compliance processes. |

| Customer Experience | Personalized and seamless service through tailored components. | Standardized experience across wide product ranges. |

| Cost Efficiency | Cost-effective through selective service usage and reduced overhead. | Higher operational costs due to extensive infrastructure. |

| Scalability | Scalable on demand via modular components and APIs. | Scalability limited by legacy systems and physical infrastructure. |

| Compliance | Embedded compliance via agile, specialized service providers. | Compliance managed internally, sometimes slower to adapt. |

Which is better?

Composable banking offers enhanced flexibility by allowing financial institutions to select and integrate best-of-breed components tailored to specific needs, resulting in faster innovation and lower costs. Universal banking, with its all-in-one approach, provides comprehensive services under one roof but may lack the agility and customization advantages of composable systems. Banks aiming for scalability and rapid adaptation often prefer composable banking over the traditional universal banking model.

Connection

Composable banking enhances Universal Banking by enabling modular integration of diverse financial services through APIs, allowing banks to build customizable, scalable platforms. Universal banks leverage composable architecture to combine retail, corporate, investment, and wealth management services into a unified offering. This synergy drives agility, improves customer experience, and accelerates innovation in comprehensive banking solutions.

Key Terms

Integrated Services

Universal banking offers a comprehensive range of financial services under one roof, including retail, commercial, and investment banking, enabling seamless customer experience and operational efficiency. Composable banking leverages modular architecture, allowing financial institutions to integrate best-of-breed services through APIs, fostering flexibility and rapid innovation in delivering tailored customer solutions. Explore the benefits and implementation strategies of integrated services in modern banking by learning more about universal and composable banking models.

Modularity

Universal banking integrates a wide range of financial services into a single platform, offering convenience but often lacking flexibility in adapting to new technologies. Composable banking emphasizes modularity by allowing banks to select and assemble best-of-breed components, enabling rapid innovation and tailored customer experiences. Explore how modular design in composable banking can transform financial service delivery.

Flexibility

Universal banking integrates diverse financial services within a single institution, offering convenience but limited flexibility in customization. Composable banking enables modular, API-driven solutions that allow banks to rapidly adapt and tailor services to evolving customer needs. Discover how composable banking transforms financial flexibility and innovation.

Source and External Links

Universal bank - Wikipedia - A universal bank is a type of bank that combines commercial banking, investment banking, and other financial services such as insurance in one institution, enabling full-service financial offerings typically seen in large banks across the US, UK, and Europe.

What is Universal Banking? | Metropolitan Capital Bank & Trust - Universal Banking integrates a wide range of financial services within a single platform to create efficiencies and tailored financial solutions especially useful for growing businesses.

Universal banking - EBF - Universal banks provide comprehensive services that enhance competitiveness and financial stability, offering benefits like one-stop banking while supporting various client types including SMEs, households, and multinationals.

dowidth.com

dowidth.com